Dividend Stocks Outperformed S&P 500 Index in 2011

April 26 2012 - 8:20AM

Marketwired

With the low interest rates provided by the banks, investors have

been turning to dividend-paying stocks as a source of investment

income. Dividend investing has become increasingly popular among

investors, and the resulting demand is driving up stock prices. In

2011, dividend stocks crushed the 2.1% gain for the S&P 500

Index, gaining an average of 8.3%. Five Star Equities examines the

outlook for Dividend paying stocks and provides equity research on

Aflac Incorporated (NYSE: AFL) and Leggett & Platt, Inc. (NYSE:

LEG).

Access to the full company reports can be found at:

www.FiveStarEquities.com/AFL www.FiveStarEquities.com/LEG

Howard Silverblatt, S&P's senior index analyst, recently

stated that the Standard & Poor's 500 Index companies have

never paid more dividends than now. In 2012, S&P 500 companies

are on pace to pay out a record amount in dividends -- $277 million

or about $29.02 per index share.

"The pressure to introduce and increase dividends could get

intense," said Joshua Peters, an equity analyst at Morningstar Inc.

"Chief executives and corporate boards are going to start noticing

that investors are rewarding dividend-paying stocks."

Five Star Equities releases regular market updates on Dividend

paying stocks so investors can stay ahead of the crowd and make the

best investment decisions to maximize their returns. Take a few

minutes to register with us free at www.FiveStarEquities.com and

get exclusive access to our numerous stock reports and industry

newsletters.

Aflac traded sharply higher Wednesday after reporting strong

earnings beating analyst estimates. Aflac recently declared the

second quarter cash dividend. The second quarter dividend of $.33

per share is payable on June 1, 2012, to shareholders of record at

the close of business on May 16, 2012.

Leggett & Platt announced a dividend of $.28 per share for

the first quarter, a 3.7% increase versus the dividend declared in

the first quarter of 2011. The dividend was paid on April 13, 2012

to shareholders of record on March 15, 2012.

Five Star Equities provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. Five Star Equities has not been compensated by any of the

above-mentioned companies. We act as an independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at:

www.FiveStarEquities.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: Five Star Equities Email Contact

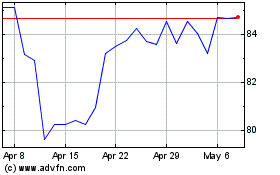

AFLAC (NYSE:AFL)

Historical Stock Chart

From Mar 2024 to Apr 2024

AFLAC (NYSE:AFL)

Historical Stock Chart

From Apr 2023 to Apr 2024