Dollar And Yen Weaken On Renewed Risk-sentiment

April 12 2012 - 3:36AM

RTTF2

The US dollar and the Japanese yen fell against their major

rivals in late Asian deals Thursday as traders bought risk

associated assets in the wake of some positive news in the

market.

The latest bull wave was driven by a warm kick start of earning

season with Alcoa posting a surprise profit in the first quarter.

Easing bond yields in Spain and Italy and an upbeat jobs data from

Australia also supported the risk-sentiment.

The Federal Reserve's latest Beige Book revealed that the U.S.

economic recovery proceeded at a modest pace in recent months, as

manufacturers expressed optimism despite concerns about higher

energy prices.

Consumer spending was "encouraging" across a number of the Fed's

twelve districts, according to the Beige Book, which gathers

anecdotal information on current economic conditions.

European Central Bank Executive Board member Benoit Coeure

helped alleviate some recent investor concerns about Europe's debt

problems by saying that the ECB will revive its bond-purchase

program to lower Spain's borrowing costs.

Although the risk-sentiment regained, the undertone remains

cautious due to concerns over a cooling Chinese economy and slowing

jobs growth in the United States.

Traders also await for Google's earnings results due later in

the global day, which could offer more clues into whether firms

were able to sustain their profit momentum despite rising

costs.

The World Bank today lowered China's growth estimate for 2012 to

8.2 percent from 8.4 percent and said that the prospects for a

gradual adjustment of growth remain high.

Meanwhile, the Bank of Japan Governor Masaaki Shirakawa said

that the central bank will continue powerful monetary easing and

warned that uncertainty over global economy still remained

high.

In a speech at a quarterly meeting of the central bank's

regional branch managers, Shirakawa said the BoJ will pursue

powerful easing to help the economy overcome deflation and return

to a sustainable growth path.

The Australian Bureau of Statistics said that employment rose by

44,000 from a month earlier to 11.5 million. This was nearly seven

times the economists' expectations of an increase of 6,500.

Moreover, the March gain reversed a fall in employment of 15,400 in

February.

The dollar reached as far as yesterday's 8-day low of 1.5940

against the pound around 2:45 am ET and the pair has been hovering

in that level since then.

The greenback reached 1.3151 against the euro, a few pips short

of yesterday's new multi-day lows. The pair is staying around the

1.3140/50 level with 1.3290/1.33 seen as the next likely target

area.

The dollar also slipped to 0.9146 against the Swiss franc around

2:10 am ET and the pair held steady thereafter. On the downside,

the greenback may find target around the 0.9130 level.

Snapping back from yesterday's pivotal support of 80.60, the US

currency advanced to a 2-day high of 81.14 against the yen around

3:15 am ET. On the upside, the greenback may find target around the

81.70 level.

The lower-yielding yen also fell across the board in late Asian

deals Thursday, hitting 2-day lows of 129.26 against the pound,

84.38 against the Australian dollar, 66.70 versus the New Zealand

dollar and 81.15 against the Canadian dollar around 3:15 am ET.

The Japanese currency also declined to 106.62 against the euro

and 88.70 against the Swiss franc by 3:20 am ET. On the downside,

the yen may find support levels at 91.15 against the franc and

107.60 against the euro.

Looking ahead, European Central Bank monthly report, U.K. trade

data and the Eurozone industrial production - both for February are

slated for release in the European session.

The U.S. PPI for March, trade data for February, weekly jobless

claims for the week ended April 07, Canada's trade data and new

housing price index for February are expected in the New York

morning session.

Investors also await Italian government bond auction results

later in the day.

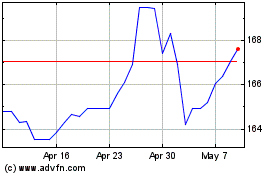

Euro vs Yen (FX:EURJPY)

Forex Chart

From Mar 2024 to Apr 2024

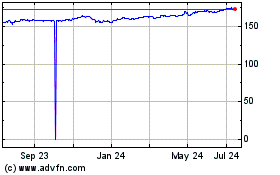

Euro vs Yen (FX:EURJPY)

Forex Chart

From Apr 2023 to Apr 2024