Lloyd's of London, the U.K.'s 324-year-old insurance and

reinsurance market, Wednesday posted its first pretax loss in six

years after being hit by lower investment returns and major

catastrophes, in what industry experts call the second-costliest

year on record in terms of insured disaster claims.

Lloyd's also said 2012 remains challenging for insurers with

tough economic conditions globally. And despite the losses,

insurance rates may rise only slowly because insurers have bulked

up on capital, especially during years with smaller catastrophe

claims.

For 2011, the Lloyd's market had a pretax loss of GBP516

million, compared with a pretax profit of GBP2.2 billion a year

earlier, consisting of the sum result of its members and itself as

the managing corporation.

The loss comes as industry estimates show that total claims from

natural catastrophes last year were between $100 billion and $116

billion, the second-highest on record after 2005, when strong

hurricanes in the U.S. pushed the figure to $120 billion.

Willis Re said catastrophe losses last year were worth at least

$100 billion. Aon Benfield puts the figure at $107 billion and

Swiss Re (SREN.VX) puts it at $116 billion.

Lloyd's Chief Executive Richard Ward said: "Make no mistake,

2011 was a difficult year for the insurance industry. Given the

scale of the claims, a loss is unsurprising, but it reflects what

we're here to do--help communities and businesses rebuild after

disaster."

"However, I am disappointed that, given the exceptional level of

catastrophes in 2011, insurance rates have not responded more

positively. These events demonstrate the need for the industry to

show discipline in terms of pricing," Ward said.

Ward said in a Bloomberg TV interview that the insured losses in

2011 "don't happen every year."

"When we do have these significant claims coming in, yes, the

market reports a loss. But when claims don't come in, the market

reports a profit," he said.

"It's important that we're here to pay the claims of

policyholders. We've been doing that for 324 years, we're building

our financial strength so we can do that in the next 324 years,"

Ward said.

Lloyd's new chairman, John Nelson, noted that Lloyd's was able

to make a profit in the second half of the year despite the floods

in Thailand and continuing low investment returns.

"2012 remains challenging for insurers with tough economic

conditions globally. It is vital that the market continues to take

a disciplined approach to underwriting," Nelson said.

Lloyd's investment return fell to GBP955 million from GBP1.26

billion in 2010 amid poor investment markets.

Lloyd's said its combined ratio worsened to 106.8% from 93.3%. A

combined ratio is a measure of claims costs compared with premiums.

A figure below 100% indicates an underwriting profit. Conversely, a

figure above 100% indicates a loss.

Lloyd's last had a pretax loss in 2005 worth GBP103 million.

Before that was 2001 with a loss of GBP3.1 billion.

Lloyd's Finance Director Luke Savage told Dow Jones Newswires

that 2011 was one of the costliest for Lloyd's. Despite that,

insurance rates may only see sluggish growth.

"When you have major claims like earthquakes and windstorms

outside the U.S., we tend to have a higher share of claims than

from inside the U.S. Last year, there were major disasters in

Australia, New Zealand, Japan and Thailand, so we picked up a

higher share than we normally do," he said.

Savage said only a few lines of insurance are seeing increased

rates but even those increases are "not enough."

"We've seen property treaty improving, as well as in energy, and

there's a big improvement in U.K. motor rates, but that's just

trying to claw back previous losses," he said.

"Beyond that, rates are still sluggish because of excess capital

in the industry. It's going to be difficult to drive rates up, even

though we don't think there's going to be much in the way of

investment returns to support underwriting," Savage said.

Excess capital means that insurers have enough funds to back the

offering of new insurance policies. That increases competition and

makes it difficult to raise premium prices.

Savage said Lloyd's central fund--a pool of money used in case

troubled member insurers have difficulty paying claims--has risen

to GBP3.095 billion from GBP3.028 billion in 2010. "This shows

we're in pretty good shape in a pretty disciplined market," he

said.

Savage said Lloyd's managed to post a GBP181 million pretax

profit in the second half of last year despite the floods in

Thailand.

Lloyd's isn't publicly traded, though some of its members are

listed companies, such as Hiscox Ltd. (HSX.LN), Catlin Group Ltd.

(CGL.LN) and Hardy Underwriting Bermuda Ltd. (HDU.LN).

Shore Capital analyst Eamonn Flanagan said in a recent note that

the strong level of capital of general insurance companies is like

a "double-edged sword."

On the one hand, Flanagan said, tight management of capital has

enabled the non-life industry to endure the huge insured

catastrophe losses in 2011.

But on the other hand, "such financial strength has hampered

attempts to push through much-needed hardening of premium rates in

many key lines, especially liability, despite the low interest-rate

environment" Flanagan said.

"The non-life insurance industry has stood firm, paid its claims

and continued to provide cover--all without assistance from the

beleaguered taxpayer. For this, we must give management throughout

the industry considerable credit," he said.

Analysts from Oriel Securities said there may be "more

pronounced increases" in rates in April and July insurance

contracts in Asia-Pacific are renewed.

- By Vladimir Guevarra, Dow Jones Newswires. Tel. +44 (0)

2078429486, vladimir.guevarra@dowjones.com

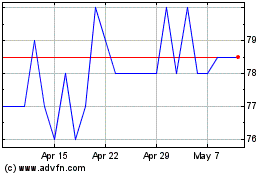

Castelnau (LSE:CGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

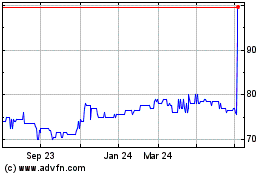

Castelnau (LSE:CGL)

Historical Stock Chart

From Apr 2023 to Apr 2024