Australia's Big Four Banks First-Half Profits To Hit A$12.6 Billion - Analyst

April 25 2012 - 8:06PM

Dow Jones News

Australia's banks are set to report higher first-half profits

next month but analysts expect subdued lending growth to drive more

interest rate rises this year.

Combined profits of the four major banks are expected to be

around 12.6 billion Australian dollars (US$13.05 billion),

according to a note by Macquarie Group analyst Michael Wiblin

released Thursday, beating the A$12 billion reaped in the first

half of 2011.

Westpac Banking Corp. (WBC.AU) is expected to report a cash

profit of A$3.198 billion, up 0.9% from a year earlier. Australia

and New Zealand Banking Group Ltd. (ANZ.AU) is expected to post a

5.2% rise in cash profit to A$2.694 billion and National Australia

Bank Ltd. (NAB.AU) a 4% increase to A$2.776 billion, he said.

In February, Commonwealth Bank of Australia (CBA.AU),

Australia's biggest bank by market capitalization, beat analyst

expectations to report a 19% rise in net profit for the six months

to Dec. 31 to A$3.62 billion, up from A$3.05 billion a year

earlier.

Macquarie's forecasts echo similar predicts from JP Morgan

analysts earlier this month and reflect a broad consensus among

commentators that Australia's big four banks have managed to stay

profitable in recent months, despite higher funding costs and

slowing domestic credit growth.

Yet Wiblin noted that the "outlook for the sector remains

subdued" and predicted that the banks would raise their interest

rates again independently from the Reserve Bank of Australia to

compensate for weak mortgage demand, thereby increasing "the risks

to softer loan growth."

Earlier this month ANZ, for the second time this year, raised

its home loan rates independently of the RBA. The other big four

banks haven't yet followed suit but analysts expect more rate rises

by the middle of the year.

UBS analyst Jonathan Mott said in another note to clients that

the changing environment pointed to a fundamental shift in the

profile of Australia's banks.

"The banks [will] revert to low growth, profitable companies

producing strong dividends," he said. "This should continue so long

as Australia can achieve an 'orderly' deleveraging process."

-By Caroline Henshaw, Dow Jones Newswires; 61-2-8272-4680;

caroline.henshaw@dowjones.com

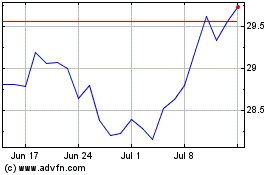

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Apr 2023 to Apr 2024