AXA's U.S. Subsidiary Seeks $2.75 Billion in IPO -- Update

May 10 2018 - 2:16AM

Dow Jones News

(Adds valuation, background.)

By Max Bernhard

AXA Equitable Holdings Inc., the subsidiary of French insurance

giant AXA SA (CS.FR), is seeking proceeds of $2.75 billion in its

IPO of 137.25 million existing shares, priced at $20 each, AXA said

Thursday.

AXA Equitable Holdings had earlier set an initial price range

for the IPO of between $24 and $27 a share.

The company starts trading Thursday on the New York Stock

Exchange and the offering is expected to close on May 14, AXA

said.

The IPO pricing would value the U.S. unit at roughly $11.2

billion, and AXA said it plans to sell about 25% of its

subsidiary's existing issued and outstanding shares.

AXA could use some of the proceeds of the IPO to help finance

its planned $15.3 billion acquisition of insurer XL Group Ltd. The

deal, which was announced by AXA in March, would create one of the

world's largest property and casualty insurers.

AXA Equitable Holdings was founded in New York in 1859, making

it one of America's oldest life insurers.

Write to Max Bernhard at Max.Bernhard@dowjones.com;

@mxbernhard

(END) Dow Jones Newswires

May 10, 2018 02:01 ET (06:01 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

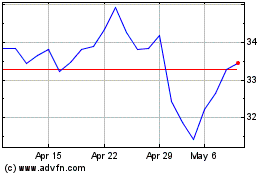

Axa (EU:CS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Axa (EU:CS)

Historical Stock Chart

From Apr 2023 to Apr 2024