Superior Plus Corp. (TSX:SPB) ("Superior") is pleased to provide a

reminder that its Annual Investor Day will be held today at the

King Edward Hotel in Toronto. The formal presentation will commence

at 9:00 a.m. EST, a light breakfast and lunch will be served.

Members of the professional investment community are invited to

attend. Details of the event, including access to the live webcast,

can also be found on Superior's website at

www.superiorplus.com.

A copy of the presentation to be used by Superior in conjunction

with Investor Day will be posted on Superior's website at 8:00 a.m.

EST. The presentation will include an update and details on

Superior's business operations, business improvement initiatives,

strategy and future growth prospects post 2013. As detailed in the

presentation, Superior anticipates the business improvement

initiatives in conjunction with Superior's overall strategy and

business plan will provide the opportunity to achieve a growth rate

in adjusted operating cash flow per share for 2013, 2014 and 2015

of 7% to 10% per year.

Superior is also pleased to announce that it will redeem $50.0

million principal amount of its 5.85% convertible unsecured

subordinated debentures (the "Debentures") due October 31, 2015 in

accordance with the indenture governing the Debentures. The $50.0

million of Debentures will be redeemed on January 3, 2013 (the

"Redemption Date") at the redemption price (the "Redemption Price")

which is equal to the outstanding principal amount of the

Debentures to be redeemed, together with all accrued and unpaid

interest thereon up to the Redemption Date, being $1,010.2575 per

$1,000 principal amount of the Debentures. The Debentures that are

redeemed will cease to bear interest from and after the Redemption

Date.

The record date for the redemption is December 31, 2012. As a

result, Debentures purchased after December 31, 2012 will not

participate in the partial redemption. The Debentures to be

redeemed shall be selected by the debenture trustee on a pro rata

basis to the nearest multiple of $1,000. As a result, no Debenture

shall be redeemed in part unless the principal amount redeemed is

$1,000 or a multiple of $1,000.

The aggregate amount of 2012 Debentures outstanding as of the

date hereof is $75.0 million. Upon completion of this redemption,

the outstanding balance of the Debentures is expected to be $25.0

million.

Pursuant to the terms of the Indenture governing the Debentures,

holders of the Debentures that are to be redeemed have the right

until the last business day prior to the Redemption Date to convert

their Debentures into common shares of Superior ("Common Shares")

at a conversion price of $31.25, being a rate of 32.0000 Common

Shares per $1,000 principal amount of Debentures.

Superior expects to use funds from its credit facility to fund

the redemption of the Debentures.

Wayne Bingham, Executive Vice-President and Chief Financial

Officer stated "The redemption of $50 million of Debentures is

consistent with Superior's on going debt reduction plan and is

possible due to the success of our deleveraging plans and the

confidence we have in our business plan for 2013 and beyond.

Superior's debt reduction initiatives have been successful

throughout 2012, reducing our Total Debt to EBITDA to 4.1X's as at

September 30, 2012. By redeeming the Debentures in January 2013,

Superior is not only actively managing its balance sheet maturities

but will also benefit from a lower average interest rate as a

result of the refinancing."

Webcast of Investor Day Presentation

A webcast for investors, analysts, brokers and media

representatives to listen to the Investor Day presentation is

scheduled for 9:00 a.m. EST on Friday, November 30, 2012. To listen

to the webcast live, or as an archived recording which will be

available until November 29, 2013, listeners should go to

Superior's website at www.superiorplus.com under the webcasts

section.

About the Corporation

Superior consists of three primary operating businesses: Energy

Services includes the distribution of propane and distillates,

providing fixed-price energy services, and supply portfolio

management; Specialty Chemicals includes the manufacture and sale

of specialty chemicals; and Construction Products Distribution

includes the distribution of specialty construction products.

For further information about Superior, please visit our website

at: www.superiorplus.com.

Forward Looking Information

Certain information included herein is forward-looking, within

the meaning of applicable Canadian securities laws. Forward-looking

information is often, but not always, identified by the use of

words such as "anticipate", "believe", "could", "estimate",

"expect", "plan", "intend", "forecast", "future", "guidance",

"may", "predict", "project", "should", "strategy", "target", "will"

or similar words suggesting future outcomes or language suggesting

an outlook. Forward-looking information in this press release

includes anticipated adjusted operating cash flow growth rates in

2013, 2014 and 2015, the partial redemption of Debentures and

anticipated use of Superior's credit facility to fund such

redemption. Superior believes the expectations reflected in such

forward-looking information are reasonable but no assurance can be

given that these expectations will prove to be correct and such

forward-looking statements should not be unduly relied upon.

Forward-looking information is based on various assumptions.

Those assumptions are based on information currently available to

Superior, including information obtained from third party industry

analysts and other third party sources and the historic performance

of Superior's businesses. Some of the more significant assumptions

supporting the forward looking information in this press release

are the outcomes and anticipated benefits of Superior's business

initiatives and continuous improvement projects, costs and benefits

associated with intellectual technology implementations,

anticipated pulp capacity growth, costs, timing and anticipated

benefits of major capital projects, anticipated U.S. and Canadian

housing starts, the availability and amount of Superior's tax

basis, economic growth rates, future average temperatures and

future exchange and interest rates. Further details relating to

these assumptions are contained in the Investor Day presentation

and Superior's 2012 Third Quarter Management's Discussion and

Analysis ("Q3 MD&A"). Additional assumptions are set forth

under the "Outlook" sections contained in Superior's Q3 MD&A.

Readers are cautioned that the preceding list of assumptions is not

exhaustive.

Forward-looking information is not a guarantee of future

performance. By its very nature, forward-looking information

involves inherent risks and uncertainties, both general and

specific, and risks that predictions, forecasts, projections and

other forward-looking information will not be achieved. Such risks

and uncertainties may cause Superior's or Superior Plus LP's actual

performance and financial results in future periods to differ

materially from any projections of future performance or results

expressed or implied by such forward-looking information. We

caution readers not to place undue reliance on this information as

a number of important factors could cause the actual results to

differ materially from the beliefs, plans, objectives, expectations

and anticipations, estimates and intentions expressed in such

forward-looking information. Some of the more significant risks

include the execution of Superior's business initiatives, volume

variability, weather conditions, general economic conditions,

product demand, availability and sources of funding, risks relating

to the availability of Superior tax basis resulting from the

conversion transaction, competition and changes in interest rates.

These risks, as well as additional risks and uncertainties are

described under the section entitled "Risk Factors to Superior", in

Superior's Q3 MD&A and in Superior's 2011 Annual Information

Form under the heading "Risk Factors", each of which are available

at www.sedar.com and from Superior's website at

www.superiorplus.com.

Readers are cautioned that the foregoing list of factors that

may affect future results is not exhaustive. Forward-looking

information contained in this press release is provided for the

purpose of providing information about management's goals, plans

and range of expectations for the future and may not be appropriate

for other purposes. When relying on our forward-looking information

to make decisions with respect to Superior, investors and others

should carefully consider the foregoing factors and other

uncertainties and potential events. Any forward-looking information

is made as of the date hereof and, except as required by law,

Superior does not undertake any obligation to publicly update or

revise such information to reflect new information, subsequent or

otherwise.

Non-IFRS Financial Measure - Adjusted Operating Cash Flow

Adjusted operating cash flow is equal to cash flow from

operating activities as defined by IFRS, adjusted for changes in

non-cash working capital, other expenses, non-cash interest

expense, current income taxes and finance costs. Superior may

deduct or include additional items to its calculation of adjusted

operating cash flow; these items would generally, but not

necessarily, be items of a non-recurring nature. Adjusted operating

cash flow is the main performance measure used by management and

investors to evaluate the performance of Superior. Readers are

cautioned that adjusted operating cash flow is not a defined

performance measure under IFRS and that adjusted operating cash

flow cannot be assured. Superior's calculation of adjusted

operating cash flow may differ from similar calculations used by

comparable entities. Adjusted operating cash flow represents cash

flow generated by Superior that is available for, but not

necessarily limited to, changes in working capital requirements,

investing activities and financing activities of Superior.

The seasonality of Superior's individual quarterly results must

be assessed in the context of annualized adjusted operating cash

flow. Adjustments recorded by Superior as part of its calculation

of adjusted operating cash flow include, but are not limited to,

the impact of the seasonality of Superior's businesses, principally

the Energy Services segment, by adjusting for non-cash working

capital items, thereby eliminating the impact of the timing between

the recognition and collection/payment of Superior's revenues and

expense, which can differ significantly from quarter to quarter.

Adjustments are also made to reclassify the cash flows related to

natural gas and electricity customer contract related costs in a

manner consistent with the income statement recognition of these

costs.

Contacts: Superior Plus Corp. Wayne Bingham Executive

Vice-President and Chief Financial Officer (403) 218-2951 (403)

218-2973 (FAX)wbingham@superiorplus.com Superior Plus Corp. Jay

Bachman Vice-President, Investor Relations and Treasurer (403)

218-2957 (403) 218-2973 (FAX) Toll Free: 1-866-490-PLUS

(7587)jbachman@superiorplus.com

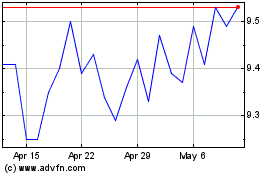

Superior Plus (TSX:SPB)

Historical Stock Chart

From Mar 2024 to Apr 2024

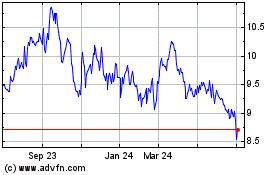

Superior Plus (TSX:SPB)

Historical Stock Chart

From Apr 2023 to Apr 2024