AeroVironment, Inc. (NASDAQ: AVAV) today reported financial

results for its third quarter ended January 27, 2018.

“The AeroVironment team continued to execute our fiscal 2018

plan effectively, increasing third quarter revenue by 20 percent

year-over-year and generating funded backlog of $123.5 million,

which gives us full visibility to the midpoint of our annual

revenue guidance range of $290 million. The Tax Relief and Jobs Act

of 2017 reduced our federal income tax rate and the value of

deferred tax credits, resulting in an estimated $0.13 reduction in

third quarter earnings per share to a loss of $0.04,” said Wahid

Nawabi, AeroVironment chief executive officer. “In the third

quarter we entered into a $100 million joint venture with SoftBank

Corp. to launch our global, stratospheric broadband communication

business. Our joint venture has signed a $65 million contract with

AeroVironment to demonstrate the next generation solar

High-Altitude Pseudo-Satellite, or HAPS. Our core unmanned aircraft

systems business secured its largest-ever international contract,

valued at $44.5 million, reflecting continued strong international

demand for our market-leading small UAS family of systems. We

remain committed to delivering transformational innovations to our

customers and creating significant value for our stockholders.”

FISCAL 2018 THIRD QUARTER RESULTS

Revenue for the third quarter of fiscal 2018 was

$63.9 million, an increase of 20% from third quarter fiscal

2017 revenue of $53.2 million. The increase in revenue

resulted from an increase in sales in our Unmanned Aircraft Systems

(UAS) segment of $11.5 million, partially offset by a decrease

in sales in our Efficient Energy Systems (EES) segment of $0.8

million.

Gross margin for the third quarter of fiscal 2018 was

$20.6 million, an increase of 6% from third quarter fiscal

2017 gross margin of $19.4 million. The increase in gross

margin was primarily due to an increase in product margin of

$4.2 million, partially offset by a decrease in service margin

of $3.0 million. As a percentage of revenue, gross margin decreased

to 32% from 36%. The decrease in gross margin percentage was

primarily due to a decrease in service gross margin resulting from

a lower service margin on a UAS program due to unfavorable cost

adjustments and an unfavorable sales mix.

Loss from operations for the third quarter of fiscal 2018 was

$0.2 million, a decrease from third quarter fiscal 2017 loss

from operations of $1.4 million. The decrease in the loss from

operations was primarily a result of an increase in gross margin of

$1.2 million and a decrease in research and development (R&D)

expense of $0.7 million, partially offset by an increase in

selling, general and administrative (SG&A) expense of $0.7

million.

Other income, net, for the third quarter of fiscal 2018 was $0.4

million compared to other income, net of $0.4 million for the third

quarter of fiscal 2017.

Provision for income taxes for the third quarter of fiscal 2018

was $0.6 million compared to a provision for income taxes of $1.1

million for the third quarter of fiscal 2017. The provision for

income taxes for the third quarter of fiscal 2018 included the

impact of the Tax Cut and Jobs Act of 2017, inclusive of a

reduction in the blended fiscal year 2018 federal statutory tax

rate from 35% to 30.4% and an estimated $3.1 million one-time

expense resulting from the remeasurement of our deferred tax assets

and liabilities.

Equity method investment activity, net of tax, for the third

quarter of fiscal 2018 was a loss of $0.4 million compared to

equity method investment activity, net of tax loss of $8,000 for

the third quarter of fiscal 2017. The increase was due to the

equity method loss associated with our investment in HAPSMobile,

Inc. joint venture formed in December 2017.

Net loss attributable to AeroVironment for the third quarter of

fiscal 2018 was $0.8 million, a decrease from third quarter

fiscal 2017 net loss of $2.2 million.

Loss per share for the third quarter of fiscal 2018 was $0.04

compared to loss per share for the third quarter fiscal 2017 of

$0.09.

FISCAL 2018 YEAR-TO-DATE RESULTS

Revenue for the first nine months of fiscal 2018 was $181.5

million, an increase of 30% from the first nine months’ fiscal 2017

revenue of $139.5 million. The increase in revenue resulted from an

increase in sales in our UAS segment of $40.5 million and an

increase in our EES segment of $1.6 million.

Gross margin for the first nine months of fiscal 2018 was $63.2

million, an increase of 46% from the first nine months’ fiscal 2017

gross margin of $43.5 million. The increase in gross margin was due

to an increase in product margin of $23.3 million, partially offset

by a decrease in service margin of $3.5 million. As a percentage of

revenue, gross margin increased to 35% from 31%. The increase in

gross margin percentage was primarily due to an increase in revenue

and an increase in the proportion of product sales to total

revenue.

Income from operations for the first nine months of fiscal 2018

was $0.9 million, an increase from the first nine months’ of fiscal

2017 loss from operations of $21.5 million. The increase in income

from operations was the result of an increase in gross margin of

$19.8 million and a decrease in R&D expense of $4.1 million,

partially offset by an increase in SG&A expense of $1.5

million. During the second quarter of fiscal 2018, we recorded

impairment charges totaling $1.0 million to the identifiable

intangible assets and goodwill of Altoy, our Turkish majority-owned

subsidiary.

Other income, net, for the first nine months of fiscal 2018 was

$1.3 million compared to other income, net, for the first nine

months of fiscal 2017 of $0.8 million.

Provision for income taxes for the first nine months of fiscal

2018 was $0.3 million compared to a benefit for income taxes of

$2.8 million for the first nine months of fiscal 2017. The

provision for income taxes for the first nine months of fiscal 2018

included the impact of the Tax Cut and Jobs Act of 2017, including

a reduction in the blended fiscal year 2018 federal statutory tax

rate from 35% to 30.4% and an estimated $3.1 million one-time

expense resulting from the remeasurement of our deferred tax assets

and liabilities.

Equity method investment activity, net of tax, for the first

nine months of fiscal 2018 was a loss of $0.4 million compared to

equity method investment activity, net of tax loss of $0.1 million

for the first nine months of fiscal 2017. The increase was due to

the equity method loss associated with our investment in

HAPSMobile, Inc. joint venture formed in December 2017.

Net income attributable to AeroVironment for the first nine

months of fiscal 2018 was $1.7 million, an increase from the first

nine months of fiscal 2017 net loss of $18.0 million.

Earnings per diluted share for the first nine months of fiscal

2018 was $0.07 compared to loss per share for the first nine months

of fiscal 2017 of $0.78.

BACKLOG

As of January 27, 2018, funded backlog (unfilled firm orders for

which funding is currently appropriated to us under a customer

contract) was $123.5 million compared to $78.0 million as of

April 30, 2017.

FISCAL 2018 — OUTLOOK FOR THE FULL YEAR

For fiscal 2018, the company continues to expect to generate

revenue of between $280 million and $300 million, and earnings per

diluted share of between $0.45 and $0.65.

The foregoing estimates are forward-looking and reflect

management's view of current and future market conditions,

including certain assumptions with respect to our ability to obtain

and retain government contracts, changes in the timing and/or

amount of government spending, changes in the demand for our

products and services, activities of competitors, changes in the

regulatory environment, and general economic and business

conditions in the United States and elsewhere in the world.

Investors are reminded that actual results may differ materially

from these estimates.

CONFERENCE CALL

In conjunction with this release, AeroVironment, Inc. will host

a conference call today, Tuesday, March 6, 2018, at 1:30 pm Pacific

Time that will be broadcast live over the Internet. Wahid Nawabi,

president and chief executive officer, Teresa P. Covington, chief

financial officer and Steven A. Gitlin, vice president of investor

relations, will host the call.

4:30 PM ET3:30 PM CT2:30 PM MT1:30 PM PT

Investors may dial into the call at (800) 708-4540 (U.S.) and

enter the passcode 46503973 or (847) 619-6397 (international) five

to ten minutes prior to the start time to allow for

registration.

Investors with Internet access may listen to the live audio

webcast via the Investor Relations page of the AeroVironment, Inc.

website, http://investor.avinc.com. Please allow 15 minutes prior

to the call to download and install any necessary audio

software.

Audio Replay Options

An audio replay of the event will be archived on the Investor

Relations page of the company's website, at

http://investor.avinc.com. The audio replay will also be available

via telephone from Tuesday, March 6, 2018, at approximately 4:00

p.m. Pacific Time through Tuesday, March 13, 2018, at 11:59 p.m.

Pacific Time. Dial (888) 843-7419 and enter the passcode 46503973.

International callers should dial (630) 652-3042 and enter the same

passcode number to access the audio replay.

ABOUT AEROVIRONMENT, INC.

AeroVironment (NASDAQ: AVAV) provides customers with more

actionable intelligence so they can proceed with

certainty. Based in California, AeroVironment is a global

leader in unmanned aircraft systems, tactical missile systems and

electric vehicle charging and test systems, and serves militaries,

government agencies, businesses and consumers. For more information

visit www.avinc.com.

FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking statements” as that

term is defined in the Private Securities Litigation Reform Act of

1995. Forward-looking statements include, without limitation, any

statement that may predict, forecast, indicate or imply future

results, performance or achievements, and may contain words such as

“believe,” “anticipate,” “expect,” “estimate,” “intend,” “project,”

“plan,” or words or phrases with similar meaning. Forward-looking

statements are based on current expectations, forecasts and

assumptions that involve risks and uncertainties, including, but

not limited to, economic, competitive, governmental and

technological factors outside of our control, that may cause our

business, strategy or actual results to differ materially from the

forward-looking statements. Factors that could cause actual results

to differ materially from the forward-looking statements include,

but are not limited to, reliance on sales to the U.S. government;

availability of U.S. government funding for defense procurement and

R&D programs; changes in the timing and/or amount of government

spending; risks related to our international business, including

compliance with export control laws; potential need for changes in

our long-term strategy in response to future developments;

unexpected technical and marketing difficulties inherent in major

research and product development efforts; the impact of potential

security and cyber threats; changes in the supply and/or demand

and/or prices for our products and services; the activities of

competitors and increased competition; failure of the markets in

which we operate to grow; uncertainty in the customer adoption rate

of commercial use unmanned aircraft systems and electric vehicles;

failure to remain a market innovator and create new market

opportunities; changes in significant operating expenses, including

components and raw materials; failure to develop new products; the

extensive regulatory requirements governing our contracts with the

U.S. government; product liability, infringement and other claims;

changes in the regulatory environment; and general economic and

business conditions in the United States and elsewhere in the

world. For a further list and description of such risks and

uncertainties, see the reports we file with the Securities and

Exchange Commission. We do not intend, and undertake no obligation,

to update any forward-looking statements, whether as a result of

new information, future events or otherwise.

AeroVironment, Inc. Consolidated Statements of Operations

(Unaudited) (In thousands except share and per share

data) Three Months Ended Nine

Months Ended January 27, January 28,

January 27, January 28, 2018

2017 2018

2017 Revenue: Product sales $ 49,204 $ 36,746 $

133,228 $ 81,833 Contract services 14,731

16,417 48,298 57,664 63,935

53,163 181,526 139,497 Cost of sales: Product sales 31,911 23,641

86,142 58,060 Contract services 11,438 10,171

32,168 37,986 43,349 33,812

118,310 96,046 Gross margin: Product sales 17,293 13,105 47,086

23,773 Contract services 3,293 6,246

16,130 19,678 20,586 19,351 63,216

43,451 Selling, general and administrative 13,500 12,788 41,295

39,838 Research and development 7,314 7,988

21,047 25,105 (Loss) income from

operations (228 ) (1,425 ) 874 (21,492 ) Other income (expense):

Interest income, net 545 390 1,489 1,162 Other expense, net

(108 ) (38 ) (159 ) (357 ) Income (loss)

before income taxes 209 (1,073 ) 2,204 (20,687 ) Provision

(benefit) for income taxes 628 1,102 277 (2,809 ) Equity method

investment activity, net of tax (418 ) (8 )

(418 ) (119 ) Net (loss) income (837 ) $ (2,183 ) 1,509

(17,997 ) Net loss attributable to noncontrolling interest 9

— 238 — Net (loss)

income attributable to AeroVironment $ (828 ) $ (2,183 ) $ 1,747

$ (17,997 ) Net (loss) income per share attributable to

AeroVironment: Basic $ (0.04 ) $ (0.09 ) $ 0.07 $ (0.78 ) Diluted $

(0.04 ) $ (0.09 ) $ 0.07 $ (0.78 ) Weighted-average shares

outstanding: Basic 23,515,622 23,082,974 23,443,673 23,029,546

Diluted 23,515,622 23,082,974 23,774,946 23,029,546

AeroVironment, Inc. Consolidated Balance Sheets

(In thousands except share data) January

27, April 30, 2018

2017 (Unaudited) Assets Current assets:

Cash and cash equivalents $ 112,304 $ 79,904 Short-term investments

109,543 119,971 Accounts receivable, net of allowance for doubtful

accounts of $1,360 at January 27, 2018 and $291 at April 30, 2017

25,690 74,361 Unbilled receivables and retentions 24,961 14,120

Inventories, net 77,327 60,076 Income taxes receivable 292 —

Prepaid expenses and other current assets 5,138

5,653 Total current assets 355,255 354,085 Long-term

investments 38,822 42,096 Property and equipment, net 21,626 19,220

Deferred income taxes 14,837 15,089 Other assets 2,305

2,010 Total assets $ 432,845 $ 432,500

Liabilities and stockholders’ equity Current

liabilities: Accounts payable $ 13,249 $ 20,283 Wages and related

accruals 15,090 12,966 Income taxes payable — 1,418 Customer

advances 3,555 3,317 Other current liabilities 8,651

10,079 Total current liabilities 40,545 48,063

Deferred rent 1,589 1,719 Capital lease obligations - net of

current portion 7 161 Other non-current liabilities 184 184

Deferred tax liability 67 116 Liability for uncertain tax positions

64 64 Commitments and contingencies Stockholders’ equity: Preferred

stock, $0.0001 par value: Authorized shares—10,000,000; none issued

or outstanding at January 27, 2018 and April 30, 2017 — — Common

stock, $0.0001 par value: Authorized shares—100,000,000 Issued and

outstanding shares—23,906,043 shares at January 27, 2018 and

23,630,419 at April 30, 2017 2 2 Additional paid-in capital 168,735

162,150 Accumulated other comprehensive loss (25 ) (127 ) Retained

earnings 221,676 219,929 Total

AeroVironment stockholders' equity 390,388

381,954 Noncontrolling interest 1 239 Total equity

390,389 382,193 Total liabilities and

stockholders’ equity $ 432,845 $ 432,500

AeroVironment, Inc. Consolidated Statements of Cash Flows

(Unaudited) (In thousands) Nine Months

Ended January 27, January 28,

2018 2017 Operating

activities Net income (loss) $ 1,509 $ (17,997 ) Adjustments to

reconcile net income (loss) to cash provided by (used in) operating

activities: Depreciation and amortization 5,605 5,188 Loss from

equity method investments 418 119 Impairment of long-lived assets

255 — Provision for doubtful accounts 1,102 115 Impairment of

intangible assets and goodwill 1,021 — (Gains) losses on foreign

currency transactions (36 ) 272 Deferred income taxes 175 (698 )

Stock-based compensation 3,899 2,736 Tax benefit from exercise of

stock options — 22 Loss on disposition of property and equipment 15

37 Amortization of held-to-maturity investments 1,250 1,827 Changes

in operating assets and liabilities: Accounts receivable 47,652

32,553 Unbilled receivables and retentions (10,841 ) 4,079

Inventories (17,251 ) (31,320 ) Income tax receivable (292 ) (2,487

) Prepaid expenses and other assets 472 (1,190 ) Accounts payable

(6,684 ) (3,170 ) Other liabilities (153 ) (4,510 )

Net cash provided by (used in) operating activities 28,116 (14,424

)

Investing activities Acquisition of property and equipment

(8,450 ) (7,586 ) Equity method investments (1,860 ) — Redemptions

of held-to-maturity investments 163,813 93,208 Purchases of

held-to-maturity investments (151,740 ) (122,978 ) Proceeds from

the sale of property and equipment — 7 Redemptions of

available-for-sale investments 450 400

Net cash provided by (used in) investing activities 2,213 (36,949 )

Financing activities Principal payments of capital lease

obligations (231 ) (291 ) Tax withholding payment related to net

settlement of equity awards (389 ) — Exercise of stock options

2,691 655 Net cash provided by

financing activities 2,071 364 Net

increase (decrease) in cash and cash equivalents 32,400 (51,009 )

Cash and cash equivalents at beginning of period 79,904

124,287 Cash and cash equivalents at end of

period $ 112,304 $ 73,278

Supplemental disclosures

of cash flow information Cash paid, net during the period for:

Income taxes $ 1,812 $ 1,786

Non-cash activities Unrealized

gain on investments, net of deferred tax expense of $29 and $6,

respectively $ 42 $ 32 Reclassification from share-based liability

compensation to equity $ 384 $ 307 Change in foreign currency

translation adjustments $ 62 $ — Acquisitions of property and

equipment included in accounts payable $ 332 $ 408

AeroVironment, Inc. Reportable Segment Results are as

Follows (Unaudited) (In thousands)

Three Months Ended Nine Months Ended

January 27, January 28, January 27,

January 28, 2018

2017 2018 2017

Revenue: UAS $ 53,433 $ 41,894 $ 153,671 $ 113,220 EES

10,502 11,269 27,855

26,277 Total 63,935 53,163 181,526 139,497 Cost of

sales: UAS 36,130 25,530 98,355 76,549 EES 7,219

8,282 19,955 19,497 Total

43,349 33,812 118,310

96,046 Gross margin: UAS 17,303 16,364 55,316 36,671

EES 3,283 2,987 7,900

6,780 Total 20,586 19,351

63,216 43,451 Selling, general and

administrative 13,500 12,788 41,295 39,838 Research and development

7,314 7,988 21,047

25,105 (Loss) income from operations (228 ) (1,425 ) 874

(21,492 ) Other income (expense): Interest income, net 545 390

1,489 1,162 Other expense, net (108 ) (38 )

(159 ) (357 ) Income (loss) before income taxes $ 209

$ (1,073 ) $ 2,204 $ (20,687 )

Stay connected with the latest news by following us on social

media:

Facebook: http://www.facebook.com/aerovironmentincTwitter:

http://www.twitter.com/aerovironmentLinkedIn:

https://www.linkedin.com/company/aerovironmentYouTube:

http://www.youtube.com/user/AeroVironmentIncGoogle+:

https://plus.google.com/100557642515390130818/posts

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180306006643/en/

AeroVironment, Inc.Steven Gitlin+1 (626)

357-9983ir@avinc.com

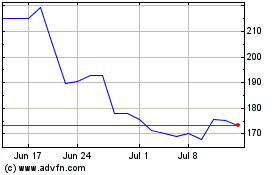

AeroVironment (NASDAQ:AVAV)

Historical Stock Chart

From Mar 2024 to Apr 2024

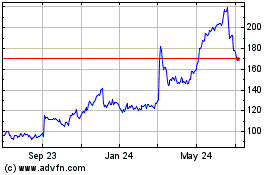

AeroVironment (NASDAQ:AVAV)

Historical Stock Chart

From Apr 2023 to Apr 2024