Glaxo Smith Kline (GSK)

05/11/2005

Two weeks ago GlaxoSmithKline (GSK) unveiled a stellar first quarter result. Operating profit grew 17 percent in sterling terms to £1.5 billion, on sales of £5 billion. We are confident that a robust product offering and exciting drug pipeline will allow GSK to maintain earnings growth momentum. We are particularly encouraged by the 'blockbuster' potential being displayed by one of the company's vaccines. Two weeks ago GlaxoSmithKline (GSK) unveiled a stellar first quarter result. Operating profit grew 17 percent in sterling terms to £1.5 billion, on sales of £5 billion. We are confident that a robust product offering and exciting drug pipeline will allow GSK to maintain earnings growth momentum. We are particularly encouraged by the 'blockbuster' potential being displayed by one of the company's vaccines.

The standout performer in Glaxo's product line-up continues to be Seretide/Advair. Sales on a constant exchange rate (CER) basis grew 22 percent to £690 million. European sales are expected to benefit further from trial data published in March. Studies showed that patients receiving Seretide displayed significantly more symptom-free days, and almost half the rate of asthma attacks, when compared to AstraZeneca's Symbicort.

Meanwhile Glaxo's pipeline of new drugs continues to rate as one of the largest and most promising in the industry. The launch of bladder control treatment Vesicare in the US in January was particularly well received. Last month GSK, along with partner Roche, launched Boniva in the US. The drug is an oral bisphosphonate that treats osteoporosis. We believe this drug could have significant potential as the global bisphosphonate market grew 20 percent last year and was worth £3 billion.

The pipeline drug with perhaps the most potential is Cervarix an exciting vaccine for the prevention of cervical cancer. Last week GSK revealed that Cervarix has been found to be effective against three more types of the virus that causes the disease. As a result we expect consensus sales forecasts (£2 billion per year in sales) for the drug will need to be upgraded. Indeed CEO Jean-Pierre Garnier suggested that Cervarix could be the world's biggest selling vaccine ever. Cervarix is expected to reach the market in 2006.

The company's confidence in Cervarix was behind its decision to buy US-based biotechnology firm Corixa recently for around US$300 million. The deal gives GSK access to Corixa's Monophosphoryl Lipid, (MPL) a key ingredient in Cervarix, amongst other vaccines. Following the acquisition GSK will no longer incur royalties in relation to MPL.

Currently, GSK trades on a prospective price earnings multiple of 17 times while offering investors a yield over 3 percent. Despite the recent rally we believe GSK offers compelling value. In our opinion GSK is still being weighed down by negative industry sentiment. Ultimately we expect GSK will be re-rated in line with its excellent stand-alone growth prospects.

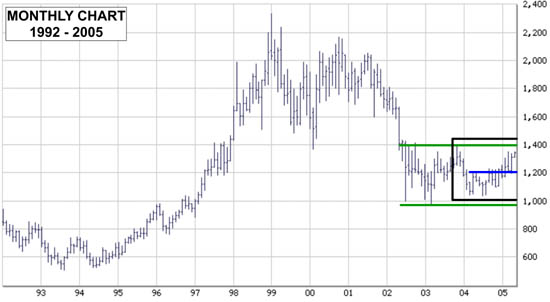

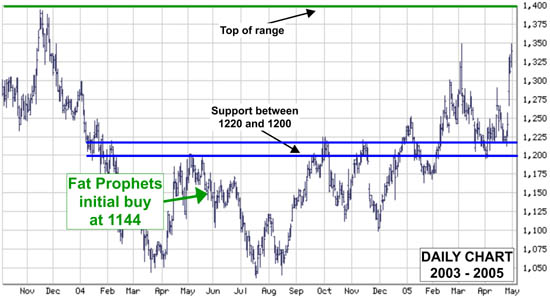

Glaxo Smith Kline (GSK) Stock Charts :

|