Dealers Vie For NY Fed CDOs, May Unwind Swap With Barclays

April 12 2012 - 5:27PM

Dow Jones News

At least six Wall Street dealers are preparing bids for more

than $7 billion in complex commercial-mortgage securities, which

are part of assets tied to the Federal Reserve Bank of New York's

bailout of American International Group Inc. (AIG), according to

investors briefed by dealers.

Deutsche Bank (DB, DBK.XE), Bank of America Corp. (BAC), Morgan

Stanley (MS), Credit Suisse (CS), Goldman Sachs Group Inc. (GS) and

Barclays (BCS, BARC.LN) are preparing bids for the debt securities,

the investors said.

The dealers are focused on so-called commercial-real-estate

collateralized-debt-obligations, which are a corner of the $47

billion face amount of debt held by the New York Fed portfolio

known as Maiden Lane III. They are primarily focused on dismantling

the so-called CRE CDOs because the underlying commercial

mortgage-backed securities are worth more as individual pieces and

could likely generate more trading revenue, the investors said.

But the liquidation rests on the elimination of an interest-rate

swap with Barclays, the counterparty in the derivative transaction.

As the swap was put on when interest rates were higher, the

contract has risen in value and would require a payment of more

than $1 billion to Barclays if the CDO was to be unwound, two of

the investors said.

Spokesmen for Deutsche Bank, Bank of America, Morgan Stanley,

Credit Suisse, Barclays, Goldman Sachs and the New York Fed

declined to comment.

Investors have intensified their focus on the CRE CDOs last week

after the New York Fed tweaked investment guidelines on the

portfolio, setting the stage for possible sales. A pair of

commercial-mortgage-bond CDOs issued by Deutsche Bank drew

immediate focus as BlackRock had been collecting preliminary bids

from dealers, a person familiar with the matter said when Dow Jones

Newswires first reported the development last week.

The potential for bulk sales of CDOs has rattled the market

because of the impact of additional supply, just as investors are

questioning the wisdom behind a four-month rally. The flare-up in

Europe's debt crisis and signs that the U.S. economic recovery was

slowing also decreased risk appetites, exacerbating a selloff in

CMBS.

The risk premium on a benchmark commercial-mortgage bond jumped

to 235 basis points over an interest-rate benchmark from 180 basis

points in March, giving back virtually the entire rally of 2012,

according to Credit Suisse's Locus analytics platform. CMBS spreads

were bid about 10 basis points tighter on Thursday, however, as

investors heartened by prospects of long-term low interest rates

turned back to riskier debt.

-By Al Yoon, Dow Jones Newswires; 212-416-3216;

albert.yoon@dowjones.com

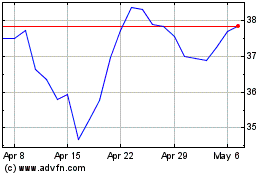

Bank of America (NYSE:BAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

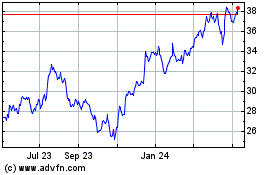

Bank of America (NYSE:BAC)

Historical Stock Chart

From Apr 2023 to Apr 2024