Macquarie Group Eyes Dexia Amid Hunt For Annuity Growth - Official

April 27 2012 - 5:01AM

Dow Jones News

Macquarie Group (MQG.AU) is mulling acquisitions in the funds

management industry, including Ausbil Dexia, in the hope of

expanding its best-performing business of the past year, Deputy

Managing Director Greg Ward said Friday.

Ward said funds management businesses such as Ausbil Dexia,

which has been put on the block as part of the sale of its

Franco-Belgian parent Dexia Asset Management, could be attractive

as Macquarie looks to expand its footprint in its growth businesses

of corporate and asset finance, banking and financial services.

"We're more interested in the annuity-style businesses," he told

Dow Jones Newswires. "We would look at that (Ausbil Dexia). We're

looking at a whole range of things."

Australia's largest investment bank on Friday reported a 24%

drop slump in annual net profit to the lowest level in eight years

after a slowdown in corporate dealmaking and trading income dragged

on its securities and investment banking business.

Yet despite the widely flagged slump in profits and the imminent

start of a 500 million Australian dollar share buyback, Macquarie

remains well-capitalized enough to pursue a selective acquisition

strategy, Chief Executive Nicholas Moore told reporters. The group

holds A$3.5 billion in excess of minimum regulatory capital

requirements on a harmonized Basell III basis, it said in a

statement

Macquarie has long been an opportunistic buyer. In 2009, it

bought U.S-based Delaware Investments in a move that has boosted

its income from the U.S. to around 30% of the group total in the

past two years, up from 8% previously. In recent weeks it has also

been linked to acquiring ING Groep NV's Asian-based asset

management arm as well as other Australia-based fund managers.

But speaking at a media briefing after the bank's results, Moore

hinted that any acquisition would have to present a compelling

return on investment to tempt Macquarie to spend its hard-earned

cash.

"There are less opportunities out there than we saw than during

the crisis," he said. "Things have basically re-priced to a level

where we don't see exceptional returns in the market the way we saw

with the motor leasing portfolio" that the bank bought for A$1

billion in 2009.

-By Caroline Henshaw, Dow Jones Newswires; 61-2-8272-4680;

caroline.henshaw@dowjones.com

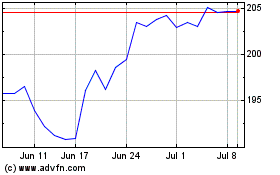

Macquarie (ASX:MQG)

Historical Stock Chart

From Mar 2024 to Apr 2024

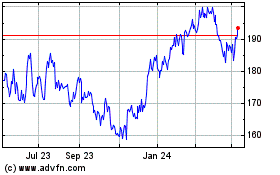

Macquarie (ASX:MQG)

Historical Stock Chart

From Apr 2023 to Apr 2024