Cal-Maine Foods, Inc. (NASDAQ: CALM) today reported results for

the third quarter and nine months ended February 25, 2012.

Net sales for the third quarter of fiscal 2012 were $303.7

million compared with net sales of $274.7 million for the same

quarter of fiscal 2011. The Company reported net income of

$26.1 million, or $1.09 per basic share, for the third quarter

of fiscal 2012 compared with net income of $33.6 million,

or $1.41 per basic share, for the third quarter of fiscal

2011. The results for the third quarter of fiscal 2011 include

in other income a one-time cash distribution of approximately $4.8

million pre-tax ($3.2 million after tax) or $0.13 per basic share,

received in exchange for the Company’s non-voting stock ownership

in the Eggland’s Best, Inc. cooperative.

For the first nine months of fiscal 2012, net sales were $837.9

million compared with net sales of $699.6 million for the

prior-year period. The Company reported net income of

$52.5 million, or $2.20 per basic share, for the

first nine months of fiscal 2012 compared with net income of

$53.6 million, or $2.25 per basic share, for the

prior-year period.

“We are pleased with Cal-Maine’s financial and operating

performance for the third quarter of fiscal 2012,” said Dolph

Baker, president and chief executive officer of Cal-Maine Foods,

Inc. “Total sales for the quarter were up 10.6 percent

compared with the same period a year ago, reflecting higher average

selling prices and good retail demand for shell eggs. We

benefited from record high market prices for shell eggs during the

strong holiday selling season. However, prices adjusted down

approximately 35 percent in the ten market days after their

December peak level due to typically slower post-holiday demand

trends and warmer weather across the country. Overall, average

selling prices for shell eggs were up 3.3 percent over the third

quarter of fiscal 2011, and specialty egg prices were up 9.0

percent compared with the same period last year.

“Our volumes also improved as dozen eggs produced by Cal-Maine

Foods increased 3.0 percent and dozen eggs sold were up 6.5

percent. Sales of specialty eggs represented 23.8 percent of shell

egg revenue for the third quarter and accounted for 16.8

percent of total dozen eggs sold. Specialty eggs, which

include nutritionally enhanced, cage-free and organic eggs,

have become an important focus of our growth strategy as we

have been at the forefront of meeting the growing consumer demand

for these products. Additionally, specialty eggs have higher and

less cyclical retail selling prices.

“Our feed costs have continued to affect our production costs in

fiscal 2012,” added Baker. “For the third quarter, feed costs were

up 4.5 cents per dozen, or 11.1 percent, compared with

the third quarter of fiscal 2011. We expect feed costs

will remain very high and volatile throughout the summer of

calendar 2012 due to tight supplies of corn and soybeans, our

primary feed ingredients. However, all of Cal-Maine Foods’

operations have continued to run well and our management team is

focused on managing the aspects of our business we can control

and improving efficiencies where possible.

“We believe we are well positioned for another successful year

for Cal-Maine Foods with a proven management team, efficient

operations and a strong balance sheet to support our growth

strategy,” Baker concluded.

For the third quarter of fiscal 2012, Cal-Maine will pay a cash

dividend of approximately $0.364 per share to holders of its

common and Class A common stock. The amount paid could

vary slightly based on the amount of outstanding

shares on the record date. The dividend is payable

May 10, 2012, to shareholders of record on April 25,

2012.

Selected operating statistics for the third quarter and first

nine months of fiscal 2012 compared with the prior-year periods are

shown below:

13 Weeks Ended 39 Weeks Ended

February 25,

2012

February 26,

2011

February 25,

2012

February 26,

2011

Dozen Eggs Sold (000) 229,235 215,233 655,463 615,257 Dozen Eggs

Produced (000) 166,109 161,295 491,785 476,388 % Specialty

Sales (dozen) 16.8 % 17.5 % 16.3 % 16.0 % Net Average

Selling Price (dozen) $ 1.275 $ 1.234 $ 1.224 $ 1.090 Feed Cost

(dozen) $ 0.449 $ 0.404 $ 0.466 $ 0.376 % Specialty Sales

(dollars) 23.8 % 23.5 % 23.4 % 23.9 %

Cal-Maine Foods, Inc. is primarily engaged in the production,

grading, packing and sale of fresh shell eggs, including

conventional, cage-free, organic and nutritionally-enhanced eggs.

The Company, which is headquartered in Jackson,

Mississippi, is the largest producer and distributor of fresh shell

eggs in the United States and sells the majority of

its shell eggs in approximately 29 states across the

southwestern, southeastern, mid-western and mid-Atlantic regions of

the United States.

Statements contained in this press release that are not

historical facts are forward-looking statements as that term

is defined in the Private Securities Litigation Reform Act of 1995.

The forward-looking statements are based on management’s current

intent, belief, expectations, estimates and projections regarding

our company and our industry. These statements are not guarantees

of future performance and involve risks, uncertainties, assumptions

and other factors that are difficult to predict and may be beyond

our control. The factors that could cause actual results to differ

materially from those projected in the forward-looking statements

include, among others, (i) the risk factors set forth in the

Company’s SEC filings (including its Annual Reports on Form

10-K, Quarterly Reports on Form 10-Q and Current Reports on Form

8-K), (ii) the risks and hazards inherent in the shell

egg business (including disease, pests, weather conditions and

potential for recall), (iii) changes in the market prices of

shell eggs and feed costs, (iv) changes or obligations that could

result from our future acquisition of new flocks or businesses, and

(v) adverse results in pending litigation matters. SEC filings

may be obtained from the SEC or the Company’s website,

www.calmainefoods.com. Readers are cautioned not to place undue

reliance on forward-looking statements because, while we

believe the assumptions on which the forward-looking statements are

based are reasonable, there can be no assurance that these

forward-looking statements will prove to be accurate. Further, the

forward-looking statements included herein are only made as of

the respective dates thereof, or if no date is stated, as of

the date hereof. Except as otherwise required by law, we

disclaim any intent or obligation to update publicly these

forward-looking statements, whether as a result of new information,

future events or otherwise.

CAL-MAINE FOODS, INC. AND

SUBSIDIARIES

FINANCIAL HIGHLIGHTS

SUMMARY STATEMENTS OF INCOME

(Unaudited) (In thousands, except per share amounts)

13 Weeks Ended

39 Weeks Ended

February 25,

February 26,

February 25,

February 26,

2012

2011

2012

2011

Net sales $ 303,660 $ 274,674 $ 837,871 $ 699,600 Gross profit

65,149 65,580 160,427 143,531 Operating income 34,939 38,961 76,569

69,785 Other income 5,636 11,573 4,747 10,232 Income before income

taxes 40,575 50,534 81,316 80,017 Net income $ 26,102 $

33,619 $ 52,479 $ 53,568 Net income per common share: Basic

$ 1.09 $ 1.41 $ 2.20 $ 2.25 Diluted $ 1.09 $ 1.40 $ 2.19 $ 2.24

Weighted average shares outstanding: Basic 23,874 23,861

23,871 23,852 Diluted 23,949 23,943 23,948 23,941

SUMMARY BALANCE SHEETS

February 25,

2012

May 28,

2011

ASSETS Cash and short-term investments $ 225,701 $ 176,429

Receivables 66,339 62,790 Inventories 118,925 110,021 Prepaid

expenses and other current assets 6,094 5,801 Current

assets 417,059 355,041 Property, plant and equipment (net)

222,176 224,887 Other noncurrent assets 56,162 60,915

Total assets $ 695,397 $ 640,843 LIABILITIES AND

STOCKHOLDERS' EQUITY Accounts payable and accrued expenses $ 98,516

$ 71,969 Current maturities of long-term debt 11,458 11,743

Deferred income taxes 24,093 23,770 Current

liabilities 134,067 107,482 Long-term debt, less current

maturities 67,488 76,418 Deferred income taxes and other

liabilities 40,209 38,066 Stockholders' equity 453,633

418,877 Total liabilities and stockholders' equity $ 695,397

$ 640,843

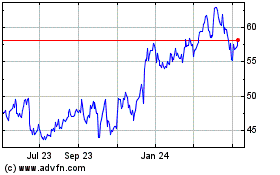

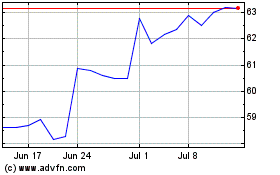

Cal Maine Foods (NASDAQ:CALM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cal Maine Foods (NASDAQ:CALM)

Historical Stock Chart

From Apr 2023 to Apr 2024