Money-Making Machines - Zacks Industry Rank Analysis

April 03 2012 - 8:00PM

Zacks

Industry Rank Analysis 4-4-12

The U.S. economy is continuing to recover, and one of the sectors

which has been the real engine of that growth is business

investment in equipment and software. While such investment

in the fourth quarter accounted for less than 7.6% of the overall

economy, it accounted for 18.3% of the overall growth in the fourth

quarter, and that was down from an astounding 62.2% in the third

quarter and 33.8% of the growth in the second quarter.

Today I am focusing on the equipment side of that, and more

specifically investments in machinery. The strong macro

performance of the sector is showing in upward estimate revisions

and positive earnings surprises, and those in turn at reflected in

the Zacks Rank.

Zacks Industry Classifications

The Zacks industry classifications are very fine, with 258

different industries tracked. It is not particularly

noteworthy if a single small industry shows up doing well; a single

firm with good news can propel a one or two firm industry to the

top (or bottom) of the charts.

It is interesting when you see a cluster of similar industries at

the top of the list. The same holds true for the bottom of

the list. The definition of size that matters here is not the

total sales or market capitalization but the number of companies in

the “industry.”

4 Machinery Groups Working Well

There are four Machinery “industries” that are showing up very well

on the Zacks Rank. The strongest three of which are about

median sized “industries,” with seven or eight firms in them.

The “weakest” of the four is by far the largest, General Industrial

Machinery, with 37 firms in it. It still shows up pretty

well, coming in 44th place, a drop of five slots from last

week. Its average Zacks Rank is 2.57, up slightly from 2.54

last week.

The strongest of the Groups is Machine Tools, with eight firms in

it. It is currently the fifth strongest “industry” with an

average Zacks Rank of 1.88, down from 2.00 last week. In

Between we have the Construction and Mining Machinery “industry” in

19th place (up one from last week, and an average Zacks Rank of

2.38, unchanged from last week), and The Farm Machinery “industry,”

a seven member group in 23rd place, slipping one spot from last

week on an unchanged average of 2.43.

If the Zacks Ranks were distributed randomly, one would expect that

only 5% of the members of the firms would earn the coveted Zacks #1

Rank (Strong Buy). Instead, of the total of 13 firms in these

four groups, 21.7%, have earned that distinction. If it were

random, only 15% would hold Zacks #2 Ranks (Buy) but actually 10

(16.7%) hold it.

Go Big or Go Small

There is a huge range of market capitalizations from which to

choose from on these lists, from very large down to micro

cap. While the growth rate from this year to next is not

shown directly, you can get a sense of it from looking at the

change in the P/E ratio from this year to next. Most of these

firms are looking at very respectable growth rates, at least in the

short term.

Of course, Machinery is a quintessentially cyclical part of the

market, so it is NOT a good idea to extrapolate those growth rates

too far into the future. It does, however, indicate that we

are in the middle of a cyclical upswing. Valuations on these stocks

-- particularly if you are willing to look out to FY2 (mostly 2013)

earnings -- are quite reasonable. While most of the smaller

cap names do not pay dividends, some of the large and mid-cap cap

names do provide a nice payout.

Number 1 Ranked Firms

| Company |

Ticker |

Market Cap ($ mil) |

P/E Using Curr FY Est |

P/E Using Next FY Est |

"%Ch Curr Fiscal Yr Est - 4 wks" |

"%Ch Next Fiscal Yr Est - 4 wks" |

"Current Price" |

Div Yield |

| Caterpillar Inc |

CAT |

$58,661 |

12.86 |

9.76 |

1.69% |

3.36% |

$90.99 |

2.02% |

| Lincoln Electrc |

LECO |

$2,639 |

12.95 |

10.94 |

12.37% |

9.97% |

$31.28 |

1.98% |

| Robbins & Myers |

RBN |

$1,987 |

18.6 |

14.36 |

0.00% |

0.00% |

$43.48 |

0.41% |

| Middleby Corp |

MIDD |

$1,434 |

16.58 |

13.95 |

0.00% |

0.00% |

$76.50 |

0.00% |

| Actuant Corp |

ATU |

$1,377 |

12.24 |

10.26 |

0.00% |

0.00% |

$20.06 |

0.20% |

| Barnes Grp |

B |

$1,191 |

15.37 |

12.61 |

5.29% |

3.58% |

$21.87 |

1.46% |

| Lindsay Corp |

LNN |

$692 |

18.55 |

17.45 |

0.00% |

0.00% |

$55.08 |

0.62% |

| Sun Hydraulics |

SNHY |

$647 |

17.2 |

14.7 |

0.08% |

0.06% |

$25.25 |

1.43% |

| H&E Equip Svcs |

HEES |

$355 |

N/A |

12.32 |

-226.32% |

0.00% |

$10.14 |

0.00% |

| Dxp Enterprises |

DXPE |

$322 |

11.66 |

9.81 |

4.45% |

4.10% |

$22.81 |

0.00% |

| Hurco Cos Inc |

HURC |

$168 |

18.11 |

12.98 |

0.00% |

0.00% |

$26.08 |

0.00% |

| Flow Intl Corp |

FLOW |

$146 |

19.87 |

11.41 |

0.00% |

0.00% |

$3.08 |

0.00% |

| Manitex Int Inc |

MNTX |

$48 |

16.96 |

8.48 |

0.00% |

0.00% |

$4.24 |

0.00% |

Number 2 Ranked Firms

| Company |

Ticker |

Market Cap ($ mil) |

P/E Using Curr FY Est |

P/E Using Next FY Est |

"%Ch Curr Fiscal Yr Est - 4 wks" |

"%Ch Next Fiscal Yr Est - 4 wks" |

"Current Price" |

Div Yield |

| Deere & Co |

DE |

$30,496 |

11.34 |

9.68 |

0.33% |

0.01% |

$72.66 |

2.26% |

| Sandvik Ab |

SDVKY |

$16,062 |

11.88 |

9.47 |

-8.80% |

-8.33% |

$13.54 |

2.86% |

| Eaton Corp |

ETN |

$14,450 |

10.51 |

8.88 |

2.60% |

2.62% |

$42.35 |

3.21% |

| Kubota Corp Adr |

KUB |

$10,827 |

15.37 |

14.14 |

0.00% |

0.00% |

$42.57 |

1.74% |

| Metso Corp -Adr |

MXCYY |

$5,765 |

13.64 |

10.66 |

-5.20% |

-4.74% |

$38.53 |

4.86% |

| Idex Corp |

IEX |

$3,128 |

15.33 |

13.17 |

1.69% |

2.14% |

$37.74 |

1.80% |

| Nordson Corp |

NDSN |

$2,944 |

12.65 |

11.61 |

0.13% |

0.13% |

$43.13 |

0.97% |

| Terex Corp |

TEX |

$2,016 |

35.81 |

8.55 |

-29.53% |

-8.27% |

$18.39 |

0.00% |

| Astec Inds Inc |

ASTE |

$730 |

16.19 |

12.77 |

13.95% |

8.92% |

$32.22 |

0.00% |

| Graham Corp |

GHM |

$178 |

17.07 |

13.16 |

4.64% |

1.99% |

$17.98 |

0.44% |

CATERPILLAR INC (CAT): Free Stock Analysis Report

DEERE & CO (DE): Free Stock Analysis Report

EATON CORP (ETN): Free Stock Analysis Report

KUBOTA CORP ADR (KUB): Free Stock Analysis Report

To read this article on Zacks.com click here.

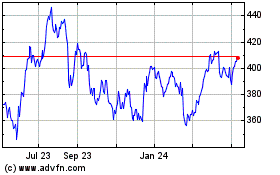

Deere (NYSE:DE)

Historical Stock Chart

From Mar 2024 to Apr 2024

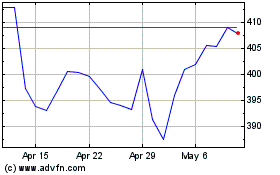

Deere (NYSE:DE)

Historical Stock Chart

From Apr 2023 to Apr 2024