Companies Enlarge Bond Offerings As Risk Appetite Improves

April 12 2012 - 4:49PM

Dow Jones News

Renewed appetite for risk trickled into the new-issue bond

market and enabled companies lucky or smart enough to be borrowing

to take advantage of the recent drop in yields.

Following a three-day lull in which just $2 billion of new

volume was sold, three companies were on track to price $2.75

billion of new debt Thursday, and strong demand allowed each to cut

the offered yield from earlier pricing guidance.

State-owned China National Petroleum Corp. led the market with a

$1.15 billion deal of five- and 10-year bonds. It had received more

than triple the bids needed, allowing it to narrow the spread over

Treasurys by 0.20 percentage point to 1.85 and 1.9 points,

respectively. Final pricing was still to come.

Deere & Co. (DE) found enough investors to increase the size

of its offering to $1 billion from $750 million. It priced $500

million of three-year notes at just 0.896%, or 0.47 point over

Treasurys, and $500 million of seven-year notes at 2.292%, a spread

of 0.87 point.

Ventas Inc. (VTR) also boosted the size of its seven-year

offering by 50% to $600 million, and it cut the offered yield 0.05

percentage point to 2.65 points over Treasurys.

The improved sentiment was reflected clearly in Markit's CDX

North America Investment-Grade Index, which steadily climbed

throughout the day, improving 5.1% in late trading to 97 basis

points. That matches its biggest one-day improvement of 2012,

according to Markit, and places the index at its best level in a

week.

"This is the first day I've been back in the market for new

issues in a few weeks," said a corporate bond trader in Chicago. He

noted that new-issues had been performing poorly in recent weeks,

making it unattractive to participate. But with the market

rebounding, it pays to play.

"A lot of accounts are attracted to the new issues because there

isn't a lot of paper available at par or at discount in the

secondary market--that makes it attractive," he added.

Unless there's a surge of issuance following the first-quarter

earnings releases from J.P. Morgan Chase & Co. (JPM) and Wells

Fargo & Co. (WFC) on Friday, this will easily be the slowest

week for high-grade issuance of 2012, according to Dealogic. The

week's tally should finish Thursday around $5 billion; the lightest

week of the year was $10.7 billion, in late January.

High-grade issuance is likely to remain slow for the rest of the

month, according to Bank of America Merrill Lynch. The bank noted

that April issuance tends to be soft due to earnings-related

blackout periods, and robust bank volume in the first quarter could

dampen issuance further, particularly with spreads on riskier bonds

widening early in the month.

-By Patrick McGee, Dow Jones Newswires; 212-416-2382;

patrick.mcgee@dowjones.com

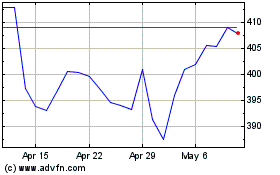

Deere (NYSE:DE)

Historical Stock Chart

From Mar 2024 to Apr 2024

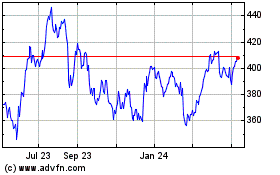

Deere (NYSE:DE)

Historical Stock Chart

From Apr 2023 to Apr 2024