TIDMHEAD

RNS Number : 0048Z

Headlam Group PLC

09 March 2012

9 March 2012

Preliminary Results for the Year Ended 31 December 2011

Headlam Group plc ("Headlam"), Europe's leading floorcoverings

distributor, announces its final results for the year ended 31

December 2011.

Financial highlights

2011 2010 Change

GBP000 GBP000

Revenue 569,795 535,690 +6.4%

Operating profit 28,052 26,066 +7.6%

Profit before tax 27,588 25,006 +10.3%

Basic earnings per share 24.6p 21.5p +14.4%

Dividend per share 14.15p 12.40p +14.1%

Key points

-- UK like for like revenues increase by 7.7% indicating further increase in market share

-- Continental European revenues decrease by 5.0% on a like for like basis

-- Profit before tax increased by 10.3%

-- Group net funds GBP7.6 million

-- Dividend per share increased by 14.1%

Tony Brewer, Headlam's Group Chief Executive, said:

"The first ten weeks of 2012 have continued a positive trend

with all five business sectors and each product category in the UK

continuing to produce increases in revenue against the

corresponding period last year.

Markets remain challenging and somewhat unpredictable due to the

general economic outlook combined with uncertainty over both raw

material prices and currency exchange. However through the group's

strategy and structure combined with extensive product and

marketing initiatives, we are confident that our individual

businesses can collectively outperform the market."

Enquiries:

Headlam Group plc

Tony Brewer, Group Chief Executive Tel: 01675 433000

Steve Wilson, Group Finance Director

Chairman's Statement

I am pleased to report that the group's revenue increased by

6.4% in 2011 from GBP535.7 million to GBP569.8 million. Like for

like revenue increased in the UK by 7.7% and, declined in

Continental Europe by 5.0%. The increase in the UK, achieved in

challenging conditions, represents a continued outperformance

compared with the floorcovering market.

Earnings and dividend

Profit before tax increased by 10.3% from GBP25.0 million to

GBP27.6 million and earnings per share improved by 14.4% from 21.5p

to 24.6p. The board is therefore proposing to increase the final

dividend by 14.9% from 8.57p to 9.85p resulting in a total dividend

for the year of 14.15p, up 14.1% on 2010.

The final dividend, if approved by shareholders at the Annual

General Meeting, will be paid on 2 July 2012 to shareholders on the

register at close of business on 1 June 2012.

Strategy

Our strategy remains focused on the development of our

floorcovering distribution businesses in the UK and Continental

Europe and the continued improvement of the service we provide to

independent floorcovering retailers and contractors.

The strategy is based upon a well defined operating structure

that delivers sustained product development, marketing and

distribution services aimed at supporting and enhancing our

customers' position in their markets. This structure, built upon

over many years, has allowed us to continually outperform the

floorcovering market through various economic cycles. This has been

particularly evident in recent years when conditions have proved to

be particularly challenging and during which time the group has

maintained the ability to increase its market share.

One of the key components of the group's structure is the

deliberate proliferation of autonomous businesses controlled by

dedicated management teams empowered to independently develop and

enlarge their individual business. This decentralised approach, set

within a well developed and consistently applied framework of

operational and financial controls, provides the group with a wide

and penetrating access to the floorcovering market enabling our

businesses to minimise risk in challenging trading environments and

respond swiftly to opportunities.

In the UK, it was particularly encouraging to see this strategy

deliver success in 2011 when each of the five business sectors and

all our product categories showed increases in revenue against the

previous year.

We have a number of investment plans at various stages of

development, aimed at enlarging and improving the infrastructure of

the group. The plans relate to replacing one and extending two

existing distribution centres and establishing additional service

centres, which will enhance our logistics capability and contribute

to the group's long-term future growth objectives.

Employees

2011 represents another year of progress for the group and has

been achieved through the collective endeavour of all our

employees. The board would like to thank our management and

employees for their efforts and contribution in producing another

positive result over the course of the year.

Outlook

With the benefit of the clearly defined strategy and autonomous

structure, the group has made a solid start to 2012. Each of the

management teams in the UK and Continental Europe are clearly

focused on their specific objectives with regard to revenue and

profit contribution.

Whilst we are operating in challenging markets and a

particularly competitive environment persists, the autonomous

structure combined with the experience and tenacity of our

individual management teams, sales representatives and employees

should enable the group to achieve its internal objectives assuming

normal seasonal trends prevail.

Graham Waldron, Chairman

Chief Executive's Review

The 7.7% like for like increase in UK revenue reflects a

particularly positive performance, in a floorcovering market, where

various indicators would suggest that challenging trading

conditions remain.

Market sectors

The 50 businesses in the UK, operating from 18 distribution

centres and 16 service centres, are structured within five market

sectors based on their geographical position or product

offering.

Regional multi-product: These 20 businesses, operating in both

the residential and commercial markets, collectively provide a

comprehensive national coverage. During the year the revenue from

these businesses increased by 5.3% and given that they represent

51% of UK revenue, their positive performance is important since it

provides the group with a solid base from which to expand its

market presence.

National multi-product: The Mercado businesses have been able to

increase revenue by 6.8% across their residential and commercial

activities throughout England, Wales and Northern Ireland. We have

implemented further initiatives to enhance Mercado's geographical

presence and these are covered more fully below.

Regional commercial: This sector, which increased revenue by

10.2%, currently includes 18 operations based in 5 distribution and

13 service centres. During the year, we opened a new service centre

in Carlisle and with modest investment, intend to increase the

number of service centres to expand our UK locations.

Residential specialist: The 14 businesses, operating principally

in the middle to premium quality carpet market, achieved a

successful year increasing their revenue by 16.1%. Further targeted

investment in sales and marketing activities should result in these

businesses gaining additional market share within their sector.

Commercial specialist: These businesses, which increased revenue

by 1.7% during the year operate throughout the commercial markets

but have a primary focus in the healthcare and education sectors.

With additional product development, these businesses can secure

opportunities in other commercial segments.

Suppliers

Our suppliers are integral to the business development of the

group and liaise closely with our senior and operating management

teams. This relationship with the leading floorcovering

manufacturers, principally in the UK and Continental Europe,

ensures that our 50 businesses in the UK and five businesses in

Continental Europe are continuously able to provide independent

floorcovering retailers and contractors with new products. This is

supported by appropriate point of sale displays to present new

floorcovering products and innovations to the ultimate end

user.

One particular innovation, developed during 2011, is the

revolutionary carpet fibre WOLLTEC--. This fibre, which is

exclusive to the group, combines the appearance and luxury

characteristics of wool with the durability and stain resistant

properties of polypropylene. The products manufactured with this

fibre, which have received a particularly positive reaction from

independent floorcovering retailers, are an example of how the

group maintains its position at the forefront of new floorcovering

technology and passes the benefits to its customers.

Market presence

Our external sales representatives are positioning new product

into customers on a daily basis, using various types of display

stands and sample books. In conjunction with the ongoing product

launches, we further improve our supplier and customer

relationships with an extensive programme of promotional events and

customer initiatives.

During 2011, our businesses launched 3,501 (2010: 3,109) new

products and we supplied our customers with 658,188 (2010: 626,637)

sample books and display stands. This level of activity has

contributed to the particularly encouraging trend for 2011 where

our businesses increased revenue in each of the product categories

of carpet, residential vinyl, wood, laminate, commercial flooring

and accessories. Whilst revenue attributable to commercial flooring

increased at a slightly faster rate than residential, the overall

mix remains unchanged compared with last year at 69% residential

and 31% commercial.

Lifestyle Floors is now firmly established as a trade brand in

the UK floorcovering market. The steps taken to significantly

enlarge our market presence, principally through the installation

of display modules and lecterns, have been extremely well received

by independent floorcovering retailers.

We have invested in a management team who are responsible for

enhancing the performance of Lifestyle Floors, by identifying

opportunities to maximise the brand and supervise product

development. They also manage a team of ten merchandisers who are

being utilised to ensure that the modules and lecterns used to

display the product are up to date, complete and in pristine

condition allowing the independent floorcovering retailer to

maximise the potential of the brand.

Customers

We continue to maximise our presence with independent

floorcovering retailers and contractors, through our 383 external

sales people, collectively visiting our customers 488,660 (2010:

475,901) times during the year.

In the UK, the group is focused on encouraging the individual

sales and marketing autonomy of the 50 businesses. We are able to

provide an efficient logistics service to our customers because of

our comprehensive stockholding and availability of next day

delivery. During 2011, our fleet of 371 vehicles completed

1,143,860 (2010: 1,126,676) deliveries to our customers'

premises.

Active accounts in the UK increased from 41,994 to 43,347 during

the year. As reflected in our revenue increase, the independent

sector is in good health and continues to take market share. It is

inevitable that there are business failures and the occurrence of

bad debts has increased compared with the previous year, however,

the average period of credit taken by our independent customer

base, decreased from 42.0 to 40.9 days.

iPads

The introduction of iPads, in conjunction with the development

of bespoke software, to all of our sales people has undoubtedly

been beneficial in further improving their working practices and

time management and ultimately, provides an enhanced service to our

customers.

The iPads provide our sales people with improved visibility of

real time customer data, the ability to access stock files to place

orders and give an immediate flow of information on customer visits

to our sales managers. An additional benefit is that our

businesses' extensive marketing literature and display information

can be contained within the iPad for efficient demonstration to our

customers.

We have launched the iPad initiative in the Netherlands and

intend to extend it to France and Switzerland during 2012.

Continental Europe

In Continental Europe, each of our five businesses has

contributed to an increased level of profitability in mixed market

conditions.

Belcolor, our business based in Switzerland, purchases 44.0% of

its total product requirements in Euros. The appreciation of the

Swiss Franc against the Euro has therefore had a beneficial impact

on the business, improving gross margins during the year,

compensating for reductions in revenue and enabling Belcolor to

produce a satisfactory result compared with last year.

Market conditions were relatively stable in France, allowing LMS

to increase its profitability. Similarly in the Netherlands, Lethem

Vergeer, Interplan and Sylvester were able to produce a solid

result.

Management and employees

In addition to the group's strategy and operating structure, the

other key element underpinning our ongoing success is the strength

and experience of our management teams and employees.

The group has a clear policy of promoting employees from within

wherever possible affording all employees the opportunity to

develop and fulfil their career aspirations. This has enabled

employees to progress from relatively junior positions into middle

and senior management roles and has allowed us to develop an

entrepreneurial culture throughout the business.

The benefit of this approach is that the group has operating

management teams, with in-depth knowledge of their business

objectives and processes, leading the development of our

businesses.

The strength of our management at the individual business level

is supported by the small team of senior executive managers who

through guidance and direction, ensure that our teams are pursuing

the group's strategy and contributing to the achievement of our

operating objectives.

Investments

We currently have a number of plans to further improve and

enlarge the infrastructure of the group.

We have obtained planning permission to extend our distribution

centre in Tamworth, increasing its footprint from 147,400 square

feet to 160,200 square feet. This will allow our Residential and

Commercial specialist businesses to further develop their

activities in the middle to higher market sectors that they

serve.

In Coleshill, we have agreed to acquire, subject to planning

permission, land adjacent to the existing distribution centre in

order to increase the size of the centre from 159,500 square feet

to 283,800 square feet. This will provide the capacity to increase

our central stock holding in certain product sectors to satisfy the

demand from our regional distribution centres and manage our future

working capital investment on a more efficient basis.

We have been involved in a very protracted process to relocate

Faithfulls, our Regional multi-product business in Hadleigh, near

Ipswich. Unfortunately, the planning permission issues proved to be

insurmountable and therefore, we are currently in dialogue with

other parties to acquire an alternative site, to accommodate a

127,000 square feet distribution centre, in close proximity to our

existing operation.

Mercado, our National multi-product business, is currently in

the process of opening a 6,800 square feet service centre in

Liverpool. The service centre will enable Mercado to expand its

position in the area and provides an opportunity to develop its

market share in the commercial sector.

Furthermore, we plan to relocate the trans-shipping depot based

in Chelmsford, which Mercado utilises to service the southeast of

England. The new facility, which is located in the near vicinity,

will also operate as a service centre for Mercado to enlarge its

commercial activities in this region.

We are evaluating other modest investments to increase the

number of service centres in specific geographical locations, which

will expand our regional commercial activities.

Outlook

The first ten weeks of 2012 have continued a positive trend with

all five business sectors and each product category in the UK

continuing to produce increases in revenue against the

corresponding period last year.

Markets remain challenging and somewhat unpredictable due to the

general economic outlook combined with uncertainty over both raw

material prices and currency exchange. However through the group's

strategy and structure combined with extensive product and

marketing initiatives, we are confident that our individual

businesses can collectively outperform the market.

2011 financial review

Results for 2011

Revenue

The revenue result for 2011 is the highest ever recorded by the

group and represents a very satisfactory achievement given the

current trading environment. At GBP569.8 million, it exceeds the

results achieved in 2007 and 2008 respectively amounting to

GBP544.7 million and GBP557.3 million, which were previously the

two best years and were, attained prior to markets being affected

by the current economic issues.

However, whilst we continue to make steady progress in the UK,

in markets that anecdotal evidence suggests remain flat, the

significant impact of currency translation on the evolution of

group revenue should not be overlooked.

By way of illustration, the table below documents the principal

factors giving rise to the changes in group revenue between 2007

and 2011.

GBP000 GBP000

Revenue 2007 544,718

UK growth 3,297

Continental European decline (6,808)

Benefits of currency translation 28,588

--------

21,780

Revenue 2011 569,795

--------

The analysis highlights the benefits of currency gains, which

arise from the depreciation of Sterling against the Euro and Swiss

Franc. Based on the average currency rates used to translate the

results of the Continental businesses in 2007 and 2011, Sterling

has depreciated by 21.1% against the Euro and 40.9% against the

Swiss Franc.

Growth in the UK during the four years since 2007 is the net

result of expansion in the Residential and Commercial specialist

businesses amounting to GBP33.2 million and a net decline of

GBP29.9 million in the traditional distribution businesses.

The Residential specialist businesses represent a sector the

group has invested in during the last ten years, firstly by

acquisition and secondly, through ongoing investment in sales and

marketing, the combination of which has seen this sector continue

to grow notwithstanding market contraction.

The decline in the multi-product businesses has occurred as a

direct consequence of the decrease in UK floorcovering markets.

These businesses collectively represent 63% of UK revenue and as

highlighted in the Chief Executive's Review, the resumption of

growth in these two sectors during 2011 was an important step

forward, since they provide the UK operation with the base of its

market presence.

The impact of the reduction in the floorcovering markets in

Continental Europe has been at its most acute in Switzerland, where

revenues, at constant currency compared with those achieved in

2007, have reduced by 14.7%. Revenue is down in the Netherlands

over the four year period by 9.1% and in France by 4.5%.

Gross margin and expenses

Group gross margin as a percentage of revenue remained unchanged

compared with 2010. In the UK, the ongoing improvement in gross

margin performance was unable to progress because of changes in

product mix and increased price competition, particularly during

the second half of the year. Further price competition is expected

to be a feature of UK trading during 2012.

Total distribution and administration expenses as a percentage

of revenue remained unchanged compared with the last two years at

25.9%. The increase in expenditure during the year, amounting to

GBP8.8 million, was principally due to

-- employment costs, in constant currency terms, up 5.9% to GBP4.4 million,

-- fuel costs, up 14.0% to GBP1.4 million,

-- cost of the delivery fleet up 12.5%, GBP1.0 million and

-- sampling and bad debts up 7.2% to GBP1.1 million

Net finance costs

Net finance costs reduced during the year by GBP0.6 million

compared with 2010. The change during the year was almost entirely

attributable to the net reduction in finance cost associated with

the group's pension plans.

Following renewal of the group's term facility, net finance

costs are likely to increase during 2012 due to pricing changes on

the new facilities.

Taxation

The effective rate of taxation reduced to 26% during the year,

reflecting the decrease in the UK headline corporation tax rate and

also the further future reduction already enacted, which impacts

upon deferred taxation. The anticipated effective rate for 2012 is

expected to reduce to 25% due to announced UK rate reductions.

Dividends

Total dividends paid and proposed for 2011 have increased by

14.1% from 12.40 pence to 14.15 pence. Dividend cover of 1.74 times

is in line with last year and represents a cover ratio the board

anticipate maintaining for the foreseeable future.

Refinancing

The group has entered into two separate agreements with Barclays

Bank and The Royal Bank of Scotland and completed the re-financing

of its existing term facility.

The new facilities, provided equally by the two banks and

totalling GBP40.0 million, are for a term of four years, which can

be extended to five on the exercise of a separate option by each

bank.

The former facility, amounting to GBP30.0 million has been

repaid in full and cancelled.

In addition to the above, the group has extended its uncommitted

UK facilities, amounting to GBP35.0 million, for another 12

months.

Cash flows

Operating cash flows before changes in working capital

Operating cash flows before changes in working capital increased

during the year by GBP2.3 million from GBP31.5 million to GBP33.8

million.

Net working capital investment during the year amounted to

GBP12.9 million compared with GBP0.2 million during the previous

year. The group continues to provide its customers with a wide

range of product. This commitment, coupled with price increases

introduced by suppliers during the first quarter of 2011, which

averaged 3.6%, has resulted in an additional GBP8.7 million

investment in inventory.

The additional funding required in connection with trade

receivables has arisen due to the increase in revenue during the

year. However, as already noted in the Chief Executive's Review,

the average period of credit taken by our independent customer

base, as measured at the end of the year, has reduced compared with

the previous year.

The additional net working capital investment is the reason for

cash generated from operations reducing by GBP10.5 million during

the year. However, the decrease in cash payments relating to tax,

GBP4.1 million, and the enhanced transfer value exercise, GBP4.2,

was the principal reason for the reduction in net cash from

operating activities to GBP2.2 million.

Cash flows from investing and financing activities

Additions to property, plant and equipment during the year were

modest compared with previous years. However, as highlighted in the

Chief Executive's Review, the group intends to embark on further

investment over the next few years with approximately GBP24.0

million being committed to the development of the Coleshill

extension and the new distribution centre for Faithfulls. It is too

early in the process to comment on the detailed timing of the cash

flows.

Cash out flows relating to financing activities amounted to

GBP12.1 million compared with GBP10.0 million in the previous year.

The main component of the cash flow relates to dividends but during

the year, GBP1.6 million was utilised to acquire shares in the

company to crystallise the cost of satisfying potential awards

under the employee share plan arrangements.

Net debt

Group net funds at the end of the year decreased compared with

the previous year by GBP2.9 million from GBP10.5 million to GBP7.6

million. The details are shown in the table below.

At At

1 January Cash Translation 31 December

2011 flows differences 2011

GBP000 GBP000 GBP000 GBP000

Cash at bank and

in hand 44,758 (3,211) (53) 41,494

Debt due within one

year (225) (30,000) 6 (30,219)

Debt due after one

year (34,011) 30,228 92 (3,691)

10,522 (2,983) 45 7,584

----------- --------- ------------- -------------

Employee benefits

As disclosed in the Cash Flow Statement, the group made further

payments totalling GBP3.3 million in connection with the enhanced

transfer value exercise during the first quarter of 2011, enabling

deferred members of the UK defined benefit pension plan the

opportunity to transfer out.

The group does not anticipate repeating this exercise in the

foreseeable future.

The results of the triennial review of the UK defined benefit

pension plan revealed a net deficit reduction from GBP22.4 million

to GBP11.5 million. The reduction has been appreciably facilitated

by both the additional contributions to the plan and the transfer

of deferred members.

The company has agreed with the plan trustee to maintain

additional contributions in line with the arrangement agreed in

2008, which means that each year's contribution will continue to

increase on the previous year at a rate of 3.2%. This commitment

gave rise to a cash payment of GBP2.8 million during the year and

should result, all else being equal, in the plan deficit being

completely eliminated by December 2015.

Going concern

Having reviewed the group's resources and a range of likely

out-turns, the directors believe they have reasonable grounds for

stating that the group has adequate resources to continue in

operational existence for the foreseeable future and that it is

appropriate to adopt the going concern basis in preparing the

group's financial accounts.

Consolidated Income Statement

for the year ended 31 December 2011

Note 2011 2010

GBP000 GBP000

Revenue 1 569,795 535,690

Cost of sales (394,056) (370,731)

----------------------------------------- ----- ---------- ----------

Gross profit 175,739 164,959

Distribution expenses (110,623) (102,016)

Administrative expenses (37,064) (36,877)

----------------------------------------- ----- ---------- ----------

Operating profit 1 28,052 26,066

Finance income 4,520 4,637

Finance expenses (4,984) (5,697)

----------------------------------------- ----- ---------- ----------

Net finance costs (464) (1,060)

----------------------------------------- ----- ---------- ----------

Profit before tax 27,588 25,006

Taxation (7,184) (7,127)

----------------------------------------- ----- ---------- ----------

Profit for the year attributable to the

equity shareholders 20,404 17,879

----------------------------------------- ----- ---------- ----------

Dividend paid per share 3 12.40p 11.00p

Earnings per share

Basic 2 24.6p 21.5p

----------------------------------------- ----- ---------- ----------

Diluted 2 24.4p 21.5p

----------------------------------------- ----- ---------- ----------

All group operations during the financial years were continuing

operations.

Consolidated Statement of Comprehensive Income

for the year ended 31 December 2011

Note 2011 2010

GBP000 GBP000

Profit for the year attributable to the equity

shareholders 20,404 17,879

Other comprehensive income:

Foreign exchange translation differences arising

on translation of overseas operations (234) 1,094

Actuarial losses and gains on defined benefit

plans (7,839) 356

Effective portion of changes in fair value

of cash flow hedges - (1)

Transfers to profit or loss on cash flow hedges - 225

Income tax on other comprehensive income 1,855 9

----------------------------------------------------------- -------- --------

Other comprehensive (expense)/income for the

year (6,218) 1,683

Total comprehensive income attributable to

the equity shareholders for the year 14,186 19,562

Statements of Financial Position

at 31 December 2011

2011 2010

Note GBP000 GBP000

Assets

Non-current assets

Property, plant and equipment 94,201 97,215

Intangible assets 13,210 13,210

Investments in subsidiary undertakings - -

Deferred tax assets 962 896

108,373 111,321

Current assets

Inventories 114,196 105,694

Trade and other receivables 111,656 102,240

Cash and cash equivalents 41,494 44,758

Assets held for sale 362 362

267,708 253,054

Total assets 1 376,081 364,375

--------------------------------------------- ------ ---------- ----------

Liabilities

Current liabilities

Other interest-bearing loans and borrowings (30,219) (225)

Trade and other payables (154,490) (149,476)

Employee benefits (2,669) (2,586)

Income tax payable (6,678) (4,201)

(194,056) (156,488)

Non-current liabilities

Other interest-bearing loans and borrowings (3,691) (34,011)

Employee benefits (11,789) (10,138)

(15,480) (44,149)

--------------------------------------------- ------ ---------- ----------

Total liabilities 1 (209,536) (200,637)

Net assets 166,545 163,738

--------------------------------------------- ------ ---------- ----------

Equity attributable to equity holders

of the parent

Share capital 4,268 4,268

Share premium 53,512 53,512

Other reserves (7,013) (6,571)

Retained earnings 115,778 112,529

---------------------------------------------- ------ ---------- ----------

Total equity 166,545 163,738

---------------------------------------------- ------ ---------- ----------

Statement of Changes in Equity

for the year ended 31 December 2011

Capital Cash

Share Share redemption Translation flow Treasury Retained Total

capital premium reserve reserve hedging reserve earnings equity

GBP000 GBP000 GBP000 GBP000 reserve GBP000 GBP000 GBP000

GBP000

Balance at

1 January 2010 4,268 53,512 88 5,297 (224) (13,057) 102,745 152,629

Profit for the

year attributable

to the equity

shareholders - - - - - - 17,879 17,879

Other comprehensive

income - - - 1,094 224 - 365 1,683

-------------------- --------- --------- ------------ ------------- --------- ---------- ---------- ----------

Total comprehensive

income for the

year - - - 1,094 224 - 18,244 19,562

-------------------- --------- --------- ------------ ------------- --------- ---------- ---------- ----------

Transactions

with equity

shareholders,

recorded directly

in equity

Share-based

payments - - - - - - 448 448

Share options

exercised by

employees - - - - - 7 - 7

Deferred tax

on share options - - - - - - 224 224

Dividends to

equity holders - - - - - - (9,132) (9,132)

-------------------- --------- --------- ------------ ------------- --------- ---------- ---------- ----------

Total contributions

by and

distributions

to equity

shareholders - - - - - 7 (8,460) (8,453)

-------------------- --------- --------- ------------ ------------- --------- ---------- ---------- ----------

Balance at

31 December 2010 4,268 53,512 88 6,391 - (13,050) 112,529 163,738

-------------------- --------- --------- ------------ ------------- --------- ---------- ---------- ----------

Balance at

1 January 2011 4,268 53,512 88 6,391 - (13,050) 112,529 163,738

Profit for the

year attributable

to the equity

shareholders - - - - - - 20,404 20,404

Other comprehensive

income - - - (234) - - (5,984) (6,218)

-------------------- --------- --------- ------------ ------------- --------- ---------- ---------- ----------

Total comprehensive

income for the

year - - - (234) - - 14,420 14,186

-------------------- --------- --------- ------------ ------------- --------- ---------- ---------- ----------

Transactions

with equity

shareholders,

recorded directly

in equity

Share-based

payments - - - - - - 871 871

Consideration

for purchase

of own shares - - - - - (1,575) - (1,575)

Share options

exercised by

employees - - - - - 1,367 (1,357) 10

Deferred tax

on share options - - - - - - (390) (390)

Dividends to

equity holders - - - - - - (10,295) (10,295)

-------------------- --------- --------- ------------ ------------- --------- ---------- ---------- ----------

Total contributions

by and

distributions

to equity

shareholders - - - - - (208) (11,171) (11,379)

-------------------- --------- --------- ------------ ------------- --------- ---------- ---------- ----------

Balance at

31 December 2011 4,268 53,512 88 6,157 - (13,258) 115,778 166,545

-------------------- --------- --------- ------------ ------------- --------- ---------- ---------- ----------

Cash Flow Statements

for the year ended 31 December 2011

Note 2011 2010

GBP000 GBP000

Cash flows from operating activities

Profit before tax for the year 27,588 25,006

Adjustments for:

Depreciation, amortisation and impairment 4,883 5,519

Net settlement loss/(gain) on enhanced transfer

value exercise 56 (176)

Finance income (4,520) (4,637)

Finance expense 4,984 5,697

Profit on sale of property, plant and equipment (86) (314)

Share-based payments 871 448

Operating cash flows before changes in working

capital and other payables 33,776 31,543

Change in inventories (8,700) (5,770)

Change in trade and other receivables (9,764) (1,405)

Change in trade and other payables 5,544 6,947

Cash generated from the operations 20,856 31,315

Interest paid (1,342) (1,344)

Tax paid (3,380) (7,506)

Additional contributions to defined benefit

plan (2,781) (2,706)

Enhanced transfer value exercise payments (3,302) (7,488)

Net cash flow from operating activities 10,051 12,271

--------------------------------------------------------- --------- --------

Cash flows from investing activities

Proceeds from sale of property, plant and

equipment 110 3,167

Interest received 751 834

Dividends received - -

Acquisition of property, plant and equipment (2,035) (6,995)

Net cash flow from investing activities (1,174) (2,994)

--------------------------------------------------------- --------- --------

Cash flows from financing activities

Proceeds from the issue of treasury shares 10 7

Payment to acquire own shares (1,575) -

Repayment of borrowings (228) (866)

Dividends paid (10,295) (9,132)

Net cash flow from financing activities (12,088) (9,991)

--------------------------------------------------------- --------- --------

Net decrease in cash and cash equivalents (3,211) (714)

Cash and cash equivalents at 1 January 44,758 44,979

Effect of exchange rate fluctuations on cash

held (53) 493

Cash and cash equivalents at 31 December 41,494 44,758

--------------------------------------------------------- --------- --------

Notes

1. Segment reporting

The group has 50 operating segments in the UK and 5 operating

segments in Continental Europe. Each segment represents an

individual trading operation, and each operation is wholly aligned

to the sales, marketing, supply and distribution of floorcovering

products. The operating results of each operation are regularly

reviewed by the Chief Operating Decision Maker, which is deemed to

be the Group Chief Executive. Discrete financial information is

available for each segment and used by the Group Chief Executive to

assess performance and decide on resource allocation.

The operating segments have been aggregated to the extent that

they have similar economic characteristics, with relevance to

products and services, type and class of customer, methods of sale

and distribution and the regulatory environment in which they

operate. The group's internal management structure and financial

reporting systems differentiate the operating segments on the basis

of the differing economic characteristics in the UK and Continental

Europe and accordingly present these as two separate reportable

segments. This distinction is embedded in the construction of

operating reports reviewed by the Group Chief Executive, the board

and the executive management team and forms the basis for the

presentation of operating segment information given below.

UK Continental Total

Europe

2011 2010 2011 2010 2011 2010

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

External revenues 466,968 432,815 102,827 102,875 569,795 535,690

-------------------- ---------- ---------- --------- --------- ---------- ----------

Reportable segment

operating profit 25,696 24,662 2,830 2,553 28,526 27,215

-------------------- ---------- ---------- --------- --------- ---------- ----------

Reportable segment

assets * 220,878 205,655 45,427 47,589 266,305 253,244

Reportable segment

liabilities (136,358) (129,365) (18,132) (20,111) (154,490) (149,476)

-------------------- ---------- ---------- --------- --------- ---------- ----------

During the year there are no inter-segment revenues for the

reportable segments (2010: GBPnil).

* Reportable segment assets have been restated for the year

ended 31 December 2010 to allocate relevant cash and cash

equivalents between the reportable segments.

Reconciliations of reportable segment profit, assets and

liabilities and other material items:

2011 2010

GBP000 GBP000

Profit for the year

Total profit for reportable

segments 28,526 27,215

Impairment of assets - (466)

Unallocated expense (474) (683)

----------------------------- -------- --------

Operating profit 28,052 26,066

Finance income 4,520 4,637

Finance expense (4,984) (5,697)

----------------------------- -------- --------

Profit before taxation 27,588 25,006

Taxation (7,184) (7,127)

----------------------------- -------- --------

Profit for the year 20,404 17,879

----------------------------- -------- --------

Notes (continued)

1. Segment reporting - continued

2011 2010

GBP000 GBP000

Assets

Total assets for reportable

segments 266,305 253,244

Unallocated assets:

Properties, plant and

equipment 84,531 86,504

Deferred tax assets 962 896

Assets held for sale 362 362

Cash and cash equivalents 23,921 23,369

Total assets 376,081 364,375

-------------------------------- -------- ------------- --- ------------ ----------- --------------

Liabilities

Total liabilities for reportable

segments (154,490) (149,476)

Unallocated liabilities:

Employee benefits (14,458) (12,724)

Other interest-bearing loans and borrowings (33,910) (34,236)

Income tax payable (6,678) (4,201)

Total liabilities (209,536) (200,637)

-------------------------------- -------- ------------- --- ------------ ----------- --------------

Reportable

Continental segment Consolidated

UK Europe total Unallocated total

GBP000 GBP000 GBP000 GBP000 GBP000

Other material items

2011

Capital expenditure 1,358 593 1,951 84 2,035

Depreciation 2,240 798 3,038 1,845 4,883

Other material items

2010

Capital expenditure 784 553 1,337 5,658 6,995

Depreciation 2,503 747 3,250 1,803 5,053

Impairment of assets - - - 466 466

-------------------------------- -------- ------------- ------------- --------------- --------------

In the UK the group's freehold properties are held within

Headlam Group plc and a rent is charged to the operating segments

for the period of use. Therefore the operating reports reviewed by

the Group Chief Executive show all the UK properties as unallocated

and the operating segments report a segment result that includes a

property rent. This is reflected in the above disclosure.

Each segment is a continuing operation.

The Group Chief Executive, the board and the senior executive

management team have access to information that provides details on

revenue by principal product group for the two reportable segments,

as set out in the following table:

Revenue by principal product group and geographic origin is

summarised below:

UK Continental Total

Europe

2011 2010 2011 2010 2011 2010

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

Residential 320,290 297,606 50,047 51,992 370,337 349,598

Commercial 146,678 135,209 52,780 50,883 199,458 186,092

------------- -------- -------- -------- -------- -------- --------

466,968 432,815 102,827 102,875 569,795 535,690

------------- -------- -------- -------- -------- -------- --------

Notes (continued)

2. Earnings per share

The calculation of the basic and diluted earnings per share is

based on the following data:

2011 2010

GBP000 GBP000

Earnings

Earnings for the purposes of basic earnings per

share being profit attributable to equity holders

of the parent 20,404 17,879

---------------------------------------------------- ------------ ------------

2011 2010

Number of shares

Issued ordinary shares at 1 January 85,363,743 85,363,743

Effect of shares held in treasury (2,423,159) (2,246,489)

Weighted average number of ordinary shares for

the purposes of basic earnings per share 82,940,584 83,117,254

---------------------------------------------------- ------------ ------------

Effect of diluted potential ordinary shares:

Weighted average number of ordinary shares at

31 December 82,940,584 83,117,254

Dilutive effect of share options 596,479 113,570

Weighted average number of ordinary shares for

the purposes of diluted earnings per share 83,537,063 83,230,824

---------------------------------------------------- ------------ ------------

At 31 December 2011, the company held 2,841,197 shares in

treasury and these are excluded from the calculation of earnings

per share.

3. Dividends

2011 2010

GBP000 GBP000

Interim dividend for 2010 of 3.83p paid 4 January 3,180 -

2011

Final dividend for 2010 of 8.57p paid 1 July 2011 7,115 -

Interim dividend for 2009 of 3.70p paid 2 January

2010 - 3,072

Final dividend for 2009 of 7.30p paid 1 July 2010 - 6,060

10,295 9,132

--------------------------------------------------- -------- --------

The final proposed dividend of 9.85p per share (2010:8.57p per

share) will not be provided for until authorised by shareholders at

the forthcoming AGM.

Interim dividends of 4.30p per share (2010: 3.83p per share) are

provided for when the dividend is paid.

The total value of dividends proposed but not recognised at 31

December 2011 is GBP11,663,000 (2010: GBP10,294,000).

Notes (continued)

4. Additional information

The financial information set out above does not constitute the

company's statutory accounts for the years ended

31 December 2011 or 2010 but is derived from those accounts.

Statutory accounts for 2010 have been delivered to the registrar of

companies, and those for 2011 will be delivered in due course. The

auditors have reported on those accounts; their reports were (i)

unqualified, (ii) did not include a reference to any matters to

which the auditors drew attention by way of emphasis without

qualifying their report and (iii) did not contain a statement under

section 498 (2) or (3) of the Companies Act 2006.

We anticipate that the company's statutory accounts will be

posted to shareholders during April 2012 and will be displayed on

the company's website at www.headlam.com during March 2012. Copies

of the statutory accounts will also be available from the company's

registered office at Headlam Group plc, PO Box 1, Gorsey Lane,

Coleshill, Birmingham, B46 1LW.

This preliminary announcement of results for the year ended 31

December 2011 was approved by the board on 9 March 2012.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR JPMRTMBMMBFT

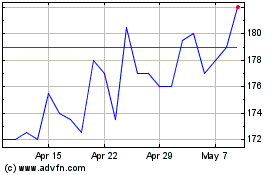

Headlam (LSE:HEAD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Headlam (LSE:HEAD)

Historical Stock Chart

From Apr 2023 to Apr 2024