Alhambra Resources Ltd. (TSX

VENTURE:ALH)(PINKSHEETS:AHBRF)(FRANKFURT:A4Y) ("Alhambra" or the

"Corporation") announces its financial and operating results for

the quarter ended September 30, 2012. All amounts related to the

financial results are expressed in thousands of United States

dollars unless otherwise indicated.

HIGHLIGHTS FOR THE QUARTER:

-- Received approval from the Kazakhstan Ministry of Industry and New

Technology ("MINT") to proceed at the Corporation's discretion with the

issue of new shares

-- Executed a non-binding term sheet to complete a financing

-- Suspended mining operations in the quarter; no fresh ore was stacked on

the heaps

-- Gold sales were realized from the drawdown of recoverable gold inventory

from work in progress ("WIP")

-- Revenue from gold sales amounted to $2.4 million based on the sale of

1,452 ounces ("ozs")

-- The estimated recoverable gold in WIP as of September 30, 2012 was

38,619 ozs

-- Cash operating costs were $751 per oz of gold sold

-- Kazakhstan mining operations recorded net income of $0.1 million

($0.00/share)

-- The Corporation recorded a net loss of $0.4 million ($0.01/share)

-- A reverse circulation ("RC") exploration drilling program was completed

at Shirotnaia and a RC drilling program was initiated at Zhusaly

-- Exploration expenditures were $0.4 million

-- Announced board of director changes

FINANCIAL HIGHLIGHTS

----------------------------------------------------------------------------

(in US$000 except per Three Months ended Nine Months ended

share amounts) September 30 September 30

----------------------------------------------------------------------------

2012 2011 2012 2011

----------------------------------------------------------------------------

Revenue from gold

sales $ 2,447 $ 7,012 $ 8,080 $ 12,555

----------------------------------------------------------------------------

Net income (loss) (365) 2,550 (1,637) (1,201)

----------------------------------------------------------------------------

Per share (basic and

diluted) (0.01) 0.02 (0.02) (0.01)

----------------------------------------------------------------------------

Weighted average

shares outstanding

----------------------------------------------------------------------------

Basic 104,132,059 104,132,059 104,132,059 104,094,115

----------------------------------------------------------------------------

Diluted 104,132,059 106,079,287 104,132,059 104,094,115

----------------------------------------------------------------------------

Shares outstanding at

end of period 104,132,059 104,132,059 104,132,059 104,132,059

----------------------------------------------------------------------------

For the third quarter of 2012, the Corporation recognized $2.4

million in revenue from the sale of 1,452 ozs of gold at an average

price of $1,686/oz. This compares to $7.0 million in revenue from

the sale of 3,858 ozs of gold at an average price of $1,817/oz

during the third quarter of 2011.

Kazakhstan mining operations recorded net income of $0.1 million

for the third quarter of 2012. This compares to net income of $3.5

million for the third quarter of 2011. The Corporation recorded a

net loss of $0.4 million ($0.01 per basic and diluted share) for

the third quarter of 2012. This compares to net income of $2.6

million ($0.02 per basic and diluted share) for the third quarter

of 2011.

OPERATING HIGHLIGHTS

During the third quarter of 2012, no fresh ore was stacked on

its heap leach pads (2011 - 257,003 tonnes ("t")) nor was any waste

mined during the same period (2011 - 279,846 t). Gold sales were

realized from the drawdown of recoverable gold inventory from WIP.

As of September 30, 2012, the estimated recoverable gold classified

as WIP was 38,619 ozs.

During the nine months ended September 30, 2012, the Corporation

mined a total of 403,952 t of waste and stacked 136,220 t of ore at

an average gold grade of 0.57 grams/t ("g/t"). This compares to

1,178,980 t of waste mined and 570,068 t of ore stacked at an

average gold grade of 0.85 g/t during the nine months ended

September 30, 2011. The reduction in tonnes mined for the nine

months ended September 30, 2012 as compared to the comparable

period in 2011 is a result of issues with the mining contractor.

Earlier in 2012 the mining contractor had mechanical issues with

its equipment which impacted their ability to mine ore. In

addition, because of the Corporation's constrained financial

resources, both the mining contractor and the Corporation agreed at

the end of the second quarter of 2012 to suspend mining operations

in order to conserve cash during this period of financial hardship.

As previously announced, the Corporation has executed a non-binding

term sheet to complete a financing and is currently completing the

due diligence process related to that financing. Should this

financing be successfully concluded, a portion of the use of the

proceeds will go towards resuming the mining of ore.

The decrease in revenue for the nine months ended September 30,

2012 over the comparable nine month period in 2011 was a result of

a 37% decrease in sales volume which was offset partially by a 2%

increase in the average price of gold. The majority of the decrease

in sales volume occurred in the first and third quarters of 2012 as

a result of the Corporation not mining any fresh ore to stack on

the heaps due to the contractor equipment issues and the

Corporation's current financial constraints described above.

Revenues from gold sales were also negatively impacted by a 7%

decline in the average price of gold in the third quarter of 2012

as compared to the third quarter of 2011.

OPERATING EXPENSES

Operating expenses consist of all costs associated with the

production of gold, (including direct costs incurred in the mining,

leaching and resin stripping processes ("Process Operating Costs"),

Mineral Extraction Tax ("MET")), transportation and refining of the

cathodic sediment. All process operating costs are charged to WIP

and are expensed on the basis of the quantity of gold sold as a

percentage of total recoverable gold mined.

Operating costs for the three months ended September 30, 2012

totaled $1.2 million or $831/oz of gold sold as compared to $3.2

million or $819/oz of gold sold for the same period in 2011.

Included in this amount is $0.1 million or $80/oz (three months

ended September 30, 2011 - $0.4 million or $107/oz) related to the

amortization of the bump-up to fair value from the estimated cost

of WIP. Cash operating costs for the third quarter were therefore

$751/oz (compared to $712/oz for the third quarter of 2011). This

was $48/oz higher than the $703/oz incurred during the second

quarter of 2012.

Operating costs for the nine months ended September 30, 2012

totaled $4.1 million or $840/oz of gold sold as compared to $6.5

million or $853/oz of gold sold for the same period in 2011.

Included in this amount for the nine months ended September 30,

2012 is $0.4 million or $74/oz (nine months ended September 30,

2011 - $0.9 million or $120/oz of gold sold) related to the

amortization of the bump-up to fair value from the estimated cost

of WIP. Cash operating costs for the nine months ended September

30, 2012 were therefore $766/oz as compared to $733/oz for the nine

months ended September 30, 2011.

CAPITAL EXPLORATION PROGRAMS

Nine months ended September 30, 2012

During the three months ended September 30, 2012 the Corporation

recorded capital expenditures of $0.4 million which relates to the

Corporation's 2012 exploration program which is detailed below.

During the three months ended September 30, 2012, Alhambra

completed a reverse circulation ("RC") drilling program at

Shirotnaia, one of its advanced exploration projects, and initiated

a RC drilling program and completed a soil sampling program at

Zhusaly, one of its early stage exploration projects.

Since the beginning of 2012, two batches of core drill samples

(totaling 5,146 samples) from Shirotnaia and Zhanatobe have been

sent to the Kyrgyzstan Stewart Group laboratory for assaying.

As of the end of the third quarter of 2012, there were 1,987

Shirotnaia assay results pending (1,978 core and 7 QA/QC core

re-sampling) from the Stewart Kyrgyzstan laboratory.

In addition, as of the end of the third quarter of 2012, 3,942

samples were being prepared for export as follows:

-- Shirotnaia - 2,525 (RC samples),

-- Vasilkovskoe East - 844 (soil samples),

-- Zhusaly - 573 (soil samples).

Shirotnaia

During the third quarter of 2012, 1,596 assay results for eight

of 18 core holes (3,691 metres ("m")) completed in the first half

of 2012 were received. The assays were being interpreted. All drill

holes encountered intervals of strong chlorite sericite alteration

and sulphide mineralization as well as intervals of

carbonate-quartz veins and veinlets.

Late in the third quarter of 2012, a RC drilling program which

was initiated earlier in the quarter, was completed. The objective

of this drilling program was to check for possible extensions of

gold mineralization to the north where it is marked on the surface

by anomalous soil and trench samples taken earlier. This area has

significant potential according to the recently prepared structural

model. A total of 26 (2,434 m) RC holes were completed and 2,525

samples were taken which have been prepared for export.

Uzboy

Alhambra's independent consultants (Micromine and ACA Howe

International) continued to work on updating the Uzboy National

Instrument ("NI") 43-101 resource estimate and Preliminary Economic

Assessment. Upon completion of these studies, the Corporation will

press release the study results.

Zhusaly

In the third quarter of 2012, soil sampling on the Zhusaly early

stage project, which commenced in the second quarter, was

completed. 573 soil samples were taken along 15 lines. They have

been dried, screened and prepared for export.

A planned seven hole (1,050 m) RC drilling program was initiated

at Zhusaly prior to the end of the third quarter. The purpose of

this drill program is to check the soil anomaly established in

2011. Two NW orientated RC lines are planned. The proposed drill

lines will be 250 m apart with the planned distance between holes

being 150 m along the SW line (scissor holes) and 75 m along the NE

line (fence holes).

Zhanatobe

The assay results from the Zhanatobe diamond drilling program

were received late in the quarter and were being interpreted. The

drilling program included nine holes totaling 1,449 m. The assay

results will be released once interpreted.

Capital Expenditure Activity Subsequent to September 30,

2012

Shirotnaia

Assay results for eight of 18 diamond drill holes completed were

interpreted and released. They were very encouraging. Diamond

drilling intersected higher-grade gold mineralization (+1.0 grams

per tonne gold ("g/t Au")) over core intervals ranging from 6.4 m

to 135.6 m (down-hole). These higher-grade intervals define a core

gold mineralization zone interpreted to be at least 1,200 m long

enveloped by an aureole of lower grade (less than 1.0 g/t) gold

mineralization with dimensions of 1,800 m by 750 m which remains

open in three directions and at depth. These assay results included

one of the best drill holes to date on the project which entered

strong mineralization from surface and returned an interval of

135.6 m averaging 1.12 g/t Au. Seven of the holes returned

intercepts with gold grades greater than 1.0 g/t Au and in four of

the holes these grade intervals have core lengths greater than 6.0

m. Thirty eight mineralized intervals (of variable widths) with

gold grades of greater than 0.2 g/t Au were intersected in the

eight holes assayed. The best mineralization intersected included:

1.12 g/t Au over 135.6 m, 1.47 g/t Au over 27.4 m, 1.73 g/t over

17.5 m and 1.56 g/t Au over 18.2 m.

OUTLOOK

Currently, Alhambra's focus is on financing. With the receipt of

MINT's approval on September 11, 2012 of the Corporation's

application requesting the pre-approval of possible future equity

financings, one of the hurdles related to financing has been

overcome. Alhambra previously announced that it had negotiated and

executed a non-binding financing term sheet complying with the

financing terms approved by MINT. The due diligence is progressing

toward the completion of the financing which, if and when

completed, will allow the Corporation to proceed with its objective

to accelerate exploration and development activities in

Kazakhstan.

Alhambra's exploration focus will continue to be its advanced

exploration targets (including Uzboy, Shirotnaia and Dombraly) as

well as the seven other early stage projects. Production

development will focus on advancing Uzboy through Pre-Feasibility

and Feasibility Studies and to assess the other advanced targets

for production potential and follow-up as appropriate with

Pre-Feasibility assessments.

BOARD OF DIRECTOR CHANGES

During the third quarter of 2012, two Alhambra directors Mr.

Mike Hriskevich and Mr. Mr. Clarence K. Wagenaar, retired.

Appointed as their replacements were Mr. John I. Huhs and Mr. Robin

M. Merrifield.

Mr. John I. Huhs, fluent in Russian, is a lawyer and graduated

with honours from both the Stanford Graduate School of Business and

Stanford Law School. He is a retired Senior Partner and Special

Counsel of Dewey & LeBoeuf, and chaired the Firm's

International Practice for almost two decades and founded the

Firm's practice in the former Soviet Union, including the Moscow

and Almaty (Kazakhstan) offices. Mr. Huhs has over 40 years of

experience in energy, mining, aerospace, hi-tech (including

intellectual property) and manufacturing. He has focused on

negotiations, concluding and implementing hundreds of international

mergers and acquisitions, production sharing agreements, joint

operating agreements, financings, joint ventures and other complex

transactions worldwide. He lived in the Republic of China from 1954

to 1957.

Mr. Merrifield, a chartered accountant, has over 30 years of

experience in the international mining industry of South Africa,

North America and in a number of Central Asian countries including

Kazakhstan, Kyrgyzstan, Armenia, Georgia and Tajikistan. Mr.

Merrifield has gained his experience both in the corporate offices

and on operating sites of a number of major international mining

companies focused mainly on the uranium, gold and copper/nickel

businesses. Mr. Merrifield is a Director of a number of junior

exploration mining companies. He currently continues to assist

Uranium One Inc. in regard to their Kazakhstan operations as a

senior staff consultant. He previously served as its CFO for four

years. Prior to this position Mr. Merrifield was an international

consultant focused on financial and general management and was the

Vice President, Finance of the Kumtor Gold Company located in

Bishkek, Kyrgyzstan from 1997 to 2001.

GOVERNMENT OF KAZAKHSTAN PRE-EMPTIVE RIGHT

The Subsoil and Subsoil Use Act (the "Act") in Kazakhstan grants

the Government of Kazakhstan the first right of refusal to purchase

any direct or indirect interest in any subsoil license or legal

entity holding that license or the legal entity controlling the

holder of the subsoil use license at market prices should the

license or shares or instruments convertible or giving rights to

shares (joint, the "Subsoil Use Assets") come up for sale. As a

result, before a company can accept an offer to sell its Subsoil

Use Assets, it must first get approval from relevant Kazakhstan

authority (MINT). The Act extends this obligation to require a

company whose main business is connected with subsoil use in

Kazakhstan to get approval should it desire to issue any common

shares or issue any derivative instruments that are convertible

into common shares. On April 21, 2011, the Corporation completed

and filed an application with MINT to have pre-approved, any shares

that may be issued upon conversion of outstanding warrants and

options as well as requested that MINT pre-approve a private

placement that the Corporation would contemplate doing in the near

future to finance its exploration and development activities. This

application was amended on August 16 and October 25, 2011 which

included responses to certain questions received from MINT. On

September 11, 2012 the Corporation received MINT's approval. This

approval is effective for six months. Under Kazakhstan legislation

the Corporation can apply to have the effective date extended a

further six months.

Alhambra's original application included a floor price for the

issuance of common shares of $0.60 per share. Unfortunately, during

the time period that MINT was considering the Corporation's

application, the trading price of Alhambra's common share dropped

below that floor. The Corporation has applied to MINT to have that

floor price reduced. The Corporation is waiting for MINT's response

on this request. While the Corporation is currently negotiating a

potential financing that's in compliance with the terms approved by

MINT, this price reduction should provide additional financing

opportunities.

UNAUDITED FINANCIAL STATEMENTS AND MANAGEMENT DISCUSSION AND

ANALYSIS ("MD&A")

The Corporation's third quarter 2012 financial statements and

MD&A are available on the Corporation's website, can be

obtained on application from the Corporation and are available

under the Corporation's profile on SEDAR at www.sedar.com.

ABOUT ALHAMBRA

Alhambra is a Canadian based international exploration and gold

production corporation with NI 43-101 gold resources as per ACA

Howe International UK and Micromine Consulting Services UK as noted

below:

--------------------------------------------------------------------------

Measured (M) Indicated (I)

--------------------------------------------------------------------------

Project Grade Grade

--------------------------------------------------------------------------

Tonnes (g/t) Ounces Tonnes (g/t) Ounces

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Uzboy (1) 14,317,200 1.52 700,000 7,009,500 1.22 275,500

--------------------------------------------------------------------------

Dombraly (2) - - 559,000 1.22 22,000

--------------------------------------------------------------------------

Shirotnaia (3) - - 2,900,000 0.76 71,000

--------------------------------------------------------------------------

TOTAL 14,317,200 1.52 700,000 10,468,500 1.09 368,500

--------------------------------------------------------------------------

----------------------------------------------------------------------------

M + I Inferred

----------------------------------------------------------------------------

Project Grade Grade

----------------------------------------------------------------------------

Tonnes (g/t) Ounces Tonnes (g/t) Ounces

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Uzboy (1) 21,326,700 1.42 975,500 11,258,200 1.17 421,700

----------------------------------------------------------------------------

Dombraly (2) 559,000 1.22 22,000 9,317,000 1.01 301,000

----------------------------------------------------------------------------

Shirotnaia (3) 2,900,000 0.76 71,000 34,577,000 0.58 645,000

----------------------------------------------------------------------------

TOTAL 24,785,700 1.34 1,068,500 55,152,200 0.77 1,367,700

----------------------------------------------------------------------------

(1) Effective as of Dec 31/07 as per ACA Howe per news release dated Apr

8/08 at a 0.40 g/t cut-off.

(2) Effective as of Nov 27/11 as per ACA Howe per news release dated Feb

7/12 using natural cut-off grades of 0.13 g/t, 0.1 g/t and 0.2 g/t for

the low grade stockpile, pit infill and in-situ mineralized zones

respectively.

(3) Effective as of Jan 9/12 as per ACA Howe per news release dated Feb

28/12 using cut-off grades of 0.1 g/t for oxide gold mineralization and

0.2 g/t for transitional and primary gold mineralization respectively.

Alhambra holds exploration and exploitation rights to a 2.4

million acre (9,800 km2), 100% owned license called the Uzboy

Project, located in the Northern Kazakhstan Metallogenic Province

which hosts numerous world-class gold deposits. Over 100 mineral

targets, including three advanced exploration areas, are contained

within the Uzboy Project.

Alhambra common shares trade in Canada on The TSX Venture

Exchange under the symbol ALH, in the United States on the

Over-The-Counter Pink Sheets Market under the symbol AHBRF and in

Germany on the Frankfurt Open Market under the symbol A4Y. The

Corporation's website can be accessed at

www.alhambraresources.com.

Elmer B. Stewart, MSc. P. Geol., a technical consultant, is the

Corporation's nominated Qualified Person. Mr. Stewart has reviewed

the technical information contained in this news release.

Forward-Looking Statements

Certain statements contained in this news release constitute

"forward-looking statements" as such term is used in applicable

Canadian and US securities laws. These statements relate to

analyses and other information that are based on forecasts of

future results, estimates of amounts not yet determinable and

assumptions of management. In particular, completing a financing,

availability of capital to fund drilling programs, initiating the

Uzboy pre-feasibility and feasibility studies, and other factors

and events described in this news release should be viewed as

forward-looking statements to the extent that they involve

estimates thereof. Any statements that express or involve

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives, assumptions or future events or

performance (often, but not always, using words or phrases such as

"expects" or "does not expect", "is expected", "anticipates" or

"does not anticipate", "plans, "estimates" or "intends", or stating

that certain actions, events or results "may", "could", "would",

"might" or "will" be taken, occur or be achieved) are not

statements of historical fact and should be viewed as

"forward-looking statements". Such forward looking statements

involve known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of

the Corporation to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements. Such risks and other factors include,

among others, completing a financing, availability of capital to

fund drilling programs, initiating the Uzboy pre-feasibility and

feasibility studies; political, social and other risks inherent in

carrying on business in a foreign jurisdiction and such other

business risks as discussed herein and other publicly filed

disclosure documents. Although the Corporation has attempted to

identify important factors that could cause actual actions, events

or results to differ materially from those described in

forward-looking statements, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that such statements will prove

to be accurate as actual results and future events could vary or

differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on

forward-looking statements contained in this news release.

Forward looking statements are made based on management's

beliefs, estimates and opinions on the date the statements are made

and the Corporation undertakes no obligation to update

forward-looking statements and if these beliefs, estimates and

opinions or other circumstances should change, except as required

by applicable law.

This news release contains forward-looking statements based on

assumptions, uncertainties and management's best estimates of

future events. When used herein, words such as "intended" and

similar expressions are intended to identify forward-looking

statements. Forward-looking statements are based on assumptions by

and information available to the Corporation. Investors are

cautioned that such forward-looking statements involve risks and

uncertainties. Actual results may differ materially from those

currently anticipated. The forward-looking statements contained

herein are expressly qualified by this cautionary statement.

Neither the TSX Venture Exchange Inc. nor its Regulation

Services Provider (as that term is defined in the Policies of the

TSX Venture Exchange Inc.) accepts responsibility for the adequacy

or accuracy of this release.

Contacts: Alhambra Resources Ltd. Ihor P. Wasylkiw VP &

Chief Information Officer +1 (403) 508-4953 Alhambra Resources Ltd.

Donald D. McKechnie VP Finance & Chief Financial Officer +1

(403) 228-2855 www.alhambraresources.com

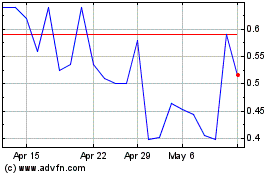

ACCENTRO Real Estate (TG:A4Y)

Historical Stock Chart

From Mar 2024 to Apr 2024

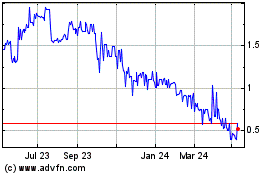

ACCENTRO Real Estate (TG:A4Y)

Historical Stock Chart

From Apr 2023 to Apr 2024