SKF First-quarter report 2015

April 17 2015 - 2:22AM

Business Wire

Regulatory News:

Alrik Danielson, President and CEO:

SKF (Pink Sheets:SKFRY) (STO:SKAB) (STO:SKFB)(STO:SKFA)

”Demand was in line with our expectations, with reported sales

growth in local currencies of 1,4%. All three business areas showed

an increase in sales in local currencies. Geographically, Asia

continued to show a good growth followed by Europe and Latin

America which were relatively unchanged while in North America the

business slowed somewhat due to lower activity in some of our key

industries. Cash flow from operations was strong, even though we

built some working capital in the quarter due to seasonality.

There has been a high focus on implementing the already

announced restructuring programme and I am pleased to see the good

progress so far, around 40%.

The high focus on innovations is continuing throughout the

organization and we have launched several new innovations to help

our customers improve their productivity and reduce energy usage.

For example, we introduced a new generalized bearing life concept

enabling customers to much better account for real-life conditions

when calculating SKF bearing life in their machines. Looking

forward, there is continued uncertainty from a macro perspective.

Sequentially and year on year we expect the demand to be relatively

unchanged for the Group.

I am also pleased to welcome a new Senior Vice President and CFO

for the Group, Christian Johansson.’’

Key figures Q1 2015 Q1 2014 Net

sales, SEKm 19 454 16 734 Operating profit, SEKm 1 721 2 024

Operating margin, % 8.8 12.1 One-time items (- costs, + income)

-655 117 Operating profit excluding one-time items, SEKm 2 376 1

907 Operating margin excl. one-time items % 12.2 11.4 Profit before

taxes, SEKm 1 592 1 787 Net profit, SEKm 1 165 1 275 Basic earnings

per share, SEK 2.46 2.72 One-time items in Q1 2015 include SEK -535

million for the ongoing cost-reduction programme, and the remainder

relates to write-offs of assets.

31-Mar-15

31-Dec-14 31-Mar-14 Net working

capital, % of annual sales 32.1 30.6 32.8 ROCE for the 12-month

period, % 12.6 13.9 8.4 Net debt/equity, % 122.2 126.6 117.6 Net

debt/EBITDA, % 3.2 3 4.2

Net sales change y-o-y, %:

Organic Structure Currency Total Q1

2015 1.4 0 14.9 16.3

Organic sales change in local

currencies, per region y-o-y, %: Europe

NorthAmerica Latin America Asia Middle East

& Africa Q1 2015 1 -2.4 0.4 5.6 14.2

Outlook for the second quarter of 2015

Demand compared to the second quarter 2014

The demand for SKF’s products and services is expected to be

relatively unchanged for the Group and for Europe. For Asia it is

expected to be higher and for North and Latin America slightly

lower. Per business area, for both Industrial Market and Automotive

Market it is expected to be relatively unchanged, and for Specialty

Business to be slightly higher.

Demand compared to the first quarter 2015

The demand for SKF’s products and services is expected to be

relatively unchanged for the Group, Europe and North America. For

Asia it is expected to be higher and for Latin America slightly

lower. Per business area, for both Industrial Market and Automotive

Market it is expected to be relatively unchanged, and for Specialty

Business to be slightly higher.

Manufacturing

Manufacturing is expected to be relatively unchanged year over

year and compared to the first quarter.

Gothenburg, 17 April 2015

Aktiebolaget SKF (publ)

A teleconference will be held on 17 April at 09.00 (CET), 08.00

(UK):

SE: +46 8 5033 6538

UK: +44 20 3427 1902

US: +1 212 444 0895

You will find all information regarding SKF First-quarter

results 2015 on the IR website.

investors.skf.com/quarterlyreporting

AB SKF is required to disclose the information provided herein

pursuant to the Securities Markets Act and/or the Financial

Instruments Trading Act. The information was submitted for

publication at around 08.00 on 17 April 2015.

SKF is a leading global supplier of bearings, seals,

mechatronics, lubrication systems, and services which include

technical support, maintenance and reliability services,

engineering consulting and training. SKF is represented in more

than 130 countries and has around 15,000 distributor locations

worldwide. Annual sales in 2014 were SEK 70 975 million and the

number of employees was 48 593. www.skf.com

® SKF is a registered trademark of the SKF Group.

This information was brought to you by Cision

http://news.cision.com

SKFPRESS:Theo KjellbergDirector, Press Relationstel: 46

31 337 6576mobile: 46 725-776576e-mail:

theo.kjellberg@skf.com (rebecca.janzon@skf.com)orINVESTOR

RELATIONS:Marita Bj�rkHead of Investor Relationstel: 46 31-337

1994mobile: 46 705-181994e-mail: marita.bjork@skf.comorMEDIA

HOTLINE: 46 31 337 2400

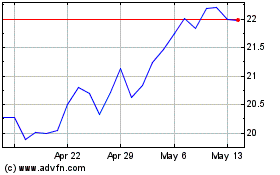

SKF Ab (PK) (USOTC:SKFRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

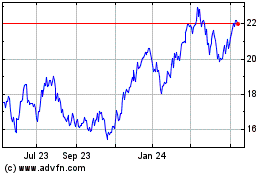

SKF Ab (PK) (USOTC:SKFRY)

Historical Stock Chart

From Apr 2023 to Apr 2024