Indian Rupee Slips To 6-day Low Against US Dollar

April 30 2012 - 8:15AM

RTTF2

The Indian rupee reached a 6-day low of 52.76 against the US

dollar on Monday despite a rally in stocks as the latter firmed up

on heavy demand from importers ahead of a public holiday

tomorrow.

Indian shares ended today's session on a firm note, with hopes

for more monetary stimulus from the U.S. Federal Reserve

underpinning sentiment.

The Fed gave no hint of more bond-buying last week but that

didn't deter investors from speculating on the Fed's next move,

given recent downbeat economic data and the uncertain economic

outlook.

The benchmark 30-share Sensex ended the session up 131 points or

0.76 percent at 17,319, while the broader Nifty index rose by 39

points or 0.75 percent to 5,248.

The rupee is now poised to extend losses beyond last week's

multi-month low of 52.88. The market is expecting the rupee to

break below the key 53.0 mark for the first time since January

5.

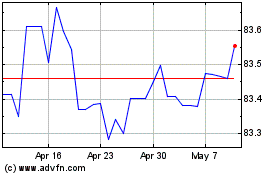

US Dollar vs INR (FX:USDINR)

Forex Chart

From Mar 2024 to Apr 2024

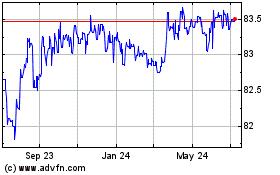

US Dollar vs INR (FX:USDINR)

Forex Chart

From Apr 2023 to Apr 2024