Alpha Pyrenees Trust Limited Trading Statement (9302G)

June 02 2017 - 2:00AM

UK Regulatory

TIDMALPH

RNS Number : 9302G

Alpha Pyrenees Trust Limited

02 June 2017

2 June 2016

Alpha Pyrenees Trust Limited (the "Trust" or the "Company")

Trading Update

Alpha Pyrenees Trust Limited today publishes its trading update

statement for the quarter ended 31 March 2017 and the period up

until the date of this announcement. The information contained

herein has not been audited.

VALUATION AND NET ASSET VALUE ("NAV")

As at 31 March 2017, the Trust owned a residual portfolio of two

properties in France (located at Saint Cyr L'Ecole and

Ivry-sur-Seine) and two properties in Spain (located at Alcalá de

Guadaíra and Écija) totalling approximately 24,740 square metres

(approximately 266,200 square feet) of commercial real estate.

These properties were last valued on 31 December 2016 at EUR15.1

million (GBP12.8 million at 31 March 2017 exchange rate). The next

independent revaluation will take place as at 30 June 2017.

As at 31 March 2017 the NAV is negative 53.4 pence per share.

The decrease in NAV from 31 December 2016 (negative 50.2 pence per

share) is due to the combined effect of the loss incurred in the

period and the loss on the sale of the Trust's property at

Champs-sur-Marne.

FINANCING

As at 31 March 2017, the Trust had total borrowings of GBP74.9

million (EUR87.8 million) under its facilities with Barclays Bank

PLC ("Barclays") and the maturity date of all its remaining

borrowings (EUR87.8m) with Barclays is 31 October 2018. The current

interest rates continue to apply to the facilities during this

period. Arrangement fees (charged at 2% per annum pro-rated) on the

initial and all extensions up to 15 April 2016 will be deferred to

the maturity date and will be payable to the extent that the Trust

has sufficient cash funds at that time.

PROPERTY SALES

As previously reported, on 30 March 2017 the Trust has sold its

vacant office property located at Champs-sur-Marne in France and

totalling approximately 5,930 square metres for GBP2.2 million

(EUR2.6 million). On 23 May 2017 the Trust sold its largely vacant

warehouse and office property located at Ivry-sur-Seine in France

and totalling approximately 7,420 square metres for GBP2.5 million

(EUR2.9 million).

The above sales form part of the ongoing orderly realisation

process supported by the Trust's lender, Barclays, and the net

proceeds have been used in the reduction of the Trust's bank

borrowings.

The remaining three properties (Saint Cyr L'Ecole in France;

Alcalá de Guadaíra and Écija in Spain) are being actively marketed

with a view to winding up the Trust's group in due course. The

results of the marketing to date indicate that, although there is

no certainty that transactions will take place, if they do, the

prices achieved are most likely to be lower than the valuation as

at 31 December 2016.

As the Board has previously stated, the sales process will not

result in any return to ordinary shareholders after repayment of

the Trust's bank borrowings has taken place, to the extent that

this is possible.

The Trust will provide further updates on progress in due

course.

DIVIDEND

The Trust does not pay dividends.

For further information:

Serena Tremlett, Chairman, Alpha Pyrenees Trust Limited 01481 231100

Paul Cable, Fund Manager, Alpha Real Capital LLP 020 7391 4700

For more information on the Company, please visit

www.alphapyreneestrust.com.

FORWARD-LOOKING STATEMENTS

This trading update contains forward-looking statements which

are inherently subject to risks and uncertainties because they

relate to events and depend upon circumstances that will occur in

the future. There are a number of factors that could cause actual

results to differ materially from those expressed or implied by

such forward-looking statements. Forward-looking statements are

based on the Board's current view and information known to them at

the date of this update. The Board does not make any undertaking to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise. Nothing in

this trading update should be construed as a profit forecast.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTZMGGVVMZGNZM

(END) Dow Jones Newswires

June 02, 2017 02:00 ET (06:00 GMT)

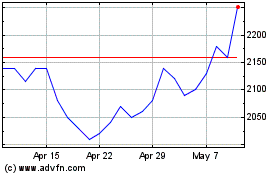

Alpha (LSE:ALPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

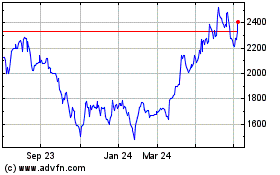

Alpha (LSE:ALPH)

Historical Stock Chart

From Apr 2023 to Apr 2024