Alphabet Set to Grow in New York -- WSJ

February 07 2018 - 3:02AM

Dow Jones News

By Keiko Morris

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 7, 2018).

The parent company of Google is expanding its real-estate

holdings in Manhattan, with plans to plow more than $2 billion into

one of the city's prime tech neighborhoods.

Under the deal, Alphabet Inc. entered a contract to buy the

Chelsea Market building at 75 Ninth Ave. from Jamestown LP,

according to a person familiar with the transaction.

The potential acquisition comes as Amazon.com Inc., narrows its

search for a second headquarters, and underscores the large impact

the two companies can have on cities, raising real-estate values

and adding high-paying jobs. The Alphabet deal also highlights New

York City's ascendance in the past decade as one of the country's

leading technology hubs.

Amazon has named New York City among the 20 finalists to host a

second headquarters.

Technology companies have been increasing their share of office

space in the Manhattan market over the past several years, with

household names such as Amazon, Facebook Inc., Spotify USA and

others signing large lease deals.

In the San Francisco Bay Area, tech companies have been gobbling

up more space than they need in the short term to ensure they have

enough capacity for workers and equipment down the line.

That might be playing out in New York too. The Chelsea Market

deal "is a potential land grab, where these firms are competing

against one another, and you might see these firms take space

defensively to ensure that they will have the space even though

they don't need it now," said Sacha Zarba, vice chairman of

real-estate-services firm CBRE Inc.

Google already has offices in the 1.2 million-square-foot

building, which houses offices on the upper floors and shops and

restaurants on the ground and lower-level floors. The building is

home to other companies, including Major League Baseball Advanced

Media and the Food Network.

The web-search giant also owns the 2.9 million-square-foot

building at 111 Eighth Ave., which it bought in 2010. In addition,

it has leased more than 200,000 square feet at Pier 57, a former

freight terminal. The Chelsea neighborhood and Meatpacking District

are part of the Midtown South office submarket, which is a favorite

of the technology sector and has had vacancy rates that are among

the lowest in the U.S.

New York City's technology landscape has changed dramatically

over the last decade, when skeptics doubted whether its labor force

could support a large technology hub.

"Any further long-term real-estate commitments by Google are

proof positive that New York is the present and future home for

technology innovation and the most fertile ground for talent

retention," said Doug Harmon, of Cushman & Wakefield, a

longtime adviser to Jamestown and the broker who worked on this

transaction and the sale of 111 Eighth Ave. to Alphabet.

The Chelsea Market deal was reported earlier by the Real

Deal.

The potential acquisition of the Chelsea Market building also

highlights some of the options that global companies, especially

tech companies, are now considering as the new tax law takes

effect. The law reduced the corporate tax rate to 21% from 35% and

included incentives for companies to bring offshore profits back to

the U.S.

"If you're bringing that much cash back, you are now probably

looking for ways to deploy it," Mr. Heller said.

Write to Keiko Morris at Keiko.Morris@wsj.com

(END) Dow Jones Newswires

February 07, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

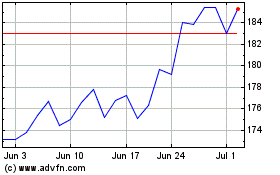

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

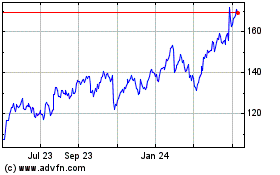

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Apr 2023 to Apr 2024