2nd UPDATE: JJB Sports Equity Issue To Proceed Imminently

October 12 2009 - 11:18AM

Dow Jones News

Struggling U.K. sportswear retailer JJB Sports PLC (JJB.LN) will

launch its GBP100 million equity issue imminently, its largest

shareholder said Monday, after the plans were delayed by an

apparent smear campaign aimed at derailing the cash call.

Richard Bernstein, fund manager at activist investment fund

Crystal Amber Fund Ltd. (CRS.LN) which has a 14% stake in JJB,

said: "I think it's just a case of re-confirming all those who were

due to subscribe as soon as possible. It shouldn't be too

long."

The cash call had initially been delayed by a technical matter

Thursday, but on Saturday JJB issued another statement to say it

was holding back the fundraising round to investigate rumors about

the financial affairs of its executive chairman and interim Chief

Executive David Jones.

According to the Sunday Times Newspaper, the allegations

centered on suggestions that the daughter of former JJB Sports

Chief Executive Dave Whelan had made payments to Jones' bank

account at the time when Whelan was in talks to buy JJB's Health

Clubs division.

A JJB Sports spokesman Monday said Jones wouldn't be commenting

on the claims.

JJB said the rumors were "totally unfounded" and it is "very

concerned" by their timing and nature. It has passed details of its

investigation to the relevant regulatory authorities.

Bernstein said: "We don't know where the rumors started. We got

a call on Friday saying the placing wasn't going to be done, but it

was the lesser of the evils. What we don't want is someone joining

as a shareholder and then saying they wouldn't have got involved if

things had turned out differently."

It is the latest twist in the tale of the Wigan, England-based

retailer, which last month posted a massive first-half pretax loss

of GBP42.8 million and was recently revealed, along with

high-street rival Sports Direct (SPD.LN), as the subject of a U.K.

Serious Fraud Office probe on alleged price-fixing.

Earlier this year, Jones faced a showdown with shareholders

after it emerged he took a loan from business rival Mike Ashley,

owner of Sports Direct.

JJB announced at the time of its interim results in September

that it had begun the process of looking for a full-time chief

executive, following the dismissal in January of former CEO Chris

Ronnie over a messy share transfer.

Ronnie was suspended when it was discovered that liquidators of

collapsed Icelandic bank Kaupthing Bank had seized his 27.5% stake

in JJB. He resigned a short while later.

A JJB spokesman Monday wouldn't comment on claims that Steve

Johnson, who was at the helm of retail stalwart Woolworths when it

collapsed at the start of the year, is one of two names in the

frame as Ronnie's successor.

Last month, Jones told Dow Jones Newswires a permanent

replacement was expected to be announced by the end of January.

JJB's board said it continues to fully support Jones, who

resurrected fashion chain Next (NXT.LN) in the 1980s.

Seymour Pierce analyst Kate Heseltine downgraded JJB to a "sell"

rating from "hold" Monday and in a note to clients said the

fundraising amount is "excessive in light of the limited progress

made with the turnaround plan."

She expects the firm will launch a placing and open offer,

priced in the region of 20 pence to 25 pence.

JJB said it has received indications of interest from investors

in excess of three times the size of the proposed capital

raising.

Company Web site: www.jjbsports.com

-By Hannah Benjamin, Dow Jones Newswires; 44-20-7842-9298;

hannah.benjamin@dowjones.com

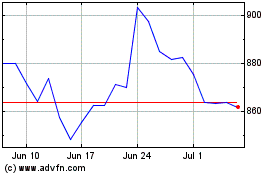

Frasers (LSE:FRAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Frasers (LSE:FRAS)

Historical Stock Chart

From Apr 2023 to Apr 2024