UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2013

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 000-52375

|

Kingfish Holding Corporation

|

|

(Exact Name of Registrant as Specified in its Charter)

|

|

Delaware

|

|

20-4838580

|

|

(State or Other Jurisdiction of

|

|

(IRS Employer

|

|

Incorporation or Organization)

|

|

(Identification No.) |

|

2641 49th Street, Sarasota, Florida

|

|

34234

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(941) 870-2986

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

|

Name of Each Exchange |

|

Title of Each Class

|

|

On Which Registered

|

|

None

|

|

None

|

Securities registered pursuant to Section 12(g) of the Exchange Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes x No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large Accelerated Filer:

|

¨

|

Accelerated Filer:

|

¨

|

|

Non-Accelerated Filer:

|

¨

|

Smaller Reporting Company:

|

x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes x No ¨

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of November 28, 2014, was approximately $417,131 as computed by reference to the closing price of the common stock as quoted by the OTC Markets Group, Inc. on the pink sheets in their OTC Pink - No Information tier on such date.

As of November 28, 2014, the number of issued and outstanding shares of common stock of the registrant was 119,180,335.

Documents Incorporated By Reference: None

Kingfish Holding Corporation

ANNUAL REPORT ON FORM 10-K

For The

Fiscal Year Ended September 30, 2013

TABLE OF CONTENTS

|

Item Number in

Form 10-K

|

|

|

Page |

|

|

|

|

|

|

|

|

PART I

|

|

|

|

|

|

|

|

Item 1.

|

Business

|

|

4

|

|

|

Item 1A.

|

Risk Factors

|

|

11

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

|

11

|

|

|

Item 2.

|

Properties

|

|

11

|

|

|

Item 3.

|

Legal Proceedings

|

|

11

|

|

|

Item 4.

|

Mine Safety Disclosures

|

|

11

|

|

|

|

|

|

|

|

PART II

|

|

|

|

|

|

|

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities

|

|

12 |

|

|

Item 6.

|

Selected Financial Data

|

|

15

|

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

15 |

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

19

|

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

|

19

|

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

|

31 |

|

|

Item 9A.

|

Controls and Procedures

|

|

31

|

|

|

Item 9B.

|

Other Information

|

|

32

|

|

|

|

|

|

|

|

PART III

|

|

|

|

|

|

|

|

Item 10.

|

Directors ,Executive Officers and Corporate Governance

|

|

33

|

|

|

Item 11.

|

Executive Compensation

|

|

35

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

|

36 |

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

|

37

|

|

|

Item 14.

|

Principal Accountant Fees and Services

|

|

39

|

|

|

|

|

|

|

|

PART IV

|

|

|

|

|

|

|

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

|

40

|

|

A NOTE ABOUT FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (including the exhibits hereto) contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, such as statements relating to our financial condition, results of operations, plans, objectives, future performance or expectations, and business operations. These statements relate to expectations concerning matters that are not historical fact. Accordingly, statements that are based on management’s projections, estimates, assumptions, and judgments constitute forward-looking statements. These forward-looking statements are typically identified by words or phrases such as “believe,” “expect,” “anticipate,” “plan,” “estimate,” “approximately,” “intend,” “objective,” “goal,” “project,” and other similar words and expressions, or future or conditional verbs such as “will,” “should,” “would,” “could,” and “may.” These forward-looking statements are based largely on information currently available to our management and on our current expectations, assumptions, plans, estimates, judgments and projections about our business and our industry, and such statements involve inherent risks and uncertainties. Although we believe our expectations are based on reasonable estimates and assumptions, they are not guarantees of performance and there are a number of known and unknown risks, uncertainties, contingencies, and other factors (many of which are outside our control) which may cause actual results, performance, or achievements to differ materially from those expressed or implied by such forward-looking statements. Accordingly, there is no assurance that our expectations will in fact occur or that our estimates or assumptions will be correct, and we caution investors and all others not to place undue reliance on such forward-looking statements.

These potential risks and uncertainties include, but are not limited to, our ability to identify, secure and obtain suitable and sufficient financing to continue as a going concern; our ability to identify, enter into and close an appropriate a merger, acquisition, or other combination transaction with a business prospect; economic, political and market conditions; the general scrutiny and limitations placed on “blank check” and “shell” companies under applicable governmental regulatory oversight; interest rate risk; government and industry regulation that might affect future operations; potential change of control transactions resulting from merger, acquisition, or combination with a business prospect; the potential dilution in our equity (both economically and in voting power) that might result from future financing or from merger, acquisition, or combination activities; and other factors.

All written or oral forward-looking statements that are made or attributable to us are expressly qualified in their entirety by this cautionary notice. The forward-looking statements included herein are only made as of the date of this Annual Report on Form 10-K for the fiscal year ended September 30, 2013 (this “Form 10-K”). We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

PART I

ITEM 1. BUSINESS

Background

Kingfish Holding Corporation (“us”, “our”, “we”, the “Company” or “Kingfish”) was incorporated in the State of Delaware on April 11, 2006 as Offline Consulting Inc. We became Kesselring Holding Corporation (“Kesselring Holding”) on June 8, 2007 and on November 25, 2014 we changed our name to Kingfish Holding Corporation. The principal executive offices of the Company are located at 2641 49th Street, Sarasota, Florida 34234, and our telephone number is (941) 870-2986.

On May 18, 2007, we entered into a reverse merger transaction pursuant to a Share Exchange Agreement (“Exchange Agreement”) whereby we acquired Kesselring Corporation, a Florida corporation (“Kesselring Florida”), that was engaged in the business of homebuilding and restoration operations in central Florida and in the manufacture of building products from operations located in the State of Washington. As a result of this transaction, Kesselring Florida became a wholly-owned subsidiary of the Company. Pursuant to the terms of the Exchange Agreement, however, Kesselring Florida’s shareholders received approximately 80% of the Company’s outstanding common stock and its management was given actual operational and governance control over the Company. As a result thereof, the Company effectively succeeded its otherwise minimal operations to Kesselring Florida and Kesselring Florida was considered the accounting acquirer in the reverse-merger transaction.

At the time of its acquisition, Kesselring Florida had the following wholly-owned subsidiaries: Kesselring Restoration Inc. (which was engaged in restoration services, principally to commercial property owners); King Brothers Woodworking, Inc. and King Door and Hardware, Inc. (which such businesses were engaged in the manufacture and sale of cabinetry and remodeling products, principally to contractors); Kesselring Homes, Inc. (which was engaged in new construction, residential and commercial remodeling, and building services on customer owned properties); and Kesselring Aluminum Corporation Inc. (formerly 1st Aluminum, Inc., which had minimal operations).

Following the completion of the reverse merger transaction, the Company formed a wholly-owned subsidiary named Kesselring Holding Corporation, a Delaware corporation, and engaged in a merger transaction with this subsidiary, pursuant to which the Company was the surviving entity, to effect a name change of the Company from “Offline Consulting, Inc.” to “Kesselring Holding Corporation.” A Certificate of Ownership was filed with the Secretary of State of the State of Delaware, effective as of June 8, 2007.

On December 12, 2008, in response to the dramatically deteriorating business environment in the West Central Florida area for the services offered by Kesselring Restoration Corporation (“KRC”), the Company decided to terminate those employees and focus its efforts on subcontracting-out certain projects. On March 31, 2009, KRC executed and delivered an Assignment for Benefit of Creditors, under Florida Statutes Section 727.101 et seq. (“Assignment”), assigning all of its assets to an assignee (“Assignee”), who was responsible for taking possession of, protecting, preserving, and liquidating such assets and ultimately distributing the proceeds to creditors of KRC according to their priorities as established by Florida law. The Assignee filed a petition commencing the assignment proceedings in the Circuit Court of the Twelfth Judicial Circuit in and for Manatee County, Florida, Civil Division on March 31, 2009. Neither the Company nor its other wholly-owned subsidiaries were included in the above referenced proceedings.

On November 16, 2009, certain shareholders of the Company owning a majority of our outstanding common stock ("Majority Shareholders") and acting pursuant to a written consent effected a change of control of the Company by removing certain of the sitting directors and electing new directors to the board. Immediately following the change of control of the board of directors, the newly elected directors terminated the then-President and Chief Executive Officer and appointed a successor.

In addition, on November 16, 2009, the Majority Shareholders and several additional shareholders also filed a Stockholders' Derivative Complaint (including Request for Temporary Restraining Order) in the United States District Court, Eastern District of Washington against the Company, Kesselring Florida, and certain officers and directors of the Company to judicially restrain the defendants from taking certain specified actions that might impair the value of the Company or its outstanding capital stock. On November 24, 2009, the United States District Court Eastern District of Washington entered a Temporary Restraining Order Granting Plaintiffs’ Order essentially ceasing all corporate activities of the Company, including, but not limited to, prohibiting the issuance of shares, entering contracts, the termination of any board member, officers and/or employees of Kesselring or its subsidiaries and the payment of cash from the subsidiary to the Company. On December 16, 2009, the Court held that actions taken by the Majority Shareholders were proper and entered an order granting a preliminary injunction in favor of the plaintiffs. The parties subsequently entered a Settlement Agreement in which the parties released one another from any and all liability and an order dismissing the action was signed April 5, 2010.

In 2007, the Company had borrowed $500,000 from AMI Holdings, Inc. ("AMI") in two separate loan transactions, which loans were secured by a continuing security interest in, a continuing lien upon, and an unqualified right to possession and disposition of, all of the Company's assets. AMI was a corporation controlled by James K. Toomey, a former director of the Company (“Mr. Toomey”), and certain of his relatives, including his wife, children and siblings. On May 13, 2010, following the Company’s default on these loans, AMI foreclosed on certain of the Company's assets, including 100% of the common stock of Kesselring Florida, and 100% of the common stock of King Brothers Woodworking, Inc., a subsidiary of Kesselring Florida. The Company also was indebted to Gary E. King, a former President and Director of the Company, evidenced by a promissory note ("Gary E. King Notes), and to Kenneth Craig, the Company’s then-President, also evidenced by a promissory note (“Kenneth Craig Note"). On May 24, 2010, AMI sold 100% of the King Brothers Woodworking, Inc. common stock to King Bro Wood, L.L.C., a Washington limited liability company, owned by Gary E. King and Terisita Craig, the wife of Don Craig, a former Chief Operating Officer of the Company (who resigned from such office on April 27, 2010) (the “King Brothers Sale”). As consideration for not objecting to the King Brothers Sale, King Bro Wood, L.L.C. delivered the Gary E. King Notes and the Kenneth Craig Note to the Company marked paid in full, resulting in substantial reduction of the Company's indebtedness. In addition, King Bro Wood, L.L.C. issued a promissory note to the Company in the principal amount of $156,990, such promissory note being payable over 24 months at the interest rate of 6% per annum.

As a result of the foreclosure, the Company no longer held any operating entities, its only asset was the King Bro Wood, L.L.C. promissory note, and it no longer conducted any business operations.

On September 16, 2011, the Company, having only 69 holders of record and no significant assets, filed a Form 15 with the U.S. Securities and Exchange Commission (the “Commission”) to terminate the registration of its common stock under Section 12 of the Exchange Act and to suspend its reporting obligations under Section 15(d) of the Exchange Act.

Recent Developments

In 2012, the sole remaining director and officer of the Company, Ted Sparling, and a former director of the Company, Mr. Toomey, met to discuss the Company’s business prospects in an effort to determine whether the Company had any viable alternatives and to assess the Company’s liabilities, if any, as well as the nature of any such remaining claims. In particular, there was an interest in seeking a means for creating stockholder value in the Company for those stockholders, who had, to that point, lost a significant amount of their investment in the Company. These discussions included the need for financing to pay for ongoing operations, to undertake an audit of the Company’s financial statements, to pay off certain outstanding indebtedness, and to reactivate the Company’s reporting obligations under Section 15(d) of the Exchange Act which had been suspended since 2011.

It was concluded that it might be feasible to acquire a target company or business seeking the perceived advantages of being a publicly held corporation and, based on these discussions, our management decided that it should explore opportunities to acquire other assets or business operations that will maximize shareholder value. Accordingly, it was determined that prior to undertaking a search for any such acquisition opportunities, the Company should take the steps necessary to (a) reconstitute a full board of directors, (b) update and complete its corporate records and corporate governance documents, including the payment of any franchise fees and taxes owed to the State of Delaware, (c) satisfy all its obligations owed to its transfer agent, (e) obtain an audit of its financial statements by independent registered public accountants, and (f) reactivate its suspended reporting obligations under Section 15(d) of the Exchange Act (collectively, “Preparatory Actions”).

Commencing in late 2012 and continuing through the date of the filing of this Form 10-K, Mr. Toomey has loaned to the Company the funds necessary to pay for the costs of such Preparatory Actions, including the payment of legal, accounting, and transfer agent fees, certain liability payments, and fees payable to the State of Delaware. In order to limit the Company’s debt burdens, these loans were evidenced by promissory notes convertible into common stock of the Company (“Convertible Notes”) and, as of the date hereof, Mr. Toomey has converted such Convertible Notes to the extent that there were sufficient authorized shares of common stock available therefor. However, there currently are an insufficient number of authorized shares to convert all of the Convertible Notes and, as a result, Convertible Notes issued after August 22, 2013 continue to be outstanding.

On November 25, 2014, as part of its Preparatory Actions, a majority of the Company’s stockholders took an action by written consent to elect the board of directors of the Company (following a removal of the then-sitting directors in accordance with the Delaware General Corporation Law) and to amend and restate the Company’s certificate of incorporation to, among other things:

| |

·

|

change the name of the Company to “Kingfish Holding Corporation,” and

|

| |

|

|

| |

·

|

require a super majority vote of at least 66 2/3% of the outstanding common stock of the Company to adopt, amend, alter, or repeal bylaw provisions and certain provisions of the certificate of incorporation.

|

Immediately following these stockholder actions, the Company’s bylaws were amended and restated, officers were appointed, and the board of directors authorized the dissemination of a Notice of Action Taken by Written Consent to those stockholders who had not provided their written consent to the above actions taken by the stockholders.

On December 15, 2014, the board of directors of the Company reviewed the audited financial statements of the Company, this Form 10-K, and the Quarterly Reports on Form 10-Qs for the quarters ended December 31, 2013, March 31, 2014, and June 30, 2014 and approved the filing of the Form 10-K and the filing of the Form 10-Qs.

Business Strategy

Currently, the Company intends to seek suitable candidates for a business combination with a private company, including a potential combination and financing transaction involving Florida Fuel Solutions, LLC, a Florida limited liability company controlled by certain of our directors (“FFS”). As of the date of the filing of this Form 10-K, the Company has only taken the Preparatory Actions and has not yet made any efforts to identify any private companies or potential business combinations other than FFS. However, the Company does not intend to enter into any negotiations or pursue a business combination transaction with any entity, including FFS, until it completes the Preparatory Actions and undertakes an evaluation of the alternatives available to the Company. As a result, the Company has not conducted negotiations or entered into a letter of intent concerning any target company or business, including FFS. The business purpose of the Company is to seek the acquisition of, or merger with, an existing company or business.

The Company is currently considered to be a "blank check" company. The rules and regulations of the Commission defines blank check companies as "any development stage company that is issuing a penny stock, within the meaning of Section 3(a)(51) of the [Exchange Act] and that has no specific business plan or purpose, or has indicated that its business plan is to merge with an unidentified company or companies." Pursuant to Rule 12b-2 promulgated under the Exchange Act, the Company also qualifies as a “shell company,” because it has no or nominal assets (other than cash) and no or nominal operations. Many states have enacted statutes, rules and regulations limiting the sale of securities of "blank check" companies in their respective jurisdictions. Management does not intend to undertake any efforts to cause a market to develop in our securities, either debt or equity, until we have successfully concluded a business combination transaction.

Consistent with this strategy, the Company’s principal business objective for the next 12 months and beyond such time will be to achieve long-term growth potential through a business combination transaction rather than seeking immediate, short-term earnings. The Company will not restrict its potential candidate target companies or businesses to any specific business, industry or geographical location and, thus, may acquire any type of business.

We may consider a business which has recently commenced operations, is a developing company in need of additional funds for expansion into new products or markets, is seeking to develop a new product or service, or is an established business which may be experiencing financial or operating difficulties and is in need of additional capital. In the alternative, a business combination may involve the acquisition of, or merger with, a company which does not need substantial additional capital, but which desires to establish a public trading market for its shares, while avoiding, among other things, the time delays, significant expense, and loss of voting control which may occur in a public offering.

We anticipate that the selection of an appropriate business combination transaction will be complex and extremely risky. Because of general economic conditions, rapid technological advances being made in some industries and shortages of available capital, our management believes that there are firms seeking the perceived benefits of becoming a publicly traded corporation. Such perceived benefits of becoming a publicly traded corporation include, among other things, facilitating or improving the terms on which additional equity financing may be obtained, providing liquidity for the principals of and investors in a business, creating a means for providing incentive stock options or similar benefits to key employees, and offering greater flexibility in structuring acquisitions, joint ventures and the like through the issuance of stock. Potentially available business combinations may occur in many different industries and at various stages of development, all of which will make the task of comparative investigation and analysis of such business opportunities extremely difficult and complex.

The Company has unrestricted flexibility in seeking, analyzing and participating in potential business opportunities and the analysis of potential business combination opportunities will be undertaken by or under the supervision of the officers and directors of the Company. In its efforts to analyze potential acquisition targets or businesses, the Company will consider the following kinds of factors:

| |

·

|

Potential for growth, indicated by new technology, anticipated market expansion or new products

|

| |

|

|

| |

·

|

The extent to which the business opportunity can be advanced

|

| |

|

|

| |

·

|

Capital requirements and anticipated availability of required funds, to be provided by the Company or from operations, through the sale of additional securities, through joint ventures or similar arrangements or from other sources

|

| |

|

|

| |

·

|

The cost of participation by the Company as compared to the perceived tangible and intangible values and potentials

|

| |

|

|

| |

·

|

Competitive position as compared to other firms of similar size and experience within the industry segment as well as within the industry as a whole

|

| |

|

|

| |

·

|

The accessibility of required management expertise, personnel, raw materials, services, professional assistance and other required items

|

| |

|

|

| |

·

|

Strength and diversity of management, either in place or scheduled for recruitment

|

| |

|

|

| |

·

|

Other relevant factors

|

In applying the foregoing criteria, none of which will be controlling, management will attempt to analyze all factors and circumstances and make a determination based upon reasonable investigative measures and available data. Potentially available business opportunities may occur in many different industries, and at various stages of development, all of which will make the task of comparative investigation and analysis of such business opportunities extremely difficult and complex. Due to the Company's limited capital available for investigation, the Company may not discover or adequately evaluate adverse facts about the opportunity to be acquired.

In evaluating a prospective business combination, we will conduct a due diligence review of potential targets in an extensive manner as is practicable given the lack of information which may be available regarding private companies, our limited personnel and financial resources, and the inexperience of our management with respect to such activities. We expect that our due diligence will encompass, among other things, meetings with the target business’s incumbent management and inspection of its facilities, as necessary, as well as a review of financial and other information which is made available to us. This due diligence review will be conducted either by our management or by unaffiliated third parties that we may engage, including but not limited to attorneys, accountants, consultants or other such professionals. At this time the Company has not specifically identified any third parties that it may engage. The costs associated with hiring third parties as required to complete a business combination may be significant and are difficult to determine as such costs may vary depending on a variety of factors, including the amount of time it takes to complete a business combination, the location of the target company, and the size and complexity of the business of the target company. Also, we do not currently intend to retain any entity to act as a “finder” to identify and analyze the merits of potential target businesses.

It is anticipated that when the Company is analyzing the available alternatives, it will consider and evaluate a potential business combination with FFS, combined with a simultaneous funding transaction. FFS is a development stage company focused producing high quality bio diesel fuel efficiently using state of the art, scalable, fully automated, continuous flow equipment from renewable sustainable feed stocks. Although FFS is negotiating for the right to purchase proprietary processing equipment from a third party corporation with substantially more resources than FFS to manufacture bio-fuels in central Florida, it does not yet have any contractual rights to purchase such equipments or processes. Furthermore, FFS is a development stage entity with limited funds and, as a result, does not have sufficient financial resources to purchase the equipment, to construct a processing plant, or to conduct any such operations. In order for a business combination with FFS to be feasible, not only would FFS need to successfully negotiate the terms and conditions of the purchase of the necessary processing equipment at a price satisfactory to it, a simultaneous source of financing must be negotiated and obtained. If the Company were to pursue a business combination with FFS under such circumstances, it is likely that the necessary financing would be in the form of an investment in the Company which would be made at the same time as the Company acquired FFS. In any event, FFS does not currently have any agreement to purchase the processing equipment or to finance its proposed business, and there can be no assurance that it will be able to do so in the future. In view of the number of significant uncertainties surrounding a possible transaction with FFS, the Company has determined not to negotiate any potential transaction with FFS at this time and will instead merely consider it as a potential alternative when seeking and evaluating other potential business combination opportunities.

Our limited funds and the lack of full-time management will likely make it impracticable to conduct a complete and exhaustive investigation and analysis of a target business before we consummate a business combination. Management decisions, therefore, will likely be made without detailed feasibility studies, independent analysis, market surveys and the like which, if we had more funds available to us, would be desirable. We will be particularly dependent in making decisions upon information provided by the promoters, owners, sponsors or others associated with the target business seeking our participation.

The time and costs required to select and evaluate a target company or business and to structure and complete a business combination cannot presently be ascertained with any degree of certainty. The amount of time it takes to complete a business combination, the location of the target company and the size and complexity of the business of the target company are all factors that determine the costs associated with completing a business combination transaction. The time and costs required to complete a business combination transaction can be ascertained once a business combination target has been identified. Any costs incurred with respect to evaluation of a prospective business combination that is not ultimately completed will result in a loss to us.

Our management anticipates that we will likely be able to effect only one business combination, due primarily to our limited financing and the degree of dilution anticipated for present and prospective shareholders, which is likely to occur as a result of our management’s plan to offer a controlling interest to a target business in order to achieve a tax-free reorganization. This lack of diversification should be considered a substantial risk in investing in us, because it will not permit us to offset potential losses from one venture against gains from another.

Form of Acquisition

The manner in which the Company participates in any specific opportunity would depend upon the nature of the opportunity, the respective needs and desires of the Company and the promoters of the opportunity, and the relative negotiating strength of the Company and such promoters.

It is likely that the Company will acquire its participation in a business opportunity through the issuance of common stock or other securities of the Company. Although the terms of any such transaction cannot be predicted, it should be noted that in certain circumstances the criteria for determining whether or not an acquisition is a so-called "tax free" reorganization under Section 368(a)(1) of the Internal Revenue Code of 1986, as amended (the "Code"), depends upon whether the owners of the acquired business own 80% or more of the voting stock of the surviving entity. If a transaction were structured to take advantage of these provisions rather than other "tax free" provisions provided under the Code, all prior stockholders would in such circumstances retain 20% or less of the total issued and outstanding shares of the surviving entity.

Under other circumstances, depending upon the relative negotiating strength of the parties and including situations where the investment is made in the Company to fund the purchase of operating assets,, prior stockholders may retain substantially less than 20% of the total issued and outstanding shares of the surviving entity. This could result in substantial additional dilution to the equity of those who were stockholders of the Company prior to such reorganization.

The stockholders of the Company will likely not have control of a majority of the voting securities of the Company following a reorganization or investment transaction. As part of such a transaction, all or a majority of the Company's directors may resign and one or more new directors may be appointed without any vote by stockholders.

In the case of an acquisition, the transaction may be accomplished upon the sole determination of management without any vote or approval by stockholders. In the case of a statutory merger or consolidation directly involving the Company, it will likely be necessary to call a stockholders' meeting and obtain the approval of the holders of a majority of the outstanding securities. The necessity to obtain such stockholder approval may result in delay and additional expense in the consummation of any proposed transaction and will also give rise to certain appraisal rights to dissenting stockholders. Most likely, management will seek to structure any such transaction so as not to require stockholder approval.

Competition

In identifying, evaluating, and selecting a target business, we may encounter intense competition from other entities having a business objective similar to ours. There are numerous “public shell” companies either actively or passively seeking operating businesses with which to merge in addition to a large number of “blank check” companies formed and capitalized specifically to acquire operating businesses. Additionally, we are subject to competition from other companies looking to expand their operations through the acquisition of a target company or business. Many of these entities are well established and have extensive experience identifying and effecting business combinations directly or through affiliates. Many of these competitors possess greater technical, human and other resources than us and our financial resources will be relatively limited when contrasted with those of many of these competitors. Our ability to compete in acquiring certain sizable target businesses is limited by our available financial resources. This inherent competitive limitation gives others an advantage in pursuing the acquisition of a target business. Further, our outstanding Convertible Notes and the future dilution they potentially represent may not be viewed favorably by certain target businesses.

Any of these factors may place us at a competitive disadvantage in successfully negotiating a business combination. Our management believes, however, that our status as a public entity and potential access to the United States public equity markets may give us a competitive advantage over privately-held entities with a business objective similar to ours to acquire a target business on favorable terms.

If we succeed in effecting a business combination, there will be, in all likelihood, intense competition from competitors of the target business. Many of our target business’ competitors are likely to be significantly larger and have far greater financial and other resources than we will. Some of these competitors may be divisions or subsidiaries of large, diversified companies that have access to financial resources of their respective parent companies. Our target business may not be able to compete effectively with these companies or maintain them as customers while competing with them on other projects. In addition, it is likely that our target business will face significant competition from smaller companies that have specialized capabilities in similar areas. We cannot accurately predict how our target business’ competitive position may be affected by changing economic conditions, customer requirements or technical developments. We cannot assure you that, subsequent to a business combination, we will have the resources to compete effectively.

Employees

We presently have no employees apart from our management. Our sole officer and our directors are engaged in outside business activities and are employed on a full-time basis by certain unaffiliated companies. Our officer and directors will be dividing their time among these entities and anticipates that they will devote very limited time to our business until the acquisition of a successful business opportunity has been identified. The specific amount of time that management will devote to the Company may vary from week to week or even day to day, and therefore the specific amount of time that management will devote to the Company on a weekly basis cannot be ascertained with any level of certainty. In all cases, management intends to spend as much time as is necessary to exercise its fiduciary duties as officer and director of the Company and believes that it will be able to devote the time required to consummate a business combination transaction as necessary. We expect no significant changes in the number of our employees other than such changes, if any, incident to a business combination.

ITEM 1A. RISK FACTORS

As a “Smaller Reporting Company”, the Company is not required to provide the information required by this Item

ITEM 1B. UNRESOLVED STAFF COMMENTS

As a “Smaller Reporting Company”, the Company is not required to provide the information required by this Item.

ITEM 2. PROPERTIES

The Company neither rents nor owns any properties. The Company utilizes the office space and equipment of its management at no charge. The Company currently has no policy with respect to investments or interests in real estate, real estate mortgages or securities of, or interests in, persons primarily engaged in real estate activities.

ITEM 3. LEGAL PROCEEDINGS

There are presently no pending legal proceedings to which the Company, any of its subsidiaries, any executive officer, any owner of record or beneficially of more than five percent of any class of voting securities is a party or as to which any of its property is subject, and no such proceedings are known to the Company to be threatened or contemplated against it.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

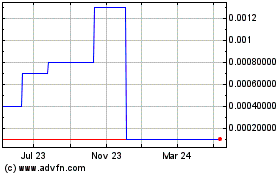

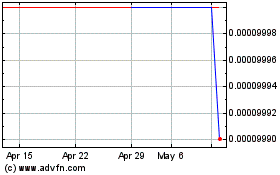

Price History. There has only been limited and sporadic trading of our common stock following the suspension of our reporting obligations under Section 15(d) of the Exchange Act on September 16, 2011. Although there is no established trading market for our shares of common stock, our common stock is quoted by the OTC Markets Group, Inc. on the pink sheets in their OTC Pink - No Information tier under the symbol “KSSH”. There is no assurance that an active trading market will ever develop or, if such a market does develop, that it will continue.

The following table sets forth high and low bid quotations for the quarters indicated. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not necessarily represent actual transactions.

|

|

|

High |

|

|

Low |

|

|

Year Ended September 30, 2013:

|

|

|

|

|

|

|

|

First Quarter (10/1/12 to 12/31/12)

|

|

$

|

0.0070

|

|

|

$

|

0.0050

|

|

|

Second Quarter (1/1/13 to 3/31/13)

|

|

$

|

0.0050

|

|

|

$

|

0.0050

|

|

|

Third Quarter (4/1/13 to 6/30/13)

|

|

$

|

0.0010

|

|

|

$

|

0.0005

|

|

|

Fourth Quarter (7/1/13 to 9/30/13)

|

|

$

|

0.0015

|

|

|

$

|

0.0050

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended September 30, 2012:

|

|

|

|

|

|

|

|

|

|

First Quarter (10/1/11 to 12/31/11)

|

|

$

|

0.0200

|

|

|

$

|

0.0060

|

|

|

Second Quarter (1/1/12 to 3/31/12)

|

|

$

|

0.0065

|

|

|

$

|

0.0060

|

|

|

Third Quarter (4/1/12 to 6/30/12)

|

|

$

|

0.0080

|

|

|

$

|

0.0010

|

|

|

Fourth Quarter (7/1/12 to 9/30/12)

|

|

$

|

0.0070

|

|

|

$

|

0.0050

|

|

The numbers of holders of record of our common stock on November 10, 2014 was approximately 70. On November 10, 2014, the last reported sale price of the common stock as quoted by the OTC Markets Group, Inc. on the pink sheets in the OTC Pink - No Information tier was $0.0035 per share.

The trading volume in our common stock has been and is extremely limited. The limited nature of the trading market can create the potential for significant changes in the trading price for the common stock as a result of relatively minor changes in the supply and demand for common stock and perhaps without regard to our business activities. Because of the lack of specific transaction information and our belief that quotations during the period were particularly sensitive to actual or anticipated volume of supply and demand, we do not believe that such quotations during these periods are necessarily reliable indicators of a trading market for the common stock.

Furthermore, the market price of our common stock may be subject to significant fluctuations in response to numerous factors, including: variations in our annual or quarterly financial results or those of our competitors; conditions in the economy in general; announcements of key developments by competitors; loss of key personnel; unfavorable publicity affecting our industry or us; adverse legal events affecting us; and sales of our common stock by existing stockholders.

Impact of Penny Stock Designation. Our common stock is designated as a “penny stock” under the Exchange Act, and the Commission has adopted rules which regulate broker-dealer practices in connection with transactions in “penny stocks” (Rules 15g-2 through l5g-6 of the Exchange Act, which are referred to as the “penny stock rules”). Penny stocks generally are any non-NASDAQ equity securities with a price of less than $5.00, subject to certain exceptions. The penny stock rules require a broker dealer to: (a) deliver a standardized risk disclosure document established under the penny stock rules, (b) provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, monthly account statements showing the market value of each penny stock held in the customer’s account, (c) make a special written determination that the penny stock is a suitable investment for the purchaser, and (d) receive the purchaser’s written agreement to the transaction. These disclosure and other requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a stock that is subject to the penny stock rules. Since our common stock is subject to the penny stock rules, persons holding or receiving such shares may find it more difficult to sell their shares. The market liquidity for the shares could be severely and adversely affected by limiting the ability of broker-dealers to sell the shares and the ability of shareholders to sell their stock in any secondary market.

Restrictions on the Use of Rule 144 by Shell Companies or Former Shell Companies. Historically, the Commission’s staff has taken the position that Rule 144 is not available for the resale of securities initially issued by companies that are, or previously were, blank check companies, to their promoters or affiliates despite technical compliance with the requirements of Rule 144. The Commission has formalized and expanded this position in recent amendments to Rule 144 which prohibit the use of Rule 144 for resale of securities issued by any shell companies (other than business combination related shell companies) or any issuer that has been at any time previously a shell company. The Commission has provided an exception to this prohibition, however, if the following conditions are met:

| |

·

|

the issuer of the securities that was formerly a shell company has ceased to be a shell company;

|

| |

|

|

| |

·

|

the issuer of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act;

|

| |

|

|

| |

·

|

the issuer of the securities has filed all Exchange Act reports and material required to be filed, as applicable, during the preceding 12 months (or such shorter period that the issuer was required to file such reports and materials), other than Form 8-K reports; and

|

| |

|

|

| |

·

|

at least one year has elapsed from the time that the issuer filed current Form 10 type information with the Commission reflecting its status as an entity that is not a shell company (which can be furnished on any other applicable form).

|

As a result, our existing stockholders will not be able to sell the shares pursuant to Rule 144 without registration until one year after we have completed our business combination and have satisfied the four conditions of a former shell company as described above.

Dividends

Holders of the Company’s common stock are entitled to receive dividends when and if declared by its Board of Directors out of funds legally available therefore. The Company, however, has never declared any cash dividends on its common stock and does not anticipate the payment of cash dividends in the foreseeable future. We do not have earnings out of which to pay cash dividends. We may consider payment of dividends at some point in the future when and if we have earning sufficient for that purpose, but the declaration of dividends is at the discretion of the board of directors, and there is no assurance that dividends will be paid at any time.

Securities Authorized under Equity Compensation Plans

We do not presently maintain any equity compensation plans.

Recent Sales of Unregistered Securities

Set forth below are the sales of unregistered securities during the fiscal year ended September 30, 2013.

| |

·

|

On July 2, 2013, Mr. Toomey elected to convert two convertible promissory notes, dated February 20, 2013, in a single transaction in aggregate principal amount of $35,000 (the “February 2013 Promissory Notes”). The conversion rate for the February 2013 Promissory Notes was determined to be $0.0029 per share, resulting in the issuance of 11,999,999 shares of common stock to Mr. Toomey. These shares of common stock of the Company were issued in reliance on Section 4(a)(2) of the Securities Act of 1933 (the “Securities Act”).

|

| |

|

|

| |

·

|

On August 31, 2013, Mr. Toomey elected to convert a convertible promissory note, dated August 22, 2013, in aggregate principal amount of $50,000 (the “August 2013 Promissory Note”). The conversion rate for the August 2013 Promissory Note was determined to be $0.00075 per share, resulting in the issuance of 66,666,667 shares of common stock to Mr. Toomey. These shares of common stock of the Company were issued in reliance on Section 4(a)(2) of the Securities Act.

|

The February 2013 Promissory Notes were issued pursuant to the terms and conditions of a Convertible Promissory Note Purchase Agreement, effective as of February 20, 2013 (the “February 2013 Note Agreement”), by and between the Company and Mr. Toomey to evidence a $5,000 loan made by Mr. Toomey to the Company on April 30, 2012, and a $30,000 loan made to the Company on February 20, 2013. The outstanding principle balance of the February 2013 Promissory Notes were convertible into shares of the Company’s common stock at a conversion price equal to the average of the mean of the bid and asked prices of the shares for the ninety consecutive full trading days in which the shares were traded ending at the close of business of the fifth day preceding the conversion date. The interest rates on the February 2013 Promissory Notes were at a fixed rate of 3% per annum, payable from the date of the actual loan. Pursuant to the terms of the February 2013 Note Agreement, the Company agreed to obtain directors’ and officers’ liability insurance for each director of the Company reasonably satisfactory to Mr. Toomey in an amount of no less than $1,000,000 and, that following the conversion of the February 2013 Promissory Notes and obtaining such directors’ and officers’ liability insurance, it would (a) fix the size of the Board of Directors at three directors, (b) appoint Mr. Toomey to serve on the board of directors of the Company until the next annual meeting of stockholders, and (c) fill the remaining vacancy on the board in the future with the appointment of a person designated by Mr. Toomey who was reasonably satisfactory to the Company.

Pursuant to the terms of the February 2013 Note Agreement, Mr. Toomey was appointed to the board of directors on August 31, 2013, and James LaManna was appointed to the board of directors on September 13, 2013.

The August 2013 Promissory Note was issued pursuant to the terms and conditions of a Convertible Promissory Note Purchase Agreement, effective as of August 22, 2013 (the “August 2013 Note Agreement”), by and between the Company and Mr. Toomey to evidence a $50,000 loan made by Mr. Toomey to the Company on February 20, 2013. The outstanding principle balance of the August 2013 Promissory Note was convertible into shares of the Company’s common stock at a conversion price equal to the average of the closing prices of the shares for the ninety consecutive full trading days in which the shares were traded ending at the close of business of the fifth day preceding the conversion date. The interest rate on the August 2013 Promissory Note was at a fixed rate of 4% per annum, payable from the date of the actual loan.

Transfer Agent

The transfer agent and registrar for our common stock is Manhattan Transfer Registrar Co., whose address is 57 Eastwood Road, Miller Place, NY 11764 and whose telephone number is 631-928-7655.

ITEM 6. SELECTED FINANCIAL DATA

As a “Smaller Reporting Company”, the Company is not required to provide the information required by this Item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

General

This Management’s Discussion and Analysis of Financial Condition and Results of Operations discusses the operating results and financial condition of the Company for the fiscal years ended September 30, 2013 and 2012. The discussion and analysis set forth below is intended to assist you in understanding the financial condition and results of our operations and should be read in conjunction with our audited financial statements and the accompanying notes included elsewhere in this Form 10-K. The following discussion contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of various factors, including those discussed elsewhere in this Form 10-K.

Overview

Operations. Historically, we were engaged in the business of homebuilding and restoration operations in central Florida and in the manufacture of building products from operations located in the State of Washington. During the fiscal year ended September 30, 2010, the Company defaulted on its loan agreements with AMI Holdings, Inc., a corporation controlled by Mr. Toomey and certain of his relatives ("AMI"), and on May 24, 2010 AMI foreclosed on and took possession of all of the Company’s then-existing operating entities. Following the foreclosure, the Company has not engaged in any business activities and has conducted only minimal operations.

During the fiscal year ended September 30, 2012, our management concluded that it may be feasible to acquire a target company or business seeking the perceived advantages of being a publicly held corporation and, as a result, our management determined that it should explore opportunities to acquire other assets or business operations that will maximize shareholder value. Following that determination, as an initial step, the Company made arrangements to take the Preparatory Actions and, as a result, the operations of the Company have been focused on preparing the Company for reactivation of its suspended reporting obligations under Section 15(d) of the Exchange Act. After it completes the Preparatory Actions, the Company will commence to investigate and, if such investigation warrants, merge or acquire an appropriate target company or business, if any.

Our plan is to seek a business venture in which to participate. The selection of a business opportunity in which to participate is complex and extremely risky and will be made by management in the exercise of its business judgment. No assurance can be given that we will be able to identify a suitable target or, if identified, that we will be able to successfully negotiate and agree upon terms acceptable to the Company or to successfully complete and close the proposed acquisition or business combination. No specific assets or businesses have yet been identified and there is no certainty that any such assets or business will be identified or any transactions will be consummated.

We expect to pursue our search for a business opportunity, including consideration of a potential transaction involving FFS, primarily through our officers and directors, although other sources, such as professional advisors, securities broker-dealers, venture capitalists, members of the financial community, and others, may present unsolicited proposals. Our activities are subject to several significant risks that arise primarily as a result of the fact that we have no specific target company or business and may acquire or participate in a business opportunity based on the decision of management which will, in all probability, act without the consent, vote, or approval of our shareholders. A description of the manner in which we will pursue the search for and participation in a business venture is described in “Item 1: Business” above.

Financial Condition. We have not recorded revenues from operations during the fiscal years covered by our financial statements included in this Form 10-K and are not currently engaged in any business activities that provide cash flows. We do not expect to generate any revenues over the next 12 months. Our principal business objective for the next 12 months and beyond such time will be to achieve long-term growth potential through a combination with a business. We will not restrict our potential candidate target companies to any specific business, industry or geographical location and, thus, may acquire any type of business. During the next 12 months we anticipate incurring costs related to: (i) investigating and analyzing potential business combination transactions; (ii) the preparation and filing of Exchange Act reports, and (iii) consummating an acquisition, if any. We believe we will be able to meet these costs through use of funds in our treasury and additional amounts, as necessary, to be loaned by or invested in us by our shareholders, management or other investors.

We have no specific plans, understandings or agreements with respect to the raising of such funds, and we may seek to raise the required capital by the issuance of equity or debt securities or by other means. Since we have no such arrangements or plans currently in effect, our inability to raise funds for the consummation of an acquisition may have a severe negative impact on our ability to become a viable company. We estimate that the level of working capital needed for these general and administrative costs for the next twelve months will be approximately $100,000.

We have negative working capital, negative shareholders’ equity and have not earned any revenues from operations since the fiscal year ended September 30, 2011. Mr. Toomey, the Company’s principal stockholder and a director, has loaned the Company monies in the past to cover our operations and Preparatory Actions. However, we have no formal commitment that he will continue to provide the Company with working capital sufficient until we consummate a merger or other business combination with a target company or business operation. We are currently devoting our efforts to locating such targets. Our ability to continue as a going concern is dependent upon our ability to develop additional sources of capital, locate and complete a merger with another company, and ultimately, achieve profitable operations. Our historical operating results disclosed in this Form 10-K are not meaningful to our future results.

Going Concern Issues

In its report dated December 17, 2014, our auditors, Warren Averett, LLC expressed an opinion that there is substantial doubt about our ability to continue as a going concern. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty. We generated no operating revenues for the fiscal years ended September 30, 2013 and 2012, and we had an accumulated stockholders’ deficit of $2,260,399 as of September 30, 2013. Furthermore, at September 30, 2013 and 2012, we had a retained deficit of $6,382,016 and $6,868,262, respectively, and a working capital deficit of $1,968,505 at September 30, 2013. As a result of our working capital deficiency and anticipated operating costs for the next twelve months, we do not have sufficient funds available to sustain our operations for a reasonable period without additional financing. Our continuation as a going concern is therefore dependent upon future events, including our ability to raise additional capital and to generate positive cash flows.

Results of Operations

Comparison of Years Ended September 30, 2013 and 2012

Revenues. Because we currently do not have any business operations, we have not had any revenues during our fiscal years ended September 30, 2013 and September 30, 2012.

General and Administrative Expenses. We had operating expenses of $30,480 and $2,724 for the years ended September 30, 2013 and 2012, respectively. These expenses consisted of general and administrative expenses which were primarily comprised of professional fees associated with various corporate and accounting matters and the cost of directors’ and officers’ insurance. The increase in such expenses for the year ended September 30, 2013 was due to the preliminary Preparatory Actions undertaken in 2013 to reactivate the Company’s suspended reporting obligations under Section 15(d) of the Exchange Act and the commencement of our directors’ and officers’ insurance during 2013. We anticipate that our general and administrative expenses will increase temporarily as we complete our Preparatory Actions and then will be reduced and remain relatively low until such time as we effect a merger or other business combination with an operating business, if at all.

Net Income (Loss). We recognized a net income of $486,246 for the fiscal year ended September 30, 2013 as compared to a net loss of $2,609 for the fiscal year ended September 30, 2012. The increase in net income in 2013 was due primarily to a gain of $782,918 from the settlement of accrued expenses during the year, offset by $266,192 provision for income taxes and a $27,756 increase in general and administrative expenses attributable to the costs and expenses associated with the Preparatory Actions.

Liquidity and Capital Resources

At September 30, 2013, we had a working capital deficit of $1,968,505. Current liabilities decreased to $1,972,947 at September 30, 2013 from $2,807,419 at September 30, 2012 primarily due to a $782,918 reduction in accrued expenses as a result of the settlement of such expenses in 2013. Total assets decreased to $4,442 at September 30, 2013 from $272,668 at September 30, 2012 due to the use of the $266,192 deferred tax asset in 2013.

We had no material commitments for capital expenditures as of September 30, 2013 and 2012. However, if we are able to execute our business plan as anticipated in the future, we would likely incur substantial capital expenditures and require additional financing to fund such expenditures.

During fiscal years ended September 30, 2013 and 2012, we have been reliant on monies loaned to us by Mr. Toomey to finance our operations and to pay the costs associated with the Preparatory Actions. On February 20, 2013, the Company acknowledged and formalized a loan made to the Company on April 30, 2012 in the amount of $5,000, and borrowed an additional $30,000 by entering into the February 2013 Note Agreement and issuing the February 2013 Promissory Notes in favor of Mr. Toomey in principal amount of $35,000 bearing interest at a fixed rate of 3% per annum, payable from the date of that the actual loan was provided to the Company. On August 22, 2013, Mr. Toomey advanced an additional $50,000 to the Company pursuant to the August 2013 Note Agreement and the Company issued the August 2013 Promissory Note in favor of Mr. Toomey in principal amount of $50,000 bearing interest at a fixed rate of 4% per annum. The February 2013 Promissory Notes and the August 2013 Promissory Note were both convertible into shares of our common stock at a conversion price equal to the average of closing prices of the shares for the ninety consecutive full trading days in which the shares were traded ending at the close of business of the fifth day preceding the conversion date. Mr. Toomey converted all of these notes during the fiscal year ended September 30, 2013.

The proceeds from the February 2013 Promissory Notes and the August 2013 Promissory Note were used primarily to the paying the operating expenses of the Company, including the amounts paid in connection with the Preparatory Actions, to settle certain outstanding debt obligations, and payments of accounts payable and interest. We do not expect to achieve positive cash flow from operations until we have a regular source of revenue, which is adequate to cover the operating costs of the Company.

Because we do not have any revenues from operations, absent a merger or other business combination with an operating company or a public or private sale of our equity or debt securities, the occurrence of either of which cannot be assured, we will continue to be dependent upon future loans or equity investments from our present shareholders or management to fund operating shortfalls and do not foresee a change in this situation in the immediate future. We will attempt to raise capital for our current operational needs through loans from related parties, debt financing, equity financing or a combination of financing options. However, there are no existing understandings, commitments or agreements for extension of outstanding notes or an infusion of capital, and there are no assurances to that effect. Moreover, our need for capital may change dramatically if and during that period, we acquire an interest in a business opportunity. There can be no assurances that any additional financings will be available to us on satisfactory terms and conditions, if at all. Unless we can obtain additional financing, our ability to continue as a going concern is doubtful. Although Toomey has provided the necessary funds for the Company in the past, there is no existing commitment to provide additional capital. In such situation, there can be no assurance that we shall be able to receive additional financing, and if we are unable to receive sufficient additional financing upon acceptable terms, it is likely that our business would cease operations.

Subsequent Events

Between October 21, 2013 and September 17, 2014, Mr. Toomey has advanced an additional $90,000 to the Company to pay for the Company’s ongoing business operations, to settle certain of its outstanding debt obligations, and to pay the costs associated with the Preparatory Actions. On October 24, 2014, the Company acknowledged and formalized these loans by entering into a Convertible Promissory Note Purchase Agreement, effective as of October 24, 2014 (the “October 2014 Note Agreement”), by and between the Company and Toomey to evidence the following loans made by Mr. Toomey to the Company:

| |

·

|

on October 21, 2013, Toomey advanced $10,000 to the Company;

|

| |

|

|

| |

·

|

on November 13, 2013, Toomey advanced $10,000 to the Company;

|

| |

|

|

| |

·

|

on January 13, 2014, Toomey advanced $10,000 to the Company;

|

| |

|

|

| |

·

|

on April 24, 2014, Toomey advanced $20,000 to the Company;

|

| |

|

|

| |

·

|

on May 22, 2014, Toomey advanced $20,000 to the Company; and

|

| |

|

|

| |

·

|

on September 17, 2014, Toomey advanced $20,000 to the Company.

|

Each of these advances are evidenced by a convertible promissory note in favor of Mr. Toomey for the principal amount thereof, bearing fixed interest rates of 3.5% per annum, payable from the date of the actual loan. The outstanding principal and interest on each of these notes are payable upon demand by Mr. Toomey; provided, however, that no demand for payment shall be made prior to earlier of: (a) June 1, 2015, and (b) thirty (30) calendar days after the Company reactivates its reporting obligations under Section 15(d) of the Exchange Act. Each of these promissory notes is convertible into the common stock of the Company by Mr. Toomey at a conversion price equal to the average of the mean of the bid and asked prices of the shares for the ninety consecutive full trading days in which the shares were traded ending at the close of business of the fifth day preceding the conversion date; but only when, and if, sufficient shares of authorized common stock exists under the Company’s certificate of incorporation. However, we do not currently have a sufficient number of authorized shares to convert the promissory notes issued pursuant to the October 2014 Note Agreement and as of the date hereof the underlying promissory notes have not yet been converted into shares of our common stock. Although we agreed in the October 2014 Note Agreement to promptly submit an amendment to the Company’s certificate of incorporation to our stockholders to increase the number of authorized shares, Mr. Toomey has agreed to waive that requirement until June 30, 2016.

Off-Balance Sheet Arrangements

We do not have any off balance sheet arrangements.

Critical Accounting Policies and Estimates

We prepare our financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”), which requires management to make certain estimates and assumptions and apply judgments. These financial statements contemplate that the Company will continue as a going concern for a reasonable period of time. Ultimately, our ability to continue as a going concern will depend on our ability to obtain additional financing to augment our working capital requirements and to support our business combination plans. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty.

We base our estimates and judgments on historical experience, current trends, and other factors that management believes to be important at the time the financial statements are prepared; actual results could differ from our estimates and such differences could be material. We have identified below the critical accounting policies, which are assumptions made by management about matters that are highly uncertain and that are of critical importance in the presentation of our financial position, results of operations and cash flows. Due to the need to make estimates about the effect of matters that are inherently uncertain, materially different amounts could be reported under different conditions or using different assumptions. On a regular basis, we review our critical accounting policies and how they are applied in the preparation our financial statements.

Use of Estimates. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Significant estimates that we have used in the preparation of our financial statements are as follows:

Income Taxes. Deferred taxes are provided on the asset and liability method whereby deferred tax assets are recognized for deductible temporary differences and operating loss and tax credit carry forwards and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences between the reported amounts of assets and liabilities and their tax bases. Future tax benefits for net operating loss carry forwards are recognized to the extent that realization of these benefits is considered more likely than not. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized.

The Company follows the provisions of FASB ASC 740-10 “Uncertainty in Income Taxes” (ASC 740-10). A reconciliation of the beginning and ending amount of unrecognized tax benefits has not been provided since there are not unrecognized benefits for all periods presented. The Company has not recognized interest expense or penalties as a result of the implementation of ASC 740-10. If there were an unrecognized tax benefit, the Company would recognize interest accrued related to unrecognized tax benefit in interest expense and penalties in operating expenses.

Net Income (Loss) Per Share. Basic income (loss) per share is computed by dividing net income (loss) available to common stockholders by the weighted average number of outstanding common shares during the period of computation. Diluted loss per share gives effect to potentially dilutive common shares outstanding. Potentially dilutive securities include stock options. The Company gives effect to these dilutive securities using the Treasury Stock Method. Potentially dilutive securities also include other convertible financial instruments. The Company gives effect to these dilutive securities using the If-Converted-Method.

New Accounting Pronouncements

For a description of recent accounting standards, including the expected dates of adoption and estimated effects, if any, on our financial statements, see “Note 9: Recent Accounting Pronouncement” in Part II, Item 8 of this Form 10-K.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

As a “Smaller Reporting Company”, the Company is not required to provide the information required by this Item.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Report of Independent Registered Public Accounting Firm

Board of Directors and Shareholders

Kingfish Holding Corporation

(formerly Kesselring Holding Corporation)

Sarasota, Florida

We have audited the accompanying balance sheets of Kingfish Holding Corporation (the “Company”), formerly Kesselring Holding Corporation, as of September 30, 2013 and 2012 and the related statements of operations, changes in stockholders’ deficit, and cash flows for the years then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required at this time, to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the Company as of September 30, 2013 and 2012 and the results of its operations and its cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company did not have any operations or generate any revenues for the years ended September 30, 2013 and 2012, and has an accumulated deficit of $6,382,016 through September 30, 2013, which raises a substantial doubt about its ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Warren Averett, LLC

Tampa, Florida

December 17, 2014

|

KINGFISH HOLDING CORPORATION

BALANCE SHEETS

SEPTEMBER 30, 2013 AND 2012

|

| |

|

2013 |

|

|

2012 |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Escrow held by attorney

|

|

$

|

1,109

|

|

|

$

|

6,476

|

|

|

Prepaid expense

|

|

|

3,333

|

|

|

|

-

|

|

|

Deferred tax asset

|

|