AXA Nine-Month Revenue Rose Slightly, Solvency Ratio Fell

November 06 2018 - 12:22PM

Dow Jones News

By Pietro Lombardi

AXA SA's (CS.FR) nine-month revenue rose 0.6%, supported by

growth across its business lines, it said Tuesday.

The French insurer reported revenue of 75.8 billion euros ($86.4

billion) in the first nine months of the year, compared with

EUR75.4 billion in the same period last year. On a comparable

basis, revenue rose 3.7%, it said.

Annual premium equivalent, known as APE, rose 9% in the period.

APE measures new business growth by combining the value of payments

on new regular premium policies, and 10% of the value of payments

made on one-time, single-premium products.

"We grew in all five of our geographies and across all business

lines," Chief Financial Officer Gerald Harlin said.

AXA's $15.3 billion acquisition of insurer XL Group that AXA

completed in September hit the French insurer's solvency II

ratio--a key measure of financial strength for insurance

companies--which fell to 195% at the end of September, down from

233% in June.

The ratio, which includes the contribution of the XL Group, is

"well within our guidance," the CFO said.

The decline in the ratio comes as "the effect of the closing of

the XL Group acquisition was partly offset by the positive impact

from the purchase during the quarter, of additional equity hedges

and a strong operating return net of accrued dividend for the

quarter," the company said.

"AXA delivered a strong performance in the first nine months of

2018, illustrating the strength of our operations and the

pertinence of our simplified operating model," Mr. Harlin

added.

Olivia Bugault contributed to this story

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

November 06, 2018 12:07 ET (17:07 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

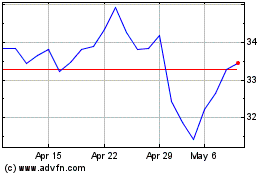

Axa (EU:CS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Axa (EU:CS)

Historical Stock Chart

From Apr 2023 to Apr 2024