- Additional Proxy Soliciting Materials (definitive) (DEFA14A)

April 26 2012 - 4:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant

x

Filed by a

Party other than the Registrant

¨

Check the

appropriate box:

|

|

|

|

|

|

|

¨

|

|

Preliminary Proxy Statement

|

|

|

|

|

¨

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

¨

|

|

Definitive Proxy Statement

|

|

|

|

|

x

|

|

Definitive Additional Materials

|

|

|

|

|

¨

|

|

Soliciting Material Pursuant to §240.14a-12

|

|

|

NATIONAL CINEMEDIA, INC.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

x

|

|

No fee required.

|

|

|

|

|

¨

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

¨

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify

the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

|

|

|

|

|

|

(4)

|

|

Date Filed:

|

|

|

|

|

|

|

April 26, 2012

Dear NCM Shareholder:

Your vote is very important to us. At the 2012 Annual Meeting, the

Company’s stockholders will vote on a non-binding proposal to approve the compensation of the Company’s named officers. The Company’s Board of Directors has unanimously recommended that you vote FOR the proposal to approve, on an

advisory (non-binding) basis, the compensation of the Company’s named executive officers. In connection with this proposal, NCM is seeking to assist our stockholders in understanding this proposal and to facilitate prompt voting.

The proxy advisory firm, Institutional Shareholder Services (“ISS”) has recommended AGAINST and Glass Lewis has recommended FOR the Advisory

Approval of the Company’s Executive Compensation at our upcoming National CineMedia (“NCM”) 2012 annual meeting.

The ISS

reason cited for the AGAINST vote was that there was a “pay for performance disconnect driven by the payment of a discretionary bonus when the threshold performance targets were not met under the annual incentive plan”. They also commented

that “CEO pay and TSR performance appears misaligned over the five-year term”. While our CEO and several employees of our Company were in fact paid a discretionary 2011 performance bonus outside of the formula established in our

performance bonus plan at the start of 2011 due to some factors described in our Proxy, we do not believe that those discretionary payments created a misalignment between our executive compensation plan structure and our long term performance as was

suggested by ISS. Following are a few pieces of data that shareholders should consider when casting their “Say-on-Pay” vote:

|

|

•

|

|

Our executive compensation was benchmarked to the median of a group of 18 companies selected proportionately from industries that represent the key

elements of our business, including: advertising, digital technology, internet software and services, and the movie and entertainment industries. Our compensation is at the median size of this peer group, as measured by market capitalization, an

appropriate size measure for growth businesses with financial operating characteristics similar to ours and more appropriate than the much broader peer group used by ISS;

|

|

|

•

|

|

Our Company achieved $227.2M of adjusted OIBDA in 2011 versus $225.4M for 2010, versus a threshold of $230.2M and a target of $255.8M. These actual

results were approximately 89% of our internal budgets and 1% point below the 90% minimum threshold to qualify for a performance bonus established in the performance bonus plan. It should be noted that consistent with our aggressive budgeting

culture we had projected a 13.4% adjusted OIBDA growth target for 2011 in the annual incentive plan, following strong 18.9% actual growth in 2010;

|

|

|

•

|

|

While 2011 adjusted OIBDA growth was below our expectations, cumulative free cash flow of $610.1 million for the recently completed 2009-2011 long-term

incentive plan performance cycle represented double-digit growth over the prior period and was in excess of the broader media marketplace and was consistent with the performance targets set for 2011. Furthermore, since the establishment of our

dividend in late 2007 at $0.60 per share, our annual dividend has increased to its current rate of $0.88 per share;

|

|

|

•

|

|

The 2011 discretionary performance bonus that our CEO and other executives and corporate employees received represented 32% of the bonuses paid in 2010

and the number of restricted share and stock option grants made to our Named Executive Officers in 2012 was approximately 65% of the 2011 grants. This decrease related directly to the 2011 below target performance;

|

|

|

•

|

|

70% or more of total direct compensation for the Named Executive Officers is performance contingent, and thus given the below expectation 2011

performance it is likely that none of the 2011 restricted share awards will ultimately vest and if they do the 2012 restricted share grant provides that there will be a 1 for 1 reduction in the number of 2012 restricted shares grants that will vest.

|

Given the factors outlined above and other factors set forth in our recently filed Proxy we believe that the Company’s

executive compensation program is aligned with and contributes to value creation for NCM shareholders. Specifically, we believe that the program design, performance standards, and pay opportunities have resulted in realized pay for our top

executives that is well aligned with our industry peer group and the relative returns provided to NCM shareholders and thus we ask you to consider the above facts when evaluating the ISS recommendation, and encourage our investors to vote FOR the

Advisory Approval of the Company’s Executive Compensation contained in the 2012 proxy.

Thanks very much for your continuing support and

please let us know if you would like to discuss this further.

NCM Compensation Committee

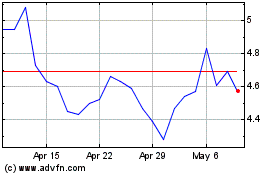

National CineMedia (NASDAQ:NCMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

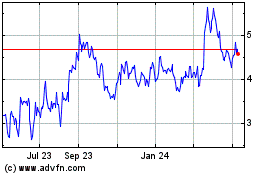

National CineMedia (NASDAQ:NCMI)

Historical Stock Chart

From Apr 2023 to Apr 2024