UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

|

|

☐

|

Preliminary Proxy Statement

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

☐

|

Definitive Proxy Statement

|

|

|

☐

|

Definitive Additional Materials

|

|

|

☒

|

Soliciting Material Under Rule 14a-12

|

|

ACACIA RESEARCH CORPORATION

|

|

(Name of Registrant as Specified in Its Charter)

|

|

|

|

SIDUS INVESTMENT PARTNERS, L.P.

SIDUS DOUBLE ALPHA FUND, L.P.

SIDUS DOUBLE ALPHA, LTD.

SIDUS ADVISORS, LLC

SIDUS INVESTMENT MANAGEMENT, LLC

MICHAEL J. BARONE

ALFRED V. TOBIA JR.

BLR PARTNERS LP

BLRPART, LP

BLRGP INC.

FONDREN MANAGEMENT, LP

FMLP INC.

BRADLEY L. RADOFF

Clifford

Press

|

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

☐

|

Fee paid previously with preliminary materials:

|

☐ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

Sidus Investment Management,

LLC and BLR Partners LP, together with the other participants named herein (collectively, “Sidus”), intend to make

a preliminary filing with the Securities and Exchange Commission of a proxy statement and accompanying

BLUE

proxy card to

be used to solicit votes for the election of Sidus’ slate of highly qualified director nominees to the Board of Directors

of Acacia Research Corporation, a Delaware corporation (the “Company”), at the Company’s upcoming 2018 annual

meeting of stockholders, or any other meeting of stockholders held in lieu thereof, and any adjournments, postponements, reschedulings

or continuations thereof.

On April 3, 2018,

Sidus issued the following press release:

SIDUS

Investment Management AND BLR Partners RESPOND TO UNILATERAL DIRECTOR APPOINTMENTS BY Acacia Research Corporation

Believe Appointments

Represent the Latest Entrenchment Tactics by the Incumbent Board in Response to Our Nominations of Director Candidates

Remind Stockholders

that Acacia’s Stock Price has Declined 41% Since Louis Graziadio’s Appointment as Executive Chairman in August 2016

NEW YORK, NY, April

3, 2018 – Sidus Investment Management, LLC and BLR Partners LP (together, “Sidus,” “we” or “us”),

collectively one of the largest stockholders of Acacia Research Corporation (“Acacia” or the “Company”)

(NASDAQ:ACTG), with aggregate ownership of approximately 4.2% of the Company’s outstanding shares, today issued a statement

in response to the Company’s unilateral appointments of Joe Davis and Paul Falzone to the Board of Directors (the “Board”).

Following yesterday’s

appointments of Messrs. Davis and Falzone, who lack any record of public company board experience, the Board is now composed of

eight directors –

four of whom have been hand-picked by the incumbent Board and never elected by stockholders

.

Rather than putting these directors up for election at the upcoming annual meeting, the Board appointed Messrs. Davis and Falzone

into classes with terms that do not expire until 2019 and 2020, respectively. This is the same tactic used by the Board when it

appointed Frank Walsh (appointed in 2016, but not subject to stockholder approval until 2018) and James Sanders (appointed in 2017,

but not subject to stockholder approval until 2019). We believe it is important for stockholders to have an annual vote on the

directors who are serving as stewards of their capital. Acacia’s use of its classified Board to shield newly appointed nominees

from a stockholder vote is another example, we believe, of why stockholder-driven change is needed at Acacia.

We also have serious

concerns regarding the alleged process that was used to identify these two new directors. While Acacia now claims that their appointments

“follows a search process conducted by the Acacia Board of Directors within the past year,” we note that the Nominating

and Governance Committee held just one meeting during the fiscal year ended December 31, 2017 (the same number it held during the

fiscal year ended December 31, 2016), and that the Board first considered appointing Messrs. Davis and Falzone two weeks after

receiving our director nominations.

1

Considering we know that the appointments of Messrs. Sanders and Walsh were accomplished with only one meeting of the Nominating

and Governance Committee, we question how comprehensive the search process was for these latest appointments.

1

According to Acacia’s proxy statements for the 2017 and 2018 annual meetings.

Further, to set the

record straight regarding Acacia’s “attempt” to interview our director candidates, we were first notified that

the Nominating and Governance Committee would like to meet with our candidates after market close on Wednesday, March 28

th

,

but that the meetings needed to take place prior to the committee’s scheduled meeting on Good Friday, March 30

th

.

Shortly after receiving the request, we advised that we were happy to make our candidates available but would like to have a dialogue

with the Board to address the concerns that we have previously raised. Acacia’s claims that our candidates’ inability

to meet on one day’s notice on the day before a religious holiday somehow constitutes them not being made available on a

timely basis is, in our view, a blatant attempt at justifying the Board’s entrenchment tactics. If the Nominating and Governance

Committee was truly interested in meeting our candidates, we doubt it would have given our nominees one day’s notice or that

it would have filed a preliminary proxy statement for its still unannounced annual meeting date the very next business day.

In our view, these

actions are yet more evidence of the abysmal corporate governance practices at the Company, which we believe have contributed to

Acacia’s nearly

67% stock price decline during the last three years alone

.

2

We believe the significant destruction of stockholder value highlights the need to overhaul Acacia’s leadership.

Contacts:

Clifford Press

(212) 277-5635

Alfred V. Tobia Jr.

(212) 751-6644

John Ferguson

Saratoga Proxy Consulting LLC

(212) 257-1311

CERTAIN INFORMATION CONCERNING

THE PARTICIPANTS

Sidus Investment Management, LLC,

together with the other participants named herein (collectively, "Sidus"), intends to file a preliminary proxy statement

and accompanying BLUE proxy card with the Securities and Exchange Commission ("SEC") to be used to solicit votes for

the election of its slate of director nominees at the 2018 annual meeting of stockholders of Acacia Research Corporation, a Delaware

corporation (the "Company").

SIDUS STRONGLY ADVISES ALL STOCKHOLDERS

OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE

PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST.

REQUESTS FOR COPIES SHOULD BE DIRECTED TO SARATOGA PROXY CONSULTING LLC.

The participants in the proxy solicitation

are anticipated to be Sidus Investment Partners, L.P. (“Sidus Partners”), Sidus Double Alpha Fund, L.P. (“Sidus

Double Alpha”), Sidus Double Alpha, Ltd. (“Sidus Double Alpha Offshore”), Sidus Advisors, LLC (“Sidus Advisors”),

Sidus Investment Management, LLC (“Sidus Management”), Michael J. Barone, Alfred V. Tobia Jr., BLR Partners LP (“BLR

Partners”), BLRPart, LP (“BLRPart GP”), BLRGP Inc. (“BLRGP”), Fondren Management, LP (“Fondren

Management”), FMLP Inc. (“FMLP”), Bradley L. Radoff and Clifford Press.

2

Calculated as of April 2, 2018 (includes dividends reinvested).

As of the date hereof, Sidus

Partners directly beneficially owns 167,448 shares of common stock, par value $0.001 per share (the “Common Stock”),

of the Company. As of the date hereof, Sidus Double Alpha directly beneficially owns 458,461 shares of Common Stock. As of the

date hereof, Sidus Double Alpha Offshore directly beneficially owns 209,967 shares of Common Stock. As of the date hereof, 194,124

shares of Common Stock were held in an account to which Sidus Management serves as the sub-advisor (the “Managed Account”).

Sidus Advisors, as the general partner of each of Sidus Partners and Sidus Double Alpha, may be deemed to beneficially own the

(i) 167,448 shares of Common Stock owned directly by Sidus Partners and (ii) 458,461 shares of Common Stock owned directly by

Sidus Double Alpha. Sidus Management, as the investment manager of each of Sidus Partners, Sidus Double Alpha and Sidus Double

Alpha Offshore, and as the sub-advisor of the Managed Account, may be deemed to beneficially own the (i) 167,448 shares of Common

Stock owned directly by Sidus Partners, (ii) 458,461 shares of Common Stock owned directly by Sidus Double Alpha, (iii) 209,967

shares of Common Stock owned directly by Sidus Double Alpha Offshore and (iv) 194,124 shares of Common Stock held in the Managed

Account. Each of Messrs. Barone and Tobia, as a Managing Member of Sidus Management, may be deemed to beneficially own the (i)

167,448 shares of Common Stock owned directly by Sidus Partners, (ii) 458,461 shares of Common Stock owned directly by Sidus Double

Alpha, (iii) 209,967 shares of Common Stock owned directly by Sidus Double Alpha Offshore and (iv) 194,124 shares of Common Stock

held in the Managed Account. As of the date hereof, BLR Partners directly beneficially owns 1,080,500 shares of Common Stock.

BLRPart GP, as the general partner of BLR Partners, may be deemed to beneficially own the 1,080,500 shares of Common Stock owned

directly by BLR Partners. BLRGP, as the general partner of BLRPart GP, may be deemed to beneficially own the 1,080,500 shares

of Common Stock owned directly by BLR Partners. Fondren Management, as the investment manager of BLR Partners, may be deemed to

beneficially own the 1,080,500 shares of Common Stock owned directly by BLR Partners. FMLP, as the general partner of Fondren

Management, may be deemed to beneficially own the 1,080,500 shares of Common Stock owned directly by BLR Partners. Mr. Radoff,

as the sole shareholder and sole director of each of BLRGP and FMLP, may be deemed to beneficially own the 1,080,500 shares of

Common Stock owned directly by BLR Partners. As of the date hereof, Mr. Press does not beneficially own any shares of Common Stock.

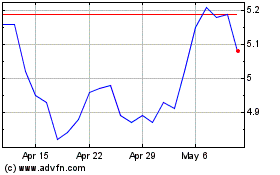

Acacia Research Technolo... (NASDAQ:ACTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

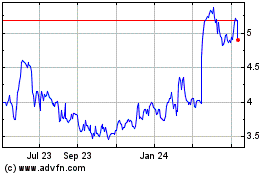

Acacia Research Technolo... (NASDAQ:ACTG)

Historical Stock Chart

From Apr 2023 to Apr 2024