AXA to Buy Insurer XL Group for $15.3 Billion -- 3rd Update

March 05 2018 - 7:55AM

Dow Jones News

By Matthew Dalton and Ben Dummett

PARIS -- French financial giant AXA SA on Monday said it would

buy New York-listed insurance company XL Group Ltd. for $15.3

billion, creating one of the world's biggest property and casualty

insurers.

The deal marks another step in AXA's plan to cut its exposure to

financial markets and focus more on insurance products that aren't

sensitive to swings in interest rates and stock prices.

In light of the XL deal, Paris-based AXA said it would

accelerate existing plans to spin off its large U.S. life-insurance

business in a public offering. That division owns a majority stake

in AllianceBernstein, a money manager struggling against

competition from cheaper index funds.

Shares in AXA dropped more than 7% in morning trading in Europe.

Investors appear to be concerned that AXA is paying too much for a

company whose shares are trading near a 10-year high, said Gianluca

Ferrari, an analyst at Mediobanca. They were also expecting AXA to

use the proceeds of the IPO of its U.S. business on a mix of share

buybacks and modest, bolt-on acquisitions.

"This one is a big deal. It's not a bolt on," Mr. Ferrari said.

"We can forget about buybacks."

Buying XL bolsters AXA in a core business area as it steps away

from its U.S. operations and allows it to cut costs and boost

revenue.

"It is a fundamental reshaping of our business," Chief Executive

Thomas Buberl said.

Shareholders in XL will receive $57.60 a share, which represents

a 33% premium to the company's closing price on Friday.

XL generated revenue of $11 billion last year but reported a

$560 million loss after the catastrophic hurricanes that slammed

the U.S. and other disasters forced it to pay $2.1 billion in

damage claims.

The deal comes as reinsurers, such as XL, struggle to raise

premiums despite a string of natural disasters -- which would

typically allow the industry to raise rates -- amid competition

from so-called catastrophe bonds. Such bonds, which essentially

package insurance risk as debt, have attracted investment from

pension funds and other investors seeking higher returns.

Although global property catastrophe policy rates were up just

under 5% at the start of 2018, policy prices were still below those

of 2016 even though 2017 marked the "most expensive catastrophe

loss year on record," according to a study by JLT Re.

That's pushing companies with reinsurance businesses to seek

greater scale through deals. The purchase of XL represents the

second acquisition of a Bermuda-based insurer and reinsurer this

year after American International Group Inc. agreed in January to

buy Validus Holding Ltd for $5.56 billion.

The XL deal also highlights a broader consolidation trend in the

insurance sector. In February, reinsurance giant Swiss RE AG

confirmed a Wall Street Journal report that it was in talks to sell

a minority stake to Japan's Softbank Group Corp.

To finance the deal, AXA said it would use EUR6 billion in

proceeds from the coming IPO of its U.S. business, EUR3 billion in

cash and issue EUR3 billion in debt. AXA filed for the offering of

the U.S. business, AXA Equitable Holdings, in November with U.S.

regulators, though shares have yet to be sold to the public.

"This means we intend to progressively sell down the AXA Group's

stake in AXA Equitable Holdings over the next couple of years

subject, of course, to market conditions," Mr. Buberl said.

AXA and XL's boards have both approved the deal but the

transaction remains subject to approval from XL's shareholders and

regulators.

--Nathan Allen contributed to this article.

Write to Matthew Dalton at Matthew.Dalton@wsj.com and Ben

Dummett at ben.dummett@wsj.com

(END) Dow Jones Newswires

March 05, 2018 07:40 ET (12:40 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

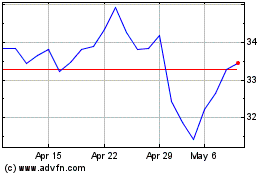

Axa (EU:CS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Axa (EU:CS)

Historical Stock Chart

From Apr 2023 to Apr 2024