Motorola Mobility Meets Estimate - Analyst Blog

May 02 2012 - 6:00AM

Zacks

Motorola Mobility Holdings

Inc.(MMI) reported mixed financial results for the first

quarter of 2012, with the bottom line matching the Zacks Consensus

Estimate while the top line surpassing the estimate. However,

following the earnings release, stock price of Motorola Mobility

increased by 13 cents (0.34%) to $38.76.

GAAP net loss was $86 million or 28 cents per share in the

quarter compared with $81 million or 27 cents per share in the

prior-year quarter. Adjusted (excluding special items) net loss per

share in the reported quarter was 18 cents, in line with the Zacks

Consensus Estimate. Total revenue in the quarter was $3,078

million, up 1.5% year over year and was also above the Zacks

Consensus Estimate of $2,929 million.

Gross margin in the reported quarter was 24.5% compared with

24.9% in the prior-year quarter. Quarterly operating loss was $70

million compared with $36 million in the year-ago quarter.

During the first quarter of fiscal 2012, Motorola Mobility’s

cash flow from operations was negative $98 million compared with

$107 million with the prior-year quarter. Free cash flow (cash flow

from operations less capital expenditure) during the reported

quarter was a negative $131 million compared with $57 million in

the prior-year quarter. Cash and cash equivalents at the end of the

reported quarter was $3,332 million compared with 3,116 million in

the previous quarter. The company had no debt on its balance sheet

in the quarter.

Mobile Devices Segment

Segment revenue was $2,194 million, up 3% year over year.

Operating loss, on a GAAP basis, was $121 million compared with $89

million in the year-ago quarter.

During the reported quarter, Motorola Mobility shipped 8.9

million mobile handsets including 5.1 million smartphones. Motorola

Mobility also shipped approximately 200,000 XOOM tablets in the

reported quarter.

Home Segment

Revenue from this segment came in at $884 million, down 2% year

over year. GAAP operating income was $68 million versus $53 million

in the year-ago quarter.

Motorola Mobility and Google Agreement

On August 15, 2011, Motorola Mobility Holdings Inc. announced

that it has entered into a definitive agreement with Google

Inc, (GOOG), under which the latter will acquire 100%

stake of Motorola Mobility for $40 per share in cash or a total

consideration of approximately $12.5 billion. On November 17, 2011,

the stakeholders of Motorola Mobility received favorable response

for the proposed merger. As per management, the deal is expected to

be completed in the first half of 2012, subject to regulatory

approvals.

Our Take

Currently, Motorola Mobility boasts a huge 4G/LTE product line

up, which we believe will act as a growth catalyst going forward as

more and more telecom carriers are shifting to LTE networks.

However, lack of product differentiations and stiff competition

from other cheap smartphone makers will act as headwinds for the

stock going forward. We also prefer to remain on the sidelines till

the merger with Google is completed. We, thus, maintain our

long-term Neutral recommendation on Motorola Mobility Holdings

Inc.

Currently, Motorola Mobility Holdings Inc. has a Zacks #3 Rank,

implying a short-term Hold rating on the stock.

GOOGLE INC-CL A (GOOG): Free Stock Analysis Report

MOTOROLA MOBLTY (MMI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

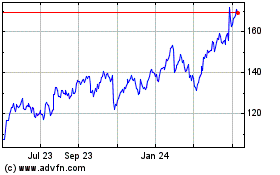

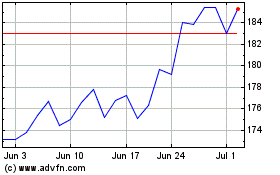

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Apr 2023 to Apr 2024