TIDMAFN

RNS Number : 2458G

ADVFN PLC

05 November 2018

5 November 2018

ADVFN PLC

("ADVFN" or the "Company")

Audited Results for the Year Ended 30 June 2018

ADVFN, the global stocks and shares website, announces its

audited results for the year ended 30 June 2018.

CHIEF EXECUTIVE'S STATEMENT

The financial year 2017/18 was a very interesting and

challenging year, one that has seen us add significant upside

potential to ADVFN. 2017 was the year of Bitcoin, which saw

Cryptocurrency and blockchains explode on to centre stage of the

financial markets. While even at the peak around Xmas of 2017 the

Cryptocurrency market was a tiny market in comparison with forex

and equities markets, it is of huge interest to the global private

investor.

We have an operating profit of GBP384,000 (GBP47,000 in 2017) a

solid improvement. Sales are up to GBP9,201,000

(GBP8,186,000 in 2017) and this is a strong result in the

circumstances.

This year we took advantage of these opportunities and have

positioned ourselves in the US and UK market with a strong

cryptocurrency information offering which has since become stronger

since the year end.

The timing of the Bitcoin bubble was fortunate as private

investor interest in equities has been at an all-time low. It is

perverse but our business in equities flourishes best when the

market crashes and our customers are hurt by corrections and

slumps. In strong markets investor complacency is not good for our

business and we rely on the diversified nature of our sales to

maintain revenue.

Happily, we were able to sail past these equity doldrums powered

by a compensating tailwind of Cryptocurrency information traffic.

Cryptocurrency information for the likes of Bitcoin and Ethereum is

a new category of financial information and one we are excited

about.

We are very bullish about the potential of future demand for

Cryptocurrency information and feel this can be a business

multiplier for us in the next 3-5 years. As you will see from the

figures, we have made the investment in technology and skills to

master and provide this information, without the costs materially

affecting our bottom line and you can see for yourself the quality

of our offering on the ADVFN and Investorshub website. This is the

platform from which we are building out our Blockchain information

offerings which we believe can be as lucrative as our equity

offerings.

Equities and Blockchain have distinct audiences and we find the

combination exciting. We believe our market potential just grew

significantly and that we can grow to fill it.

Clement Chambers

CEO

2 November 2018

The annual report and accounts will shortly be sent to

shareholders and will be available on the Company's website,

http://www.advfn.com

Enquiries:

For further information please contact:

ADVFN PLC

Clem Chambers +44 (0) 207 070 0909

Beaumont Cornish Limited (Nominated

Adviser)

www.beaumontcornish.com

Roland Cornish/Michael Cornish +44 (0) 207 628 3396

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. The person who arranged for the

release of this announcement on behalf of the Company was Clem

Chambers, Director.

STRATEGIC REPORT

Financial Overview

These consolidated and company accounts have been prepared under

International Financial Reporting Standards (IFRS) as adopted by

the European Union.

As always, we are in a continued environment of rising costs in

data licenses and exchange fees. We will continue to monitor these

and adapt as required.

Business Review

Our product, which is our website, can be seen at www.advfn.com.

Operating our websites is very technically challenging and is

subject to constant maintenance and engineering.

With the advent of the Blockchain and Cryptocurrencies we have

now added a new segment to the website to cater for the need of the

global cryptocurrency audience for timely and accurate data. We

expect this to expand the audience and traffic of our sites.

For our UK audience Brexit will be on most peoples agenda over

the next year and perhaps several years. We believe this market

stressing event could create increased interest in the markets in

the UK which is a very important market for us. ADVFN's information

sites are important windows onto world markets that private

investors around the world use to help manage their investing and

trading and we see opportunities for growth in providing these

sites.

Turnover has grown substantially in the last year and, as has

happened in previous years, the growth in the headcount has been in

parallel. This underlines the importance of having the talented

staff available in the company when there are opportunities to

expand. Our registered users go on increasing and provide us with a

ready market for the new products we are able to offer.

Operating Costs

Our main costs are relatively fixed but licence and exchange

fees are continuing to rise and it is these we must keep a close

eye on and if need be change what we offer.

Research and Development ("R&D")

Like most technology / media companies we are highly focused on

new developments including improvements to our website, products,

tools etc. Our research and development is key to our future. The

web and mobile environment continue to move and change and it's our

R&D that allows us to keep ahead. Our R & D investment this

year has been GBP353,000 (2017: GBP379,000) and all of this

investment has been to develop the website and has been

capitalised. This constant investment ensures our web experience

remains fresh and relevant.

Environmental policy

The Group as a whole continues to look for ways to develop its

environmental policy. It remains our objective to improve our

performance in this area.

Future outlook for the business

It is important for us to keep focused on the technology and

continue to strive to be ahead of this new market changing process.

The Blockchain and Crypto Currencies are a new area that we are

building upon, which could open up new opportunities that I hope we

can develop and into which we can push the business.

Summary of key performance indicators

Our key indicators have not changed, as they are an important

part of the business.

The Directors monitor the Key Performance Indicators on an

ongoing basis. The chart below shows the level of performance

achieved in the financial year. The individual items are as

follows:

2018 2018 2017 2017

Actual Target Actual Target

-------- -------- -------- --------

Turnover GBP9.2M GBP8.5M GBP8.2M GBP8.0M

-------- --------

Average head count 46 40 32 35

-------- -------- --------

ADVFN registered users 4.5M 4.2M 4.0M 3.8M

-------- -------- -------- --------

Turnover - is of vital importance as it gives the sales

department a goal and measures the financial success of the Group's

services.

Head count - is a very significant part of the costs of the

company and is fixed as an overhead. It provides a good indicator

when taken against the revenue figure for the efficiency of the

business. Talented people are a vital part of the business.

STRATEGIC REPORT (continued)

Summary of key performance indicators (continued)

Registered users - give us an accurate indication of our

audience pool and the potential available for marketing our

service.

Principal risks and uncertainties

Economic downturn

I mentioned above we may face many new potential issues. We have

no control over the outcome and impact of the Brexit negotiations

and the leaving process its self. This, mixed with the new

technologies which are on their way, could make for an interesting

experience.

High proportion of fixed overheads coupled with variable

revenues

A large proportion of the Company's overheads are fixed. There

is the risk that any significant changes in revenue may lead to the

inability to cover such costs. We closely monitor fixed overheads

against budget on a monthly basis and cost saving exercises are

implemented on a constant review basis.

Product obsolescence

I have said many times our technology that we use is always in

development and constantly changing and up dating. All our

technology and products are subject to technological change and

could become obsolete quickly.

As always we have to constantly innovate to keep up with growing

technical challenges that are changing all the time.

The Board is committed to the Research and Development strategy

in place, and are confident that the Company is able to react

effectively to the developments within the market.

Fluctuations in currency exchange rates

A major proportion of our turnover relates to overseas

operations. As a company, we are therefore exposed to foreign

currency fluctuations. The Company manages its foreign exchange

exposure on a net basis and, if required, uses forward foreign

exchange contracts and other derivatives/financial instruments to

reduce the exposure. Currently hedging is not employed and no

forward contracts are in place. If currency volatility was extreme

and hedging activity did not mitigate the exposure, then the

results and the financial condition of the Company might be

adversely impacted by foreign currency fluctuations.

Following the volatility post Brexit, management will continue

to monitor the impact of currency fluctuation. The exchange rate of

the US Dollar has been a recent focus.

People

I would like to thank the whole team at ADVFN who tirelessly

provide a global service for private investors that never

sleep.

ON BEHALF OF THE BOARD

Clement Chambers

CEO

2 November 2018

Consolidated income statement

30 June 30 June

2018 2017

Notes GBP'000 GBP'000

Revenue 9,201 8,186

Cost of sales (392) (201)

-------- --------

Gross profit 8,809 7,985

Share based payment (21) -

Amortisation of intangible assets (202) (302)

Other administrative expenses (8,202) (7,636)

-------- --------

Total administrative expenses (8,425) (7,938)

Operating profit 384 47

Finance income and expense - 167

Income from related parties 3 58 -

-------- --------

Profit before tax 442 214

Taxation (49) 30

-------- --------

Total profit for the period attributable

to shareholders of the parent 393 244

======== ========

Profit per share

Basic 2 1.53 p 0.10 p

Diluted 2 1.53 p 0.10 p

Consolidated statement of comprehensive

income

30 June 30 June

2018 2017

GBP'000 GBP'000

Profit for the period 393 244

Other comprehensive income:

Items that will be reclassified subsequently

to profit or loss:

Exchange differences on translation of

foreign operations (33) (281)

Deferred tax on translation of foreign

held assets - 92

-------- --------

Total other comprehensive income (33) (189)

Total comprehensive income for the year

attributable to shareholders of the parent 360 55

======== ========

Consolidated balance sheet

30 June 30 June

2018 2017

GBP'000 GBP'000

Assets

Non-current assets

Property, plant and equipment 136 53

Goodwill 941 948

Intangible assets 1,307 1,156

Investments 3 -

Deferred tax 4 6

Trade and other receivables 111 92

2,502 2,255

Current assets

Trade and other receivables 855 948

Cash and cash equivalents 1,061 963

-------- --------

1,916 1,911

-------- --------

Total assets 4,418 4,166

======== ========

Equity and liabilities

Equity

Issued capital 51 51

Share premium 145 145

Share based payment reserve 365 344

Foreign exchange reserve 245 278

Retained earnings 1,277 884

-------- --------

2,083 1,702

Current liabilities

Trade and other payables 2,313 2,464

Current tax 22 -

-------- --------

2,335 2,464

-------- --------

Total liabilities 2,335 2,464

-------- --------

Total equity and liabilities 4,418 4,166

Consolidated statement of changes in equity

Share Share Share Foreign Retained Total

capital premium based exchange earnings equity

payment reserve

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2016 51 119 344 467 640 1,621

Equity settled share options

Share issues - 26 - - - 26

--------- --------- --------- ---------- ---------- --------

Total transactions with owners - 26 - - - 26

Profit for the period after

tax - - - - 244 244

Other comprehensive income

Exchange differences on translation

of foreign operations - - - (281) - (281)

Deferred tax on translation

of foreign held assets - - - 92 - 92

--------- --------- --------- ---------- ---------- --------

Total other comprehensive

income - - - (189) - (189)

--------- --------- --------- ---------- ---------- --------

Total comprehensive income - - - (189) 244 55

--------- --------- --------- ---------- ---------- --------

At 30 June 2017 51 145 344 278 884 1,702

Equity settled share options - - 21 - - 21

Total transactions with owners - - 21 - - 21

Profit for the period after

tax - - - - 393 393

Other comprehensive income

Exchange differences on translation

of foreign operations - - - (33) - (33)

Total other comprehensive

income - - - (33) - (33)

--------- --------- --------- ---------- ---------- --------

Total comprehensive income (33) 393 360

--------- --------- --------- ---------- ---------- --------

At 30 June 2018 51 145 365 245 1,277 2,083

========= ========= ========= ========== ========== ========

Consolidated cash flow statement

12 months 12 months

to to

30 June 30 June

2018 2017

GBP'000 GBP'000

Cash flows from operating activities

Profit/(loss) for the year 393 244

Taxation 49 (30)

Net finance income in the income statement - (167)

Depreciation of property, plant & equipment 68 52

Amortisation 202 286

Profit on disposal of Investor Events - (56)

Profit on disposal of Equity Holdings (53) -

Adjustment to fair value of embedded derivative - 225

Share based payments - options/warrants 21 -

Decrease in trade and other receivables 74 82

Decrease in trade and other payables (151) (119)

Net cash generated by continuing operations 603 517

Income tax (payable)/receivable (27) 14

---------- ----------

Net cash generated by operating activities 576 531

Cash flows from financing activities

Issue of share capital - 26

Interest paid - -

Net cash generated/(used) by financing

activities - 26

Cash flows from investing activities

Payments for property plant and equipment (151) (37)

Purchase of intangibles (353) (379)

Sale of Investor Events - 40

Receipt from related party 50 -

Net cash used by investing activities (454) (376)

Net decrease in cash and cash equivalents 122 181

Exchange differences (24) (61)

---------- ----------

Net increase in cash and cash equivalents 98 120

Cash and cash equivalents at the start

of the period 963 843

---------- ----------

Cash and cash equivalents at the end of

the period 1,061 963

========== ==========

1. Segmental analysis

The directors identify operating segments based upon the

information which is regularly reviewed by the chief operating

decision maker. The Group considers that the chief operating

decision makers are the executive members of the Board of

Directors. The Group has identified two reportable operating

segments, being that of the provision of financial information and

that of other services. The provision of financial information is

made via the Group's various website platforms.

The parent entities operations are entirely of the provision of

financial information.

Three minor operating segments, for which IFRS 8's quantitative

thresholds have not been met, are currently combined below under

'other'. The main sources of revenue for these operating segments

is the provision of financial broking services, financial

conference events and other internet services not related to

financial information. Segment information can be analysed as

follows for the reporting period under review:

2018 Provision Other Total

of financial

information

GBP'000 GBP'000 GBP'000

Revenue from external customers 8,900 301 9,201

Depreciation and amortisation (388) 122 (266)

Other operating expenses (7,984) (567) (8,551)

-------------- -------- --------

Segment operating (loss)/profit 528 (144) 384

Interest income - - -

Interest expense - - -

============== ======== ========

Segment assets 3,831 587 4,418

Segment liabilities (2,196) (139) (2,335)

Purchases of non-current assets 444 60 504

============== ======== ========

2017 Provision Other Total

of financial

information

GBP'000 GBP'000 GBP'000

Revenue from external customers 7,814 372 8,186

Depreciation and amortisation (465) 127 (338)

Other operating expenses (7,380) (421) (7,801)

-------------- -------- --------

Segment operating (loss)/profit (31) 78 47

Interest income 167 - 167

Interest expense - - -

============== ======== ========

Segment assets 3,935 231 4,166

Segment liabilities (2,430) (34) (2,464)

Purchases of non-current assets 313 103 416

============== ======== ========

The Group's revenues, which wholly relate to the sale of

services, from external customers and its non-current assets, are

divided into the following geographical areas:

Revenue Non-current Revenue Non-current

assets assets

2018 2018 2017 2017

UK (domicile) 3,466 1,547 3,288 1,278

USA 5,259 955 4,348 977

Other 476 - 550 -

9,201 2,502 8,186 2,255

======== ============ ======== ============

Revenues are allocated to the country in which the customer

resides. During both 2018 and 2017 no single customer accounted for

more than 10% of the Group's total revenues.

Notes to the financial statements (continued)

2. Profit per share

12 months 12 months

to to

30 June 30 June

2018 2017

GBP'000 GBP'000

Profit for the year attributable to equity shareholders 393 244

Total loss per share - basic and diluted

Basic 1.53 p 0.10 p

Diluted 1.53 p 0.10 p

Shares Shares

Weighted average number of shares in issue for

the year 25,523,845 25,612,338

Dilutive effect of options 100,000 -

----------- -----------

Weighted average shares for diluted earnings

per share 25,623,845 25,612,338

=========== ===========

Where a profit has been recorded but the average share price for

the year remains under the exercise price the existence of options

is not dilutive

3. Disposal of Equity Holdings Ltd and Equity Development Ltd

Following the failure of Bashco Limited to make any payments to

the Company for the acquisition of Equity Holdings Ltd and its

subsidiary Equity Developments Ltd, the Company decided that it was

not in its interests to take back the majority ownership of the

disposed companies. The companies were not within the Group's core

operations and disposal had been the correct decision. In order

that the option to take back the disposed companies should lapse it

was agreed between the parties that a payment be made by Bashco Ltd

to ADVFN Plc amounting to a cash payment of GBP50,000 plus the

issue to ADVFN Plc of shares amounting to a 30% stake in the

disposed companies (as announced on 9 March 2018). These payments

have now been received and the parties consider the transaction

complete. The Directors have considered whether they have

significant control over Equity Holdings as a result of this

shareholding and have decided that this is not the case. The

shareholding is therefore recognised as an available for sale

financial asset within investments on the balance sheet.

4. Events after the balance sheet date

There are no events of significance occurring after the balance

sheet date to report.

5. Publication of non-statutory accounts

The financial information set out in this preliminary

announcement does not constitute statutory accounts as defined in

section 435 of the Companies Act 2006.

The consolidated balance sheet at 30 June 2018 and the

consolidated income statement, consolidated statement of

comprehensive income, consolidated statement of changes in equity,

consolidated cash flow statement and associated notes for the year

then ended have been extracted from the Company's 2018 statutory

financial statements upon which the auditors' opinion is

unqualified and does not include any statement under Section 498(2)

or (3) of the Companies Act 2006.

The annual report and accounts will shortly be sent to

shareholders and will be available on the Company's website,

http://www.advfn.com.

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR FKBDPPBDDFDK

(END) Dow Jones Newswires

November 05, 2018 02:00 ET (07:00 GMT)

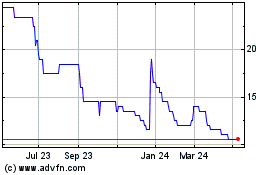

Advfn (LSE:AFN)

Historical Stock Chart

From Mar 2024 to Apr 2024

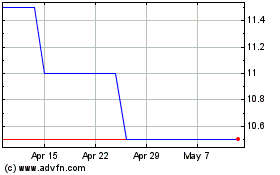

Advfn (LSE:AFN)

Historical Stock Chart

From Apr 2023 to Apr 2024