Agilent Launches Bluetooth Test - Analyst Blog

June 08 2012 - 1:13PM

Zacks

Agilent Technologies Inc. (A)

announced the availability of its Bluetooth low-energy test

solution on the N4010A wireless connectivity test set. The company

stated that Texas Instruments Inc. (TXN) was the

first to verify the product, which can be used by connectivity

chipset makers to speed up design validation for Bluetooth smart

and smart-ready devices.

Bluetooth is a wireless technology specification developed by

the Bluetooth special interest group (SIG), the founding members of

which were Ericsson, Intel Corp (INTC), Toshiba,

Nokia (NOK) and IBM (IBM). The

SIG, which now comprises several hundred members, has developed a

couple of technologies.

The smart technology usually comes with sensors, such as

heart-rate monitors, glucose meters and other health and fitness

products that basically pick up specific information (for example

heart rates in case of the heart-rate monitor) and transmit the

information to smart-ready devices.

Smart-ready devices, such as phones, computers and tablets have

dual functionality. Not only are they able to pick up information,

but they are also able to connect to other smart-ready devices and

transfer data and files.

According to IMS research, the use of Bluetooth technology in

consumer health monitoring applications will increase from less

than 40 million chips in 2009 to over 200 million in 2015. In

addition, shipments of Bluetooth smart ready handsets will exceed

370.0 million units by the end of 2012, and 1.6 billion units by

the end of 2015.

Another firm, Strategy Analytics, shows that 70.0% of all new

vehicles will have Bluetooth connectivity by 2016. Therefore,

companies will be vying with each other to launch products

incorporating the latest Bluetooth technology. This is where

Agilent should see success.

Agilent’s revenue in the second quarter of 2012 was up 6.0%

sequentially and 3.3% year over year, better than management’s

expectations of a 4-5% sequential increase ($1.70 billion to $1.72

billion).

TI’s performance was not encouraging in the first quarter of

2012, as it missed the Zacks Consensus Estimate on the bottom line.

The revenue also declined 8.0% year over year.

Currently, both Agilent Technologies Inc. and Texas Instruments

Inc. have a Zacks Rank of #3, implying a short-term Hold

recommendation.

AGILENT TECH (A): Free Stock Analysis Report

INTL BUS MACH (IBM): Free Stock Analysis Report

INTEL CORP (INTC): Free Stock Analysis Report

NOKIA CP-ADR A (NOK): Free Stock Analysis Report

TEXAS INSTRS (TXN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

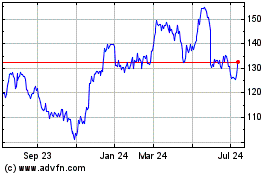

Agilent Technologies (NYSE:A)

Historical Stock Chart

From Mar 2024 to Apr 2024

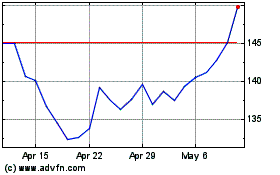

Agilent Technologies (NYSE:A)

Historical Stock Chart

From Apr 2023 to Apr 2024