Buyout Funds Submit Offers For Food Group Iglo Thursday - Sources

May 10 2012 - 10:31AM

Dow Jones News

A handful of private-equity firms will submit first-round bids

for frozen-food company Iglo Group by Thursday's deadline, people

familiar with the situation told Dow Jones Newswires.

Bain Capital, Clayton Dubilier & Rice, PAI Partners,

Blackstone Group LP (BX) and BC Partners are expected to put in

bids, the people added.

Permira, the private-equity owner of Iglo, has hired Credit

Suisse Group AG (CS) to run the auction for the business, which has

been valued between EUR2.5 billion and EUR2.6 billion, or between

eight and nine times earnings before interest, taxes, depreciation

and amortization.

Iglo is Europe's largest frozen-food company by sales and makes

products under the Captain Birds Eye and Findus brands in Italy. It

posted Ebitda of EUR325.8 million on revenue of EUR1.6 billion for

2011.

Permira bought Iglo from Unilever PLC (UL) for EUR1.7 billion in

2006, and in July 2010 recombined Birds Eye with Unilever's other

frozen-food business, Findus Italy, in a GBP675 million deal.

-By Marietta Cauchi and Jessica Hodgson, Dow Jones Newswires;

+44 207 842 9241; marietta.cauchi@dowjones.com

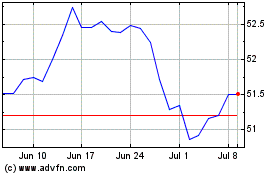

Unilever (EU:UNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

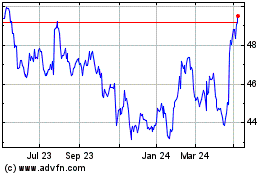

Unilever (EU:UNA)

Historical Stock Chart

From Apr 2023 to Apr 2024