3rd UPDATE: Marathon Oil 1Q Profit Falls In Spin-Off's Wake

May 02 2012 - 8:35PM

Dow Jones News

Marathon Oil Corp.'s (MRO) first-quarter earnings fell 58% from

the year-ago period that included contributions from its former

refining and marketing business, missing analysts expectations.

Marathon reported a profit of $417 million, or 59 cents a share,

down from $996 million, or $1.39 a share, a year earlier, when it

still had large refining operations. Excluding write-downs,

asset-sale gains and other items, adjusted earnings were 67 cents a

share, down from 88 cents a year earlier, and below analysts'

expectation of 87 cents. The results were also lower than in the

fourth quarter, in which the company, now dedicated to exploration

and production of oil and natural gas resources, reported adjusted

net income of 78 cents per share.

The miss was driven mainly by a higher-than-expected

international tax rate, said Fadel Gheit, an analyst at Oppenheimer

& Co.

Shares rose 2 cents to $28.90 in after-hours trading Wednesday

after ending the regular session down 4.3%.

Last June, Marathon spun off its refining business--creating

Marathon Petroleum Corp. (MPC)--to focus its drilling efforts on

unconventional U.S. oil shales, such as the Bakken field in North

Dakota, Anadarko Woodford in Oklahoma and Eagle Ford in Texas.

Marathon Oil's production in the first quarter, excluding Libya,

was 371,000 barrels of oil equivalent a day, which was above the

company's previous guidance but 1% below its production in the

fourth quarter.

The decrease in production versus the fourth quarter was a

result of a planned turnaround in Equatorial Guinea and unplanned

downtime at the Foinaven field in the U.K., the company said.

Partially offsetting these declines were increased production in

the Eagle Ford and Bakken shale plays in the U.S.

The company reiterated its full-year production guidance of

360,000 barrels to 380,000 barrels of oil equivalent per day and

increased its forecast for 2012 capital investment and exploration

spending to $5 billion from its prior estimate of $4.8 billion, due

mainly to recent acquisitions in Eagle Ford.

Revenue increased 6.1% to $4.04 billion.

Speaking to analysts in an earnings conference call, Marathon

Oil executives said results from a shale-gas well the company

drilled in Poland were below expectations. The company added it

continues exploratory activity there and that it is about to

conclude drilling of a third well.

Marathon Oil said production from its operations in Libya, which

were suspended in the first quarter of 2011 amid that country's

political unrest, resumed with limited production but no sales in

the fourth quarter. In the first quarter, net sales volumes

averaged 17,000 barrels of oil equivalent a day. As of the end of

April, Libya net production available for sale was about 43,000

barrels of oil equivalent a day.

"The timing of the return to pre-conflict production levels in

Libya is unknown at this time," the company said.

Marathon Oil is a partner at Waha Oil Co., Libya's largest

operation with foreign energy companies. Pre-war production at Waha

Oil, whose partners also include ConocoPhillips (COP) and Hess

Corp. (HES), was 350,000 barrels a day.

Marathon had an unusually higher effective income-tax rate in

the first quarter of 66% because most of its production came from

higher tax areas such as Libya, Gheit said.

In the Eagle Ford shale, Marathon added 20,000 acres through

recent and pending acquisitions. The company expects these

transactions to be closed by the end of the third quarter and to

add two rigs to its 18 rigs currently operating in the region. At

the end of April, production in Eagle Ford exceeded 20,000 barrels

of oil equivalent a day compared with an average of about 15,000

barrels of oil equivalent a day over the previous several months,

the company said.

Marathon Petroleum Corp. on Tuesday reported that first-quarter

earnings rose 13% as the refining-and-pipeline company benefited

from differentials between crude oils and stronger merchandising

margins at its Speedway gasoline stations.

-By Isabel Ordonez, Dow Jones Newswires, 713-314-6090;

isabel.ordonez@dowjones.com

-Tess Stynes and Angel Gonzalez contributed to this article.

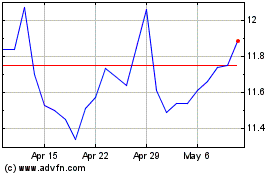

Ecopetrol (NYSE:EC)

Historical Stock Chart

From Mar 2024 to Apr 2024

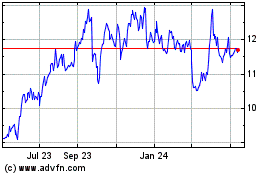

Ecopetrol (NYSE:EC)

Historical Stock Chart

From Apr 2023 to Apr 2024