Alcoa Requests Exemption from Aluminum Tariff

August 06 2018 - 5:02PM

Dow Jones News

By Bob Tita

The largest U.S. aluminum maker wants an exemption from tariffs

designed to bolster domestic metal production.

Alcoa Corp. on Monday asked the Trump administration for an

exemption from tariffs on aluminum imported from Canada, where the

company makes a raw form of the metal that it rolls into sheet for

beverage cans at a U.S. plant.

Some smelting lines have since restarted in the U.S. since the

Trump administration imposed a 10% duty on imported aluminum in

March. But Pittsburgh-based Alcoa said it can't find enough

specialty aluminum alloys for beverage cans in the U.S.

"Even if all the curtailed smelting capacity in the U.S. was

back online and producing metal, the United States would still need

to import the majority of its aluminum," said Tim Reyes, president

of Alcoa's aluminum business.

Alcoa operates three smelting plants in Canada that supply Alcoa

operations and customers in the U.S.

U.S. companies have filed thousands of tariff-exclusion requests

since the tariffs on steel and aluminum began this spring. Most use

specialized metals or components that aren't readily available in

the U.S. The aluminum tariff has snarled production of aluminum

parts and products in recent months because most of the aluminum

consumed by U.S. manufacturers is imported or remelted scrap.

Raw aluminum production in the U.S. has fallen for years as

rising electricity costs and aging equipment made U.S.-based

smelters less competitive with new smelters in other countries.

Aluminum prices have risen as buyers began to anticipate the

implementation of tariffs. Aloca said it still can't justify the

investment that would be necessary to restart some of its idle

smelters in the U.S.

Alcoa is the largest producer of raw aluminum in the U.S., but

the U.S. accounted for only 14% of the aluminum Alcoa produced

globally last year. The company wants the Commerce Department to

grant tariff relief on 40,000 metric tons a year of specialized

alloys that Alcoa uses to make aluminum sheet for cans.

The alloys are cast in 2-foot thick slabs at an Alcoa smelting

plant in Baie-Comeau, Quebec, and rolled into aluminum sheet for

cans at an Alcoa plant in Warrick, Ind. Alcoa's problem stems from

a shortage of casting capacity at Warrick and Alcoa's other U.S.

plants. In its exemption application, Alcoa said it had tried

unsuccessfully to buy more aluminum slabs from Century Aluminum

Co., the only other smelter operator in the U.S.

"Century Aluminum has indicated that it does not have the molds

to produce 24-inch thick slabs," Alcoa said. "There are no other

U.S. manufacturers currently capable of supplying the exact slabs

meeting Alcoa's specifications or an acceptable substitute."

The Commerce Department has 90 days to respond to have Alcoa's

exclusion request.

Alcoa said the tariff is increasing its costs, even as it

benefits from higher aluminum prices. The company predicted last

month that the tariff will increase its monthly costs by $12

million to $14 million for as long as the duty remains in place.

The company reported that the tariffs helped to raise its average

realized price on raw aluminum by 19% during the second quarter

from the year before.

Alcoa in July cut its profit outlook for the year, citing

increased expenses caused by the tariff. Alcoa CEO Roy Harvey said

overproduction of aluminum in China had created a global glut that

drove down prices. Mr. Harvey has urged the Trump administration to

negotiate with China to curb production as an alternative to a U.S.

tariff on all imported aluminum.

Write to Bob Tita at robert.tita@wsj.com

(END) Dow Jones Newswires

August 06, 2018 16:47 ET (20:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

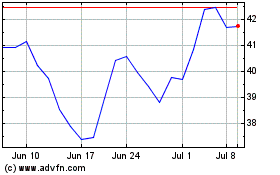

Alcoa (NYSE:AA)

Historical Stock Chart

From Mar 2024 to Apr 2024

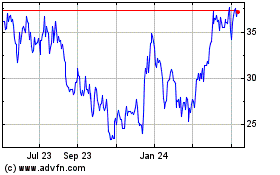

Alcoa (NYSE:AA)

Historical Stock Chart

From Apr 2023 to Apr 2024