Capital Product Partners L.P. Announces One Year Charter Extensions for M/T Aias and M/T Amoureux at Increased Day Rates Plus...

November 14 2012 - 9:00AM

Marketwired

Capital Product Partners L.P. (NASDAQ: CPLP) today announced that

Capital Maritime & Trading Corp. ('CMTC') has exercised its

option to extend the time charter employment of each of the M/T

'Aias' and the M/T 'Amoureux' for a second year at an increased

gross day rate of $24,000.

In particular, the extension of the charters for the M/T 'Aias'

(150,393 dwt, built 2008 Universal Shipbuilding Corp., Japan) and

the M/T 'Amoureux' (149,993 dwt, built 2008 Universal Shipbuilding

Corp., Japan) is expected to commence in December 2012. In addition

to the increased gross day rate of $24,000 the vessels will

continue to earn 50/50 profit share on actual earnings settled

every 6 months.

CMTC has the option to extend the time charter employment for a

third year at $28,000 per day with the same profit share

arrangements.

About Capital Product Partners L.P.

Capital Product Partners L.P. (NASDAQ: CPLP), a Marshall Islands

master limited partnership, is an international owner of modern

double-hull tankers. The Partnership currently owns 25 vessels,

including two VLCCs (Very Large Crude Carriers), four Suezmax crude

oil tankers, 18 modern MR (Medium Range) tankers and one Capesize

bulk carrier. All of its vessels are under period charters to BP

Shipping Limited, Overseas Shipholding Group, Petrobras,

Arrendadora Ocean Mexicana, S.A. de C.V., Subtec S.A. de C.V.,

Cosco Bulk Carrier Co. Ltd. and Capital Maritime & Trading

Corp.

For more information about the Partnership, please visit our

website: www.capitalpplp.com.

Forward-Looking Statements

The statements in this press release that are not historical

facts may be forward-looking statements (as such term is defined in

Section 21E of the Securities Exchange Act of 1934, as amended).

These forward-looking statements involve risks and uncertainties

that could cause the stated or forecasted results to be materially

different from those anticipated. Unless required by law, we

expressly disclaim any obligation to update or revise any of these

forward-looking statements, whether because of future events, new

information, a change in our views or expectations, to conform them

to actual results or otherwise. We assume no responsibility for the

accuracy and completeness of the forward-looking statements. We

make no prediction or statement about the performance of our common

units.

CPLP-G

Contact Details: Capital GP L.L.C. Ioannis Lazaridis CEO

and CFO +30 (210) 4584 950 E-mail: i.lazaridis@capitalpplp.com

Capital Maritime & Trading Corp. Jerry Kalogiratos

Finance Director +30 (210) 4584 950 j.kalogiratos@capitalpplp.com

Investor Relations / Media Matthew Abenante Capital Link,

Inc. (New York) Tel. +1-212-661-7566 E-mail:

cplp@capitallink.com

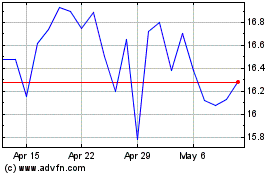

Capital Product Partners (NASDAQ:CPLP)

Historical Stock Chart

From Mar 2024 to Apr 2024

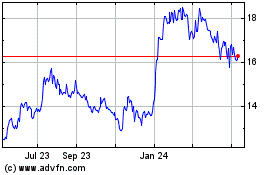

Capital Product Partners (NASDAQ:CPLP)

Historical Stock Chart

From Apr 2023 to Apr 2024