After Scandal and Death, Two Alpine Banks Aim for Crypto Gold

July 18 2018 - 5:14AM

ADVFN Crypto NewsWire

An advertising hoarding for Falcon Private Bank. Source:

Branders/Gian Marco Castelberg

Walk into Falcon Private Bank on the Pelikantrasse in central

Zurich and you’re immediately struck by the giant photo of a woman

crouched in the sprinter’s starting position, painted head-to-toe

in gold.

The image -- a throwback to the Bond movie Goldfinger half a

century ago -- casts the Abu Dhabi-backed firm as the agile adviser

you need to get off to a flying start to riches. It’s also part of

a plan to overhaul a brand tarnished by the bank’s involvement in

the 1MDB multibillion-dollar embezzlement scandal and help

advertise its push into a product that most Swiss banks are still

too nervous to touch: crypto finance.

“In areas that are new, the big banks cannot move as quickly as

the smaller banks,” Stefan Bollhalder, Falcon’s chief investment

officer, said in an interview in Zurich. Larger rivals may also

think “it’s not worth the risk, so they leave it to the smaller

ones.

Falcon Bank and Liechtenstein’s Bank Frick -- which are offering

crypto services separately -- are among a very limited number of

the 150-plus private banks in Switzerland and the neighboring duchy

that have begun offering clients a direct way to invest in the

volatile asset class. While Credit Suisse Group AG and UBS Group AG

have shied away from crypto, Falcon and Frick are tapping pent-up

demand for banking services from Crypto Valley, as the Swiss city

of Zug has dubbed itself.

“Crypto Valley is almost unbanked,” Michael Helbling, head of

Falcon’s crypto desk, said in the roundtable interview. “We have

seen tremendous interest.”

Troubled Times

Falcon is starting to move past troubled times. Its Singapore

unit was closed by regulators for failing to adequately flag $1.27

billion in suspicious deposits linked to Malaysia’s 1MDB scandal. A

branch manager in Singapore was jailed and a Swiss investigation

continues. Mindful of this, Falcon says it did its homework before

entering the crypto market. So far, it is offering investment

strategy and brokerage services.

“The bank has learned its lessons,” says Gianmarco Timpanaro,

Falcon’s marketing head, “and there was a really clear prerequisite

to have all the compliance and legal sign-offs before we would

enter this kind of business.”

That meant sharing its business plan with Swiss bank regulator

Finma. Falcon also employs a firm of money-laundering software

experts to vet new clients by scrutinizing their blockchain for red

flags. Falcon says it has -- and will continue to -- turn away some

potential crypto investors.

Blockchain Startups

A 90-minute drive from Falcon in downtown Zurich, authorities in

Liechtenstein are working on a law to promote blockchain startups.

The 160-square-kilometer country approved its first crypto fund

before Switzerland -- and Liechtenstein’s crown prince and regent

appears to endorse crypto business and other entrepreneurial

business models, Bank Frick CEO Edi Woegerer said in an interview

at the bank’s headquarters in Balzers.

Tucked into a valley between Switzerland and Austria, the bank

is also seeking to move on from a troubled past: Four years ago the

bank’s former CEO Juergen Frick was shot dead by an angry investor

who had tried to extort him, according to the bank. The suspect

fled the scene. His body was discovered months later, dead from a

gunshot wound.

Woegerer took over after Frick’s shock death. Determined to turn

the page, he’s happier talking about the bank’s future -- and the

advantages it gets from marketing digital currency services. "We

get exposure we couldn’t buy,” Woegerer says.

The bank looked at cryptocurrencies more than four years ago,

but struggled with the technology until they flew in a 19-year old

expert in California for 6 months to help. Today it focuses on

serving intermediaries such as brokers or crypto exchanges. Wealthy

clients can open an account but aren’t the bank’s focus, Woegerer

said.

Client Scrutiny

Frick also says its wary of the risks posed by the anonymous

nature of cryptocurrencies and is in regular contact with

Liechtenstein’s regulator, the FMA, which is supportive of the

crypto business. Answering their -- and correspondent bank queries

-- is more of a challenge than keeping the bank’s reputation

intact, he says.

While the blockchain, a digital log underpinning every

cryptocurrency transaction, guarantees an audit trail for each

coin, the ability of bitcoin owners to stay behind the scenes has

attracted cyber criminals to Crypto Valley. Last year, Finma warned

the public about digital coin scams, shut down one operator and

opened investigations into others. Falcon’s Bollhalder says he

welcomes the crack down on rogue actors and eliminate regulatory

gray areas.

“If we want to be a crypto-nation, we need to have clear

guidelines,” he says.

Daniel Thelesklaf, director of Liechtenstein’s Financial

Intelligence Unit which combats money-laundering, says banks that

have already received a rap on the knuckles are especially keen to

not make the same mistake twice.

“Banks that have been sanctioned for non-compliance, often have

a higher compliance level compared to others, after implementing

the measures to remedy the issue,” he says.

By

Hugo Miller and

Patrick Winters

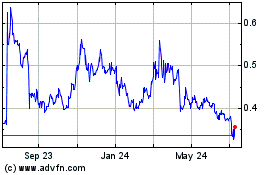

Ripple (COIN:XRPGBP)

Historical Stock Chart

From Mar 2024 to Apr 2024

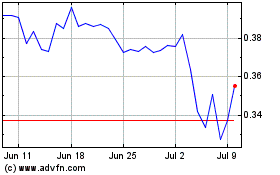

Ripple (COIN:XRPGBP)

Historical Stock Chart

From Apr 2023 to Apr 2024