AIG Investments & Highstar Capital Announce Sale of Interests in InterGen

June 24 2008 - 9:00PM

PR Newswire (US)

NEW YORK, June 24 /PRNewswire-FirstCall/ -- AIG Investments and

Highstar Capital (Highstar) today announced that AIG Highstar

Capital II, L.P. (AIG Highstar II) and certain of its investment

affiliates have agreed to sell their 50% ownership interest in

InterGen N.V. (InterGen) to GMR Infrastructure Limited (GMR), one

of India's leading private sector infrastructure developers, for an

undisclosed amount. InterGen N.V., headquartered in the

Netherlands, is a leading global power generation company with

operating power plants located across five countries with total

gross capacity of 12,766 MW (8,086 MW of operational capacity and

4,680 MW of projects under development). InterGen's operating

plants are located in the UK, The Netherlands, Mexico, Australia

and the Philippines. These facilities include 5,280 net equity MW

in operation, 428 MW under construction, 523 MW under agreement.

InterGen was formed in 1995 and was purchased by Highstar and the

Ontario Teachers' Pension Plan (Teachers') in 2005. Commenting on

the transaction, Highstar Founder and Managing Partner Christopher

H. Lee stated, "The sale of our interests in InterGen continues a

decade-long track record of successfully investing in

infrastructure assets and businesses with sustainable downside

protection, coupled with upside potential." Lee added that, "The

investment was led for Highstar by Partners John Stokes and Michael

Miller, who were instrumental in working with InterGen management

to add value, including hands-on practical input to the business'

operations. We exit our investment leaving InterGen as a strong,

well-capitalized company under the exceptional leadership of

current CEO Neil H. Smith and his very capable team. We have

greatly enjoyed working with management and our partners at OTPP

during our ownership of InterGen. We are confident that GMR will be

a great new partner for InterGen as it continues to the next level

of well-deserved success." The transaction is expected to close in

the third quarter of 2008, subject to regulatory approvals. Lehman

Brothers acted as financial advisor to Highstar and Sidley Austin

LLP acted as Highstar's legal council. About Highstar Highstar is a

leader in value added infrastructure investing with a decade long

track record. Since the closing of its first fund in 2000, Highstar

has led or co-led a number of significant, diversified

infrastructure investments, including in power generation, water

and waste water, natural gas transmission and storage, waste

management, waste-to-energy, transportation logistics, inter modal

and port concessions and operations. Highstar currently manages

over $4.5 billion of capital commitments from leading institutional

investors globally, including through its third generation private

equity fund, AIG Highstar Capital III (AIG Highstar III). Both AIG

Highstar II and AIG Highstar III are sponsored by AIG Investments.

About AIG Investments AIG Investments is a global leader in asset

management with extensive capabilities in equity, fixed income,

hedge, private equity, and real estate investments. Member

companies of AIG Investments manage more than US $750 billion in

assets and employ over 2,500 professionals in 46 offices around the

world as of March 31, 2008. AIG Investments is the asset management

arm of American International Group, Inc. (NYSE:AIG). DATASOURCE:

AIG Investments CONTACT: Jeannine Lewan of Financial Dynamics for

AIG Investments, +1-212-850-5612

Copyright

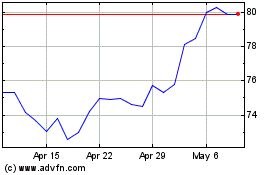

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

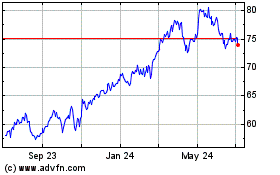

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024