Alamo Group Inc. (NYSE: ALG) today reported results for the

first quarter ended March 31, 2012.

Net sales for the first quarter were $155.9 million compared to

net sales of $140.7 million for the first quarter of 2011, an

increase of 11%. Net income for the quarter was $6.8 million, or

$0.56 per diluted share, compared to net income of $5.7 million, or

$0.47 per diluted share, for the first quarter of 2011, a 19%

increase. The Company’s 2012 results include the effect of the

acquisition of Tenco, which was completed in October 2011. Tenco

contributed $9.4 million to net sales in the first quarter of 2012

and $0.5 million to net income. The 2012 net sales and net income

levels were both records for Alamo for a first quarter as the

Company benefited from strong growth particularly in its North

American Industrial Division.

Net sales in the Industrial Division for the first quarter of

2012 were $64.7 million, a 32% increase compared to net sales of

$49.0 million in the first quarter of 2011. The results include the

contributions of Tenco outlined above. The Division also benefited

from increased sales of its mowing products and vacuum trucks.

Alamo’s North American Agricultural Division recorded net sales

of $48.3 million in the first quarter of 2012, a 3% decrease

compared to net sales of $49.7 million in the prior year’s first

quarter. The decrease reflected slower growth in the overall U.S.

agricultural market and slightly lower preseason sales, which

generally make up the majority of this Division’s first quarter

revenue.

The Company’s European Division net sales in the first quarter

of 2012 were $42.9 million, an increase of 2% versus $41.9 million

in the first quarter of 2011. The Division’s sales remained steady

despite the continuing economic slowdown affecting many of the

Company’s markets in Europe.

Ron Robinson, Alamo Group’s President and Chief Executive

Officer, commented, “Following a record year in 2011, we are

pleased to start 2012 with another strong quarter. Supported by the

acquisition of Tenco, our Industrial Division led the way with

solid year-over-year growth. Within this Division, our vegetation

maintenance products continued to perform well, aided by recent new

product introductions. The Company’s snow removal equipment also

did well despite the mild winter conditions, and our vacuum trucks

and sweepers further contributed to the sales growth in the first

quarter.”

“Our Agricultural Division experienced some softening as the

rate of growth in the overall U.S. agriculture market slowed

compared to stronger levels experienced in 2010 and 2011. For this

Division, the first quarter of each year is generally made up of

preseason sales of stocking orders from our dealers, and these

sales were below the previous year’s level as dealers ended 2011

with higher levels of inventory than in recent years. While it is

still too early to tell how the season will develop, we expect to

benefit from strong commodity prices and healthy levels of farm

income as the year progresses. In addition, the drought conditions

that have affected parts of Texas and other states in the southeast

for the last several years have moderated over recent months.”

“Our European Division also held up well even in challenging

economic conditions. Governmental markets continue to be affected

by budget constraints and the agricultural sector is experiencing

slower growth, similar to our U.S. markets. Yet, we benefited from

steady demand for our type of maintenance products which was

further helped by increased export sales.”

Mr. Robinson concluded, “Our strong results, during what is one

of our seasonally weaker quarters, provide confirmation we are

successfully executing on our growth strategies while keeping our

costs under control. Our industrial markets should benefit from

steady demand for our type of infrastructure maintenance products,

despite ongoing governmental budget limitations. And, growing

levels of demand for food globally should continue to provide

strength to our agricultural markets over the longer term. As a

result, we feel good about our prospects for the future.”

Alamo Group is a leader in the design, manufacture, distribution

and service of high quality equipment for right-of-way maintenance

and agriculture. Our products include truck and tractor mounted

mowing and other vegetation maintenance equipment, street sweepers,

snow removal equipment, pothole patchers, excavators, vacuum

trucks, agricultural implements and related after market parts and

services. The Company, founded in 1969, had approximately 2,460

employees and operates eighteen plants in North America and Europe

as of March 31, 2012. The corporate offices of Alamo Group Inc. are

located in Seguin, Texas and the headquarters for the Company’s

European operations are located in Salford Priors, England.

This release contains forward-looking statements that are made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements involve

known and unknown risks and uncertainties, which may cause the

Company’s actual results in future periods to differ materially

from forecasted results. Among those factors which could cause

actual results to differ materially are the following: market

demand, competition, weather, seasonality, currency-related issues,

and other risk factors listed from time to time in the Company’s

SEC reports. The Company does not undertake any obligation to

update the information contained herein, which speaks only as of

this date. This release may contain non-GAAP financial measures.

These measures, if included, are to help facilitate meaningful

comparisons of our results to those in prior periods and future

periods and to allow a better evaluation of our operating

performance, in management’s opinion. Our reference to any non-GAAP

measures should not be considered as a substitute for results that

are presented in a manner consistent with GAAP.

(Tables Follow)

ALAMO GROUP

REPORTS 2012 FIRST QUARTER RESULTS Alamo Group Inc.

and Subsidiaries (NYSE:ALG) Condensed Consolidated

Statements of Income (in thousands, except per share

amounts) (Unaudited) First Quarter Ended

3/31/12 3/31/11 North

American Industrial $ 64,732 $ 49,033 Agricultural 48,271 49,739

European 42,908 41,943 Total Sales

155,911 140,715 Cost of sales 120,673

108,814 Gross margin 35,238 31,901 22.6 % 22.7 %

Operating Expenses 24,245 22,560 Income

from Operations 10,993 9,341 7.1 % 6.6 % Interest Expense

(443 ) (765 ) Interest Income 55 72 Other Income (Expense)

(574 ) (147 ) Income before income taxes 10,031 8,501

Provision for income taxes 3,246 2,834

Net Income $ 6,785 $ 5,667 Net income

per common share: Basic $ 0.57 $ 0.48 Diluted

$ 0.56 $ 0.47 Average common shares: Basic

11,873 11,832 Diluted

12,027 11,980

Summary Balance

Sheet Data 3/31/12

3/31/11 Receivables 170,391 154,614 Inventories

127,989 117,460 Current Liabilities 90,583 89,840 Long Term Debt

53,512 47,021 Equity 287,156 262,733

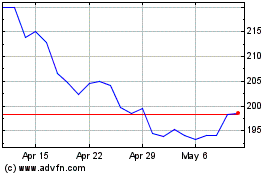

Alamo (NYSE:ALG)

Historical Stock Chart

From Mar 2024 to Apr 2024

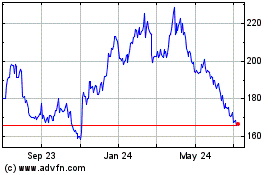

Alamo (NYSE:ALG)

Historical Stock Chart

From Apr 2023 to Apr 2024