Richemont Launches Share Buyback, Says Luxury Demand Robust

May 16 2012 - 2:24AM

Dow Jones News

Switzerland's Compagnie Financiere Richemont SA (CFR.VX)

Wednesday said it was launching a share buyback, as it reported

robust fiscal-year profit growth, with sales in April continuing to

grow apace.

The owner of Cartier and Piaget among other luxury brands said

it wanted to buy up to 10 million shares, representing 1.7% of its

capital, over the next two years.

Richemont said sales in April rose 29% on year, slightly slower

than the 32% rate of a year earlier.

The figure is being watched keenly by observers seeking signs

that the recent boom in luxury spending is waning.

Despite the increase, Richemont remained cautious about the

future, saying it is "mindful of the unstable economic environment,

particularly in the euro zone."

The luxury industry has enjoyed massive growth in the past two

years, fueled by strong demand for watches and jewelry,

particularly in China, which now accounts for about a third of

global sales of Swiss watches.

Like with other companies such as Swatch Group AG (UHR.VX) and

LVMH Moet Hennessey Louis Vuitton (MC.FR), China is an increasingly

important market in its own right, as well as the home of

luxury-hungry tourists visiting struggling markets like Europe.

But last week, China reported that its industrial output growth

slowed significantly in April to its lowest level since May 2009,

adding to worries about a slowdown in the world's No. 2

economy.

Value-added industrial output in China rose 9.3% in April from a

year earlier, slowing sharply from a 12% increase in March, data

from the National Bureau of Statistics showed Friday.

Nevertheless, Geneva-based Richemont, which also owns the Piaget

and IWC brands, reported record profit and sales in the 12 months

to March 31.

Net profit attributable to shareholders rose to EUR1.54 billion,

from EUR1.09 billion a year earlier, beating forecasts of EUR1.37

billion in a Dow Jones Newswires poll.

Revenue rose 29% to EUR8.87 billion, beating expectations of

EUR8.61 billion.

Chief Executive Johann Rupert said: "Our Maisons [divisions]

remain entrepreneurial and innovative businesses at heart. More

than ever, we are convinced of their resilience and long-term

prospects. We therefore look forward to the future with cautious

optimism."

Richemont shares closed Tuesday at CHF53.35, valuing the company

at CHF27.85 billion. The stock has gained 12% in value since the

start of the year.

- By John Revill, Dow Jones Newswires; +41 43 443 8042 ;

john.revill@dowjones.com

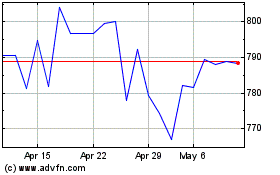

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Mar 2024 to Apr 2024

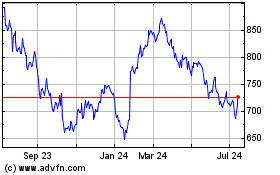

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Apr 2023 to Apr 2024