Cepheid Incurs Loss as Costs Rise - Analyst Blog

April 20 2012 - 5:15AM

Zacks

Cepheid (CPHD)

reported a net loss of $5.5 million or 8 cents per share in the

first quarter of fiscal 2012, in contrast to net income of $0.5

million or earnings per share (“EPS”) of 1 cent in the year-ago

quarter. After taking into account certain tax benefits and

amortization expense, the adjusted figure came in at a of loss of

10 cents, much wider than the Zacks Consensus Estimate of a loss of

2 cents and worse than adjusted EPS of 2 cents in the first quarter

of the previous fiscal.

Revenues during the quarter

increased 28% year over year to $77.3 million, in line with the

Zacks Consensus Estimate. The upside was driven by 33% growth at

the Clinical segment attributable to strong sales of reagents and

systems.

Among the different segments, the

Clinical segment consisting of Clinical Systems (up 8% year over

year to $12.5 million) and Clinical Reagents (up 41% to $54.4

million) contributed about 86.5% of the total sales during the

quarter. Cepheid’s Non-Clinical business increased 13% year over

year to $8.4 million. Product sales from North America and the

international market recorded a respective year-over-year increase

of 24% (to $52.4 million) and 49% (to $22.9 million).

Gross margin on product sales

dropped to 53% in the reported quarter from 56% in the year-ago

period. Operating expenses amounted to $47.7 million, up 46% year

over year, driven by higher research and development (62.8%

annually to $22.1 million), sales and marketing (26.8% to $14.5

million), and general and administrative expenses (44.8% to $11.1

million). The company reported $7.7 million as loss from operations

compared with an income of $1.16 million in the year-ago

period.

The performance in the quarter

suffered from escalating costs due to a scaling up of manufacturing

operations and higher-than-forecast investments for the completion

of the CT/NG clinical trial. However, the company is taking the

necessary steps to control its cost structure and remains confident

of returning to profitability in the second quarter.

Cepheid made a placement of 122

GeneXpert systems in the quarter in its commercial business. The

company’s High Burden Developing Country ("HBDC") Program continues

to gain traction with 151 system placements (181 in the fourth

quarter, 141 in the third quarter and 38 in the second quarter).

Including the HBDC systems, a cumulative 3,079 systems have

been placed worldwide as of March 31, 2012.

Outlook

While the revenue outlook for 2012

remained unchanged at $333–$347 million, the EPS guidance was

lowered to 12−17 cents from the previous level of 17−24 cents. The

current Zacks Consensus Estimate of $341 million in revenues is

within the company’s guidance range but the EPS consensus of 22

cents is way above the company estimates.

Recommendation

Rising expenses have marred the

top-line gains for Cepheid this quarter. Besides, the competitive

landscape is tough with the presence of players such as

Myriad Genetics (MYGN) and Qiagen

(QGEN), among others. However, with a broad portfolio of tests,

Cepheid is one of the leading players in the healthcare associated

infection (“HAI”) market. The company is working on test menu

expansion to further expand system placements.

We have an Outperform

recommendation for Cepheid. The stock retains a Zacks #1 Rank

(Strong Buy) in the short term.

CEPHEID INC (CPHD): Free Stock Analysis Report

MYRIAD GENETICS (MYGN): Free Stock Analysis Report

QIAGEN NV (QGEN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

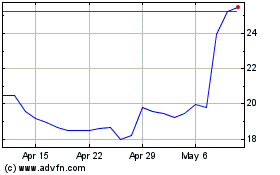

Myriad Genetics (NASDAQ:MYGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

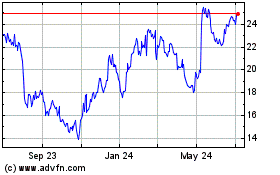

Myriad Genetics (NASDAQ:MYGN)

Historical Stock Chart

From Apr 2023 to Apr 2024