TIDMAFN

RNS Number : 3546T

ADVFN PLC

20 March 2019

20 March 2019

For immediate release

ADVFN PLC

("ADVFN" or the "Company")

Unaudited Interim Results for the Six Months Ended 31 December

2018

ADVFN today announces its unaudited interim results for the six

months ended 31 December 2018 (the "Period").

Chief Executive's Statement

The first half of the year has been a period of significant

change for ADVFN. Our users will have noticed the addition of a

strong, innovative Blockchain information offering that provides

our global userbase with exhaustive coverage of coins and tokens

across a plethora of exchanges. Meanwhile, we have significantly

re-engineered the site to cope, not only with the exciting but

technically challenging markets but with the ever-increasing

demands of markets forever pushing out more data. While nothing

sits still for long in the financial markets, we provide

information about, we try and by and large succeed in doing this

without disrupting the business.

Our re-engineering of the ADVFN website positions us for growth

especially on the eventual return of positive investor sentiment

towards blockchain cryptocurrencies after the year-long 'crypto

winter' bear market. It might seem hard for long term investors in

stocks to grasp the opportunity but in our opinion cryptocurrencies

will, in a few years, be the preferred investment market for the

generation called 'the millennials.' That futurism aside,

cryptocurrency is already a revenue generator for us and has been

the "tail-wind" making up for the regulatory "head-winds" affecting

our equity-focused customers via the ESMA regulations forcing the

spread betting community to restructure how they do business.

We have made a material investment thus far in our website and

this has added a further diversification to our product mix as well

as a chance to be at the forefront as and when Bitcoin and

cryptocurrencies catch the imagination of the traders and investors

again, as we believe it will in either later in 2019 or 2020.

After much preparation, and after seeing the first fruits of our

recent efforts turn into revenue, this has helped us maintain our

business in an environment where our customers have been buffeted

by new regulation and difficult markets and we continue to look

forward to the future with excitement.

Financial performance

Key financial performance for the period has been summarised as

follows:

Six Months ended Six Months ended

31 December 2018 31 December 2017

------------------------------ -----------------

GBP'000 GBP'000

------------------------------ -----------------

Revenue 4,265 4,282

------------------------------ -----------------

(Loss)/profit for the period (214) 24

------------------------------ -----------------

Operating (loss)/profit (210) 24

------------------------------ -----------------

(Loss)/profit per share (see

note 3) (0.84 p) 0.09 p

------------------------------ -----------------

Clem Chambers

CEO

19 March 2019

A copy of this announcement is available on the Company's

website: www.ADVFN.com

Enquiries:

For further information please contact:

ADVFN PLC +44 (0) 207 070

Clem Chambers 0909

Beaumont Cornish Limited (Nominated Adviser)

www.beaumontcornish.com

+44 (0) 207 628

Roland Cornish/Michael Cornish 3396

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. The person who arranged for the

release of this announcement on behalf of the Company was Clem

Chambers, Director.

Consolidated income statement

6 months 6 months 12 months

to to to

31 Dec 31 Dec 30 June

2018 2017 2018

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

Notes

Revenue 4,265 4,282 9,201

Cost of sales (227) (90) (392)

---------- ---------- ----------

Gross profit 4,038 4,192 8,809

Share based payment - (3) (21)

Amortisation of intangible assets (69) (105) (202)

Other administrative expenses (4,179) (4,060) (8,202)

Total administrative expense (4,248) (4,168) (8,245)

Operating (loss)/profit (210) 24 384

Finance income and expense (4) - -

Income from related parties - - 58

(Loss)/profit before tax (214) 24 442

Taxation - - (49)

---------- ---------- ----------

(Loss)/profit for the period attributable

to shareholders of the parent (214) 24 393

========== ========== ==========

Earnings per share

Basic and diluted 3 (0.84 p) 0.09 p 1.53 p

Consolidated statement of comprehensive

income

6 months 6 months 12 months

to to to

31 Dec 31 Dec 30 June

2018 2017 2018

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

(Loss)/profit for the period (214) 24 393

Other comprehensive income:

Items that will be reclassified

subsequently to profit or loss:

Exchange differences on translation

of foreign operations 33 (70) (33)

Deferred tax on translation of - - -

foreign held assets

---------- ---------- ----------

Total other comprehensive income 33 (70) (33)

Total comprehensive income for

the year attributable to shareholders

of the parent (181) (46) 360

========== ========== ==========

Consolidated balance sheet

31 Dec 31 Dec 30 June

2018 2017 2018

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

Assets

Non-current assets

Property, plant and equipment 161 54 136

Goodwill 971 913 941

Intangible assets 1,417 1,235 1,307

Investments 3 - 3

Deferred tax 1 6 4

Trade and other receivables 108 92 111

2,661 2,300 2,502

Current assets

Trade and other receivables 812 844 855

Cash and cash equivalents 871 969 1,061

---------- ---------- --------

1,683 1,813 1,916

Total assets 4,344 4,113 4,418

========== ========== ========

Equity and liabilities

Equity

Issued capital 51 51 51

Share premium 145 145 145

Share based payments reserve 365 347 365

Foreign exchange reserve 278 208 245

Retained earnings 1,063 908 1,277

---------- ---------- --------

1,902 1,659 2,083

Current liabilities

Trade and other payables 2,442 2,454 2,313

Current tax - - 22

2,442 2,454 2,335

Total liabilities 2,442 2,454 2,335

---------- ---------- --------

Total equity and liabilities 4,344 4,113 4,418

========== ========== ========

Consolidated statement of changes in equity

Share Share Share Foreign Retained Total

capital premium based exchange earnings equity

payment

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2017 51 145 344 278 884 1,702

Equity settled share options - - 3 - - 3

Share issues - - - - - -

--------- --------- --------- ---------- ---------- ----------

Transactions with owners - - 3 - - 3

Profit for the period after

tax - - - - 24 24

Other comprehensive income

Exchange differences on

translation of foreign operations - - - (70) - (70)

Total comprehensive income - - - (70) 24 (46)

--------- --------- --------- ---------- ---------- ----------

At 31 December 2017 51 145 347 208 908 1,659

Equity settled share options - - 18 - - 18

Share issues - - - - - -

--------- --------- --------- ---------- ---------- ----------

Transactions with owners - - 18 - - 18

Profit for the period after

tax - - - - 369 369

Other comprehensive income

Exchange differences on

translation of foreign operations - - - 37 - 37

--------- --------- --------- ---------- ---------- ----------

Total comprehensive income - - - 37 369 406

--------- --------- --------- ---------- ---------- ----------

At 30 June 2018 51 145 365 245 1,277 2,083

Loss for the period after

tax - - - - (214) (214)

Other comprehensive income

Exchange differences on

translation of foreign operations - - - 33 - 33

--------- --------- --------- ---------- ---------- ----------

Total comprehensive income - - - 33 (214) (181)

--------- --------- --------- ---------- ---------- --------

At 31 December 2018 51 145 365 278 1,063 1,902

========= ========= ========= ========== ========== ==========

Consolidated cash flow statement

6 months 6 months 12 months

to to to

31 Dec 31 Dec 30 June

2018 2017 2018

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

Cash flows from operating activities

(Loss)/profit for the year (214) 24 393

Taxation - - 49

Net finance income in the income statement 4 - -

Share based payment - 3 21

Depreciation of property, plant and

equipment 36 18 68

Amortisation 69 105 202

Profit on disposal of Equity Holdings - - (53)

Decrease in trade and other receivables 46 104 74

Increase/(decrease) in trade and other

payables 129 (10) (151)

Net cash generated by continuing operations 70 244 603

Income tax paid (22) - (27)

---------- ---------- ----------

Net cash generated by operating activities 48 244 576

Cash flows from financing activities

Interest paid (4) - -

Cash flows from investing activities

Payments for property, plant and equipment (61) (19) (151)

Purchase of intangibles (179) (184) (353)

Receipt from related party - - 50

Net cash used by investing activities (240) (203) (454)

Net (decrease)/increase in cash and

cash equivalents (196) 41 122

Exchange differences 6 (35) (24)

---------- ---------- ----------

Net (decrease)/ increase in cash and

cash equivalents (190) 6 98

Cash and cash equivalents at the start

of the period 1,061 963 963

---------- ---------- ----------

Cash and cash equivalents at the end

of the period 871 969 1,061

========== ========== ==========

1. Legal status and activities

ADVFN Plc ("the Company") is principally involved in the

development and provision of financial information primarily via

the internet and the development and exploitation of ancillary

internet sites.

The company is a public limited liability company incorporated

and domiciled in England and Wales. The address of its registered

office is Suite 27, Essex Technology Centre, The Gables, Fyfield

Road, Ongar, Essex, CM5 0GA.

The Company is quoted on the Alternative Investment Market

("AIM") of the London Stock Exchange.

2. Basis of preparation

The unaudited consolidated interim financial information is for

the six-month period ended 31 December 2018. The financial

information does not include all the information required for full

annual financial statements and should be read in conjunction with

the consolidated financial statements of the Group for the year

ended 30 June 2018, which were prepared under IFRS as adopted by

the European Union (EU).

The accounting policies adopted in this report are consistent

with those of the annual financial statements for the year to 30

June 2018 as described in those financial statements.

The financial statements are presented in Sterling (GBP) rounded

to the nearest thousand except where specified.

The unaudited interim financial information does not include all

the information required for full annual financial statements and

should be read in conjunction with the financial statements of the

company for the year ended 30 June 2018.

The interim financial information has been prepared on the going

concern basis which assumes the company will continue in existence

for the foreseeable future. No material uncertainties that cast

significant doubt about the ability of the company to continue as a

going concern have been identified by the directors. Accordingly,

the directors believe it is appropriate for the interim financial

statement to be prepared on the going concern basis.

The interim financial information has not been audited nor has

it been reviewed under ISRE 2410 of the Auditing Practices Board.

The financial information presented does not constitute statutory

accounts as defined by section 434 of the Companies Act 2006. The

Group's statutory accounts for the year to 30 June 2018 have been

filed with the Registrar of Companies. The auditors, Grant Thornton

UK LLP reported on these accounts and their report was unqualified

and did not contain a statement under section 498(2) or Section

498(3) of the Companies Act 2006.

New standards adopted in the period:

IFRS 15 - Revenue

The standard was adopted for the period commencing 1 July 2018.

The standard defines a new five step model to recognise revenue

from customers and will apply to the Group as follows:

Subscriptions - both monthly and annual subscriptions are

offered and annual subscriptions are deferred on a time basis with

equal monthly transfers to the income statement.

Events - revenue from events is recognised at the time of the

event. There are no circumstances when the early payment of

entrance or stand fees is entirely non-refundable.

Advertising - fees for advertising are recognised when the

service obligations are fulfilled. Where there are multiple

obligations, amounts specific to that obligation are transferred to

the income statement.

IFRS 9 Financial Instruments

The standard was adopted for the period commencing 1 July 2018.

The treatment of any doubtful receivables changed to reflect an

expected credit loss rather than an incurred credit loss. There has

been a small addition to the allowance account for doubtful

receivables.

The adoption of the above standards has not had a material

impact on the financial statements.

New standards not yet adopted:

IFRS 16 Leases

The standard will be adopted in the period commencing 1 July

2019. Under the provisions of the new standard most leases,

including the majority of those previously classified as operating

leases, will be brought onto the financial position statement as a

right-of-use asset and as an offsetting lease liability. The

directors are considering the impact of the new standards on the

Group's accounting policies and more information will be provided

in the annual report for the year ended 30 June 2019.

3. Earnings per share

6 months 6 months 12 months

to to to

31 Dec 2018 31 Dec 2017 30 June

2018

GBP'000 GBP'000 GBP'000

(Loss)/profit for the year attributable

to equity shareholders (214) 24 393

Earnings per share (pence)

Basic (0.84 p) 0.09 p 1.53 p

Diluted (0.84 p) 0.09 p 1.53 p

Shares Shares Shares

Weighted average number of shares in

issue for the period 25,623,845 25,623,845 25,623,845

Dilutive effect of options - - -

------------ ------------ -----------

Weighted average shares for diluted

earnings per share 25,623,845 25,623,845 25,623,845

Where a loss is reported for the period the diluted loss per

share does not differ from the basic loss per share as the exercise

of share options would have the effect of reducing the loss per

share and is therefore not dilutive under the terms of IAS 33.

In addition, where a profit has been recorded but the average

share price for the period remains under the exercise price the

existence of options is not dilutive.

4. Events after the balance sheet date

There are no events of significance occurring after the balance

sheet date to report.

5. Dividends

The directors do not recommend the payment of a dividend.

6. Financial statements

Copies of these accounts are available from the Company's

registered office at Suite 27, Essex Technology Centre, The Gables,

Fyfield Road, Ongar, Essex, CM5 0GA or from Companies House, Crown

Way, Maindy, Cardiff, CF14 3UZ.

www.companieshouse.gov.uk

and from the ADVFN plc website:

www.ADVFN.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR QKLFFKXFEBBF

(END) Dow Jones Newswires

March 20, 2019 03:00 ET (07:00 GMT)

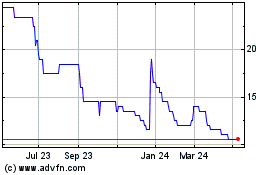

Advfn (LSE:AFN)

Historical Stock Chart

From Mar 2024 to Apr 2024

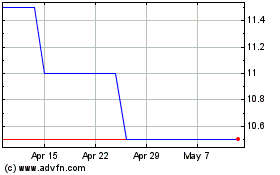

Advfn (LSE:AFN)

Historical Stock Chart

From Apr 2023 to Apr 2024