Almost two years after CPP/QPP changes were announced, many Canadian employers have yet to prepare

April 18 2018 - 9:00AM

Enhancements to the Canada Pension Plan and Quebec Pension Plan

will begin to phase in next year, yet most Canadian employers have

yet to take action to prepare, according to a new report from Aon,

a leading global professional services firm providing a broad range

of risk, retirement and health solutions. Aon’s survey of 325

organizations from across the country also found that higher costs

resulting from the enhancements are a concern among employers, but

few have developed strategies for addressing cost increases and

other impacts.

Quotes:“With just months to go before the

CPP/QPP changes kick in, it’s a bit surprising to see that so few

employers have taken steps to prepare,” said William da Silva,

Senior Partner and Retirement Practice Director for Aon in Canada.

“The reasons aren’t clear, but it appears that many employers might

be underestimating the impact these legislated changes could have

on their organizations and employees, including contributions and

benefits under their current retirement programs.”

“The good news is, employers still have time to address the new

rules proactively,” added Andrew Hamilton, Partner and Ontario

Retirement Practice Leader for Aon. “Beyond preparing for increased

costs – a key concern, according to our survey – they should

develop strategies for incorporating the changes into their

employee communications, their existing retirement plans and their

overall benefits philosophy.”

Key facts:

- Only 17% of employers have started planning for CPP/QPP

enhancements.

- About two in five employers (37%) expect to prepare this year

for the CPP/QPP enhancements, while a third (32%) do not know when

they will do so.

- The chief concerns related to CPP/QPP enhancements are higher

organizational costs (68%) and higher costs for employees (53%),

followed by the impact on retirement programs (46%) and the

potential for greater administrative demands (40%).

- More than half (57%) of employers say they understand the

overall payroll costs resulting from the enhancements, but

two-thirds (69%) don’t know how they will manage the financial

impact.

- Only 6% of employers have communicated the CPP/QPP changes to

employees, but more than half plan to do so this year.

About AonAon plc (NYSE:AON) is a leading global

professional services firm providing a broad range of risk,

retirement and health solutions. Our 50,000 colleagues in 120

countries empower results for clients by using proprietary data and

analytics to deliver insights that reduce volatility and improve

performance.

Media contact For further information please

contact Alexandre Daudelin (+1.514.982.4910)

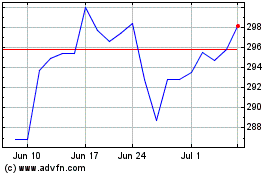

Aon (NYSE:AON)

Historical Stock Chart

From Mar 2024 to Apr 2024

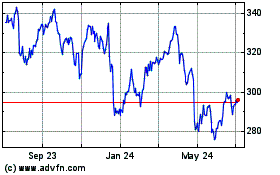

Aon (NYSE:AON)

Historical Stock Chart

From Apr 2023 to Apr 2024