TIDMHAT

RNS Number : 9091Y

H&T Group PLC

08 March 2012

H&T Group

Preliminary results

For the year ended 31 December 2011

H&T Group ("H&T" or the "Group"), is pleased to announce

its preliminary results for the year ended 31 December 2011.

John Nichols, chief executive of H&T Group, commented:

"I am pleased to report another strong performance, delivering

growth in both earnings and dividend per share.

The Group's pawnbroking operations have performed strongly with

pledge book growth of 18.0% year on year. Gold purchasing also

continues to be a strong source of profitability and cash flow in

supporting the Group's continued store expansion programme.

At a time when the availability of standard forms of credit are

diminishing, the Group continues to expand its presence, offering

immediate access to cash and credit from convenient high street

locations. The Group opened 25 stores in 2011 taking its total

outlets to over 200. With our strong balance sheet, we expect a

similar level of store openings during 2012.

A final dividend of 7.00 pence is proposed, taking the full year

dividend to 10.75 pence - a 13.2% increase on prior year."

Financial highlights

GBPm unless stated 2011 2010 Change

%

Gross profit 65.4 66.8 * 2.1

Adjusted gross profit* 65.4 61.9 +5.8

Profit before tax 23.5 25.5 * 7.8

Adjusted profit before tax* 23.5 20.6 +13.9

Basic EPS 51.12p 48.77p +4.8

Proposed full year dividend 10.75p 9.50p +13.2

Gross pledge book 46.6 39.5 +18.0

* Adjusted to remove the one-off GBP4.9m gross profit

contribution delivered in 2010 as discussed in the Chief

Executive's Review

Operational and other highlights

0 The Group's total number of outlets now exceeds 200. An

additional 25 new stores were opened during the year, taking the

national store footprint to 160 stores at 31 December 2011 (2010:

135). In addition the Group operated 54 GoldBar retail mall units

at 31 December 2011 (2010: 45).

0 New store openings in 2010 and 2011 have performed, on

average, ahead of the Board's expectations.

0 The pawnbroking business experienced record levels of lending

in 2011, driven by an increased average loan and additional new

stores.

Preliminary results

For the year ended 31 December 2011

Enquiries:

H&T Group plc Tel: 0870 9022 600

John Nichols, Chief Executive

Alex Maby, Finance Director

Hawkpoint Partners Limited (Nominated Tel: 020 7665 4500

adviser)

Lawrence Guthrie / Sunil Duggal

Numis Securities (Broker) Tel: 020 7260 1000

Mark Lander

Pelham Bell Pottinger (Public Tel: 020 7861 3932

relations)

Polly Fergusson / Damian Beeley

Chairman's Statement

I am pleased to report that the Group has continued to grow and

improve its performance in the core business lines. Continuing our

successful expansion strategy, 25 stores were opened during 2011

taking the Group's total number of outlets, including the Group's

GoldBar operation, to over 200. The performance of these new stores

continues to exceed expectations and with ongoing growth from the

remainder of the estate, the Group's year end pledge book stands in

excess of GBP46m.

Economic & Market Background

Studies have shown that over the last three years the UK's high

street banks have cut their unsecured lending by twenty per cent,

with the number of credit card and other loan providers also

falling by a similar amount. It is estimated that 8 - 10 million

people in the UK now have no access to traditional credit sources.

This environment, together with raised awareness of our services,

has created an increased opportunity for high street pawnbrokers to

expand both their secured and unsecured lending.

The majority of our customers seek small, short-term loans to

fund day to day living expenses. H&T's offering of immediate

access to cash from convenient high street locations is becoming an

increasingly attractive proposition both to the growing un-banked

market and other customers we serve.

There has been considerable growth in the alternative credit

market, reflected in the changing make-up of the high street. All

the leading operators are responding by continuing to increase

their store footprints. H&T continues to meet this demand with

its store expansion strategy and by developing its suite of lending

products. As at 31 December 2011, the Group had 160 stores and 54

GoldBar retail mall units.

The wider economic environment with continuing uncertainty and

the threat of sovereign defaults has given rise to a 23.7% increase

in the price of gold during 2011.

Strategy

The Board and its management believe in the strength of the

combination of our core business streams. These are pawnbroking,

retail sales of quality jewellery, wholesale sales of surplus

jewellery and gold. The provision of jewellery for the retail shop

window, now supplemented by quality watches, is a crucial component

of this mix attracting customers, generating good margins and

informing them of the collateral we seek for pawnbroking. The core

business streams, supplemented with gold purchase at a retail

level, and small ticket unsecured lending provide a resilient

business model. The nature and mix of these activities provides the

group with some structural hedging against changing market

conditions. The group seeks through developing this mix of business

activity to achieve a resilient business model through the economic

cycle. The board continues to believe that long term growth in

shareholder value is best achieved through considered store

expansion and improving all these business lines.

Financial Performance

The Group delivered GBP23.5m of profit before tax in 2011. This

compares to GBP25.5m in 2010 when trading and results benefited

from the inclusion of GBP4.9m of benefits delivered via a one-off

gross profit contribution from delayed auctions and reduced

inventory hold periods. Excluding the 2010 working capital

component, underlying profit before tax and movement in swap value

increased by 8.4% year on year, after absorbing the costs

associated with the store expansion programme.

The Group pledge book ended the year at GBP46.6m giving rise to

a 15.3% year on year increase in the Pawn Service Charge, with a

strong contribution from the Group's recent greenfield additions.

Gold purchasing volumes have been sustained at higher than expected

levels, and the rising gold price environment has enabled better

than expected margins in both our gold purchasing and pawnbroking

scrap operations.

The Group's financial position remains strong with net debt of

GBP29.3m as at 31 December 2011 (31 Dec 10: GBP27.0m). The Group

has adequate liquidity to fund both the capital expenditure and

working capital requirements of its continuing new store opening

programme, as it currently has available a GBP50.0m revolving

facility.

Basic earnings per share are 51.12 pence (2010: 48.77 pence,

38.76 pence pre working capital gains.)

Final Dividend

Subject to shareholder approval, a final gross dividend of 7.00

pence per ordinary share (2010: 6.00 pence) will be paid on 7 June

2012 to shareholders on the register at the close of business on 11

May 2012. The shares will be marked ex-dividend on 9 May 2012. This

will bring the full year dividend to 10.75 pence per ordinary

share. This represents an increase of 13.2% over the 2010 total

dividend of 9.50 pence.

The growth in dividend reflects the Group's strong balance sheet

position at the year-end and current earnings cover available.

Prospects

Over the last four years the Group has invested over GBP18m of

working capital into its pledge book, spent over GBP10m in almost

doubling the store estate and has doubled its annual dividend.

During the same period net debt has decreased.

With gold purchasing customers remaining steady, the Board is

optimistic that the store expansion programme can continue to be

funded via the Group's own cash flow generation during 2012.

We believe that the UK pawnbroking market remains underserved

and that further opportunities exist to fill the lending gap left

by the high street banks. The Group's new store pipeline remains

strong and already this year the Group has either opened or secured

leases on a further 18 new sites. The Board expect to open circa 25

stores in total in 2012.

The Group's recent greenfield additions continue to meet our

expectations for the future. Over one third of our estate is under

three years old thus providing significant latent growth potential

as they currently only account for 12% of the Group's pledge book

and 7% of the total Pawn Service Charge.

On the basis of the current gold price and gold purchasing

levels, the board is continuing to pursue the new store expansion

programme. The Management team have the proven ability to adapt our

approach to a developing and changing market to achieve the best

outcome for shareholders. We are therefore confident in our views

for the Group's prospects in 2012.

Key to achieving these aims I must also emphasise the importance

of the loyalty of our customers and the way this is achieved is

through the hard work of our staff; whom I thank on behalf of the

Board and shareholders for delivering these excellent results.

Peter D McNamara

Chairman

Chief Executive's Review

INTRODUCTION

With our estate increasing by 25 stores during 2011 and the

pledge book growing to over GBP46m, the Group continues to make

excellent progress both operationally and financially. The Group

has experienced another record year for lending within its

pawnbroking operations and the industry as a whole has benefited

from considerable press coverage during the last twelve months.

Raised public awareness of the simplicity and availability of our

product offerings, a continued focus on delivering excellent

customer service and improved brand recognition have all supported

our organic business growth during 2011.

The Group delivered total gross profits of GBP65.4m in 2011.

This compares to GBP66.8m a year earlier when trading and results

benefited with a GBP4.9m contribution from 'one-off' factors as

noted below and as disclosed in our 2010 annual report. Excluding

this one-off contribution, gross profit has grown by 5.8% year on

year, with profit before tax and swap fair value movement

increasing by 8.4%.

The result is particularly pleasing as it has been driven by

double digit growth in the Group's core pawnbroking operations.

Achieving year on year growth was always set to be a challenge when

the Group had seized first mover advantage in the gold purchasing

market in H1 2010 and when considering the associated costs of the

estate expansion programme. The result is a credit to the continued

hard work and dedication of our staff. The rising gold price

environment has also benefited profits due to the lag on

disposition. The average gold price in 2011 of GBP982 per troy

ounce represented a 23.7% increase on the 2010 average of

GBP794.

The Group's financial position remains strong with net debt of

GBP29.3m as at 31 December 2011 (2010: GBP27.0m). This has enabled

the Group to continue its rollout strategy during 2011 with the

addition of a further 25 new stores, taking the total estate to

over 200 outlets. This comprises 160 stores and 54 GoldBar units.

Over the last 5 years the Group has opened 83 new stores and

H&T's senior management team has gained valuable experience and

data to help identify further market opportunities. As a result,

and together with improved site availability, the Group has a good

pipeline of potential stores into 2012 having already opened or

agreed provisional lease terms on a further 18 stores.

REVIEW OF OPERATIONS

Pawnbroking

The Pawn Service Charge continues to be the Group's largest

income stream contributing GBP26.7m of gross profits (2010: 23.2m).

Another year of record lending has seen the Group's year-end pledge

book rise by 18.0% to GBP46.6m. This is a pleasing result given the

current competitive alternative credit market and the continued

availability of gold purchasing as a choice for the consumer.

Lending has been driven by a year on year increase in customer

numbers and a 13% increase in the average loan size ensuring that

the Group remains competitive on the high street. The Group

constantly monitors its lending policy with consideration of the

impact on affordability (and therefore redemption rate) and its

loan to value in relation to the current gold price. The Board is

comfortable that the Group continues to maintain adequate headroom

between lending rates and the current gold price, with the average

loan to value during 2011 being only 56%.

Retail Jewellery Sales

Jewellery retail in 2011 has been challenging due to the

increase in the underlying gold commodity price impacting on

customer affordability. The Group has performed relatively well

however, with total retail sales increasing to GBP20.0m (2010:

GBP19.6m). Our ability to continue offering good value products has

meant that the Group is now the high street's largest retailer of

second-hand jewellery.

Like-for-like sales were down 9.4% year on year, but the Group

has delivered a gross margin improvement from 45% to 49% therefore

recovering much of the sales shortfall. The Group continues to

focus on retail as an important revenue stream as it can act as a

valuable means of disposition in the event of a falling gold

price.

Pawnbroking Scrap

The Group has a natural hedge to offset any potential fall in

jewellery sales as its alternative disposition method is to scrap

the gold at the then current gold price.

Scrap profits from the disposition of forfeited items from the

Group's pledge book contributed GBP6.3m in 2011. This compares to

the 2010 gross profit realised from scrap of GBP9.0m, which was

boosted by the inclusion of GBP2.1m of profits realised from

delayed 2009 auctions.

Gold Purchasing

The Group has seen gold purchasing as a steady source of cash

flow and profitability albeit at lower levels than the exceptional

period enjoyed in the first half of 2010 when the Group was

benefiting from being one of the first companies to take advantage

of the development in the gold purchasing market.

Gross profits in the year totalled GBP17.2m (2010: GBP20.1m).

Within the 2010 result is a working capital gain of GBP2.8m

delivered via shortening the time to process and dispose of

purchased gold. Gold purchasing profits continue to be boosted by

the rising price of gold. The higher absolute price benefits scrap

proceeds but also a rising price environment helps to achieve

higher than expected margins due to the time lag between purchase

and disposition. The average daily gold price in 2011 was GBP982

per troy ounce, up 23.7% year on year.

Gold purchasing trends over the last 12 months have remained

steady with customer numbers being broadly constant. The Group

continues to remain competitive both on pricing and with its

longevity in this market helping to build brand recognition and

trust among our customers. H&T's GoldBar retail mall units

remain a profitable and flexible business with 54 units in

operation at the year end (2010: 45).

Cheque Cashing

Revenues net of bad debt and provisions from the Group's Third

Party Cheque Cashing and Payday Advance products decreased to

GBP4.9m (2010: GBP5.1m) and now contribute 7.5% of gross profit

(2010: 7.7%).

Payday Advance revenues have been impacted by the gradual

withdrawal of the cheque guarantee card. Allowing the Group to

continue offering this product to the widest possible audience, we

have developed, in conjunction with a third party, our own credit

scoring and underwriting criteria. This has enabled customers to

use the product when only presenting a debit card - there is no

need for either a cheque book or cheque guarantee card. I am

encouraged to note that the Group's overall net debt percentage has

not increased year on year.

We have also taken the opportunity to launch the Payday advance

product online to take advantage of the rapidly increasing

awareness of this product. We have applied the same high standards

operated in store to the online offering which addresses the

criticisms often levelled at online Payday loan operators. In

addition to leading lending practices we have also set the standard

on pricing with interest rates less than half the industry leader.

We aim to establish this product during the course of 2012.

Gross commission earned from third party cheque cashing was

broadly stable year on year, in contrast to declines experienced in

previous years in this product. The Group is also pleased to note

the decision taken by the Payments Council in 2011 in having

decided to withdraw its target end date to the close the

centralised cheque clearing system in the UK.

KwikLoan

The Group's KwikLoan revenues have benefited from some customers

without a cheque guarantee card switching from the Payday advance

product to our longer term unsecured KwikLoan product. The loan

book increased to GBP1.1m at the year-end (2010: GBP1.0m).

REGULATION

2011 saw the implementation of the European Credit Directive in

the UK. This imposed certain requirements on lenders in respect of

pre-contractual information, early settlement and the right of

withdrawal. More recently the Department for Business, Innovation

& Skills (BIS) has commissioned research into the potential

impact of interest rate caps on credit agreements. H&T Group is

fully engaged in this process, as are the relevant trade

associations. At this stage we do not anticipate a change in the

law given that the OFT, the industry's official regulator,

published the High Cost Credit Review findings only last year

stating that they did not believe a cap was necessary.

BUSINESS STRATEGY AND OUTLOOK

The Group seeks to retain its position as the UK's leading

pawnbroker by providing easy access to cash and other related

services in a fair, safe and friendly environment that exceeds the

expectations of our customers. The Group aims to maintain its high

levels of repeat custom with a continued focus on brand

recognition, excellent customer service, investment in the existing

store estate and maintaining its reputation for fairness and

honesty. In addition, a focus on marketing and our continued store

expansion strategy will drive new customers. Of the 160 stores open

at the year end, 34% have been opened within the last three years

either via acquisition or greenfield rollout.

The Group also continues to demonstrate its innovation skills,

with the introduction of new products and services. In 2011, the

Group has launched an on-line Payday advance service, charging a

considerably lower interest rate than any of the leading players in

this market.

Review of the Pawnbroking Market

The UK landscape of pawnbrokers, buy-back operators, and general

cheque cashing / Payday advance firms has changed substantially

over the last five years. Each of the market leaders in their

respective category has expanded rapidly during this period,

fuelled in the main by gold purchasing and the expansion in Payday

lending.

Internal research suggests that over this five year period the

number of traditional pawnbroking outlets has increased from 200 to

500, albeit that this growth is driven almost entirely by existing

operators - H&T for example, has contributed 71 greenfield

stores alone. The other high street alternative credit providers

where pawnbroking is currently more of an ancillary service have

also expanded rapidly; our research suggests from 350 to 1,100

outlets over the same period.

We continue to believe that the pawnbroking market remains

underserved. Only a fraction of the population has ever visited a

pawnbroker, whereas the performance and pledge book build of recent

store openings in new localities support the Board's view that the

potential market is far greater. One obstacle to greater growth has

been general awareness as well as people's perception of

pawnbroking. With recent positive press coverage of our industry,

the expansion in number of outlets and greater advertising from the

leading players, awareness is increasing. In addition, the open and

modern layout of our stores and the excellent customer experience

when visiting our stores continues to improve the wider public

perception of pawnbroking.

Current Trading and Outlook

The Group holds strong organic growth prospects as it is already

incurring the full operational costs for the 55 stores (34% of the

Group estate) opened in the last three years, whereas these same

stores contributed just 13% of Group gross profits during the year.

As these stores age over the medium term, our experience shows that

the pledge book continues to grow thus driving future

profitability. The Board closely monitors new store performance and

on average the recent new store openings are ahead of the

investment model. This investment model is founded upon the store

attaining a certain level of pledge balance and does not account

for gold purchasing profits at current levels beyond the first

year.

Future growth is also likely to be driven by further expansion

of the Group's geographical footprint, either via development of

greenfield sites or acquisitions. Given the financial position of

the Group, with net debt to EBITDA of under 1 times, and current

market conditions, the Board expect to open a further 25 new stores

in the current financial year. As at 1 March 2012, the Group had

already opened or agreed provisional lease terms on 18 sites.

I would also like to thank all our people whose skills,

commitment and enthusiasm continue to drive our success, and give

us confidence in the future. These efforts have also been

externally recognised by the National Pawnbroker's Association with

the Group having won both an Employer of the Year Award and Store

of the Year Award in the last 18 months. I am also proud to

announce that the Group has recently been accredited with the

Investor's In People Silver Award, demonstrating our commitment to

further developing and supporting our staff in achieving their full

potential.

John G Nichols

Chief Executive

Finance Director's Review

The realisation of GBP4.9m of working capital gains in H1 2010

together with the peak in gold purchasing volumes has provided

tough prior year comparables for our 2011 results. At a headline

level, gross profits fell by 2.0% year on year, but this is not

reflective of current trends. Excluding the one-off working capital

gains of GBP4.9m made in 2010, underlying gross profits have risen

5.8% year on year. Comparing H2 2010 with H2 2011, thus removing

the impact of both the one-off gains and the period of peak gold

purchasing volumes, reveals a growth rate of 18.4%. Key drivers

have been the 18.0% increase in the Group's pledge book, the rising

gold price and an increase in store numbers.

The year end balance sheet position remains healthy both in

terms of gearing and credit headroom. The Group currently has a

GBP50.0m credit facility of which GBP34.0m (2010: GBP31.0m) was

drawn at the year end, leaving GBP16.0m of available funding for

future store expansion. Current gearing, defined as debt as a

proportion of debt plus equity, is 31% (2010: 33%) and the Group's

net debt to EBITDA ratio stands at 1.1x (2010: 0.9x). Net debt in

the year increased to GBP29.3m from GBP27.0m, due to continued

working capital investment into the Group's pledge book. This

resulted in EBITDA of GBP27.4m converting to cash generated from

operations of GBP14.0m. This cash flow and movement in net debt

funded GBP6.7m of tax, GBP1.7m in interest, GBP4.9m of capital

expenditure and GBP3.5m of dividends.

Another highlight is the proposed final dividend of 7.00p, which

takes the full year dividend to 10.75p - a 13.2% increase year on

year. It also maintains our track record of dividend growth in

every year since the Group's flotation in 2006, despite the capital

expenditure required to fund the Group's store expansion programme

and the dilutive earnings profile of a new store in its early

stages. Earnings per share covers the dividend by 4.8x.

Other key areas of note include:

Other direct and administrative expenses

Other direct and administrative expenses rose from GBP38.1m in

2010 to GBP40.8m in 2011. The increase was driven by the full year

effect of stores opened in 2010 and the 25 new stores opened in

2011.

Finance costs

Interest on bank loans fell during 2011 to GBP1.7m (2010:

GBP2.6m), as improvement in the Group's financial covenant headroom

triggered a lower margin payable above LIBOR on the loan

balance.

H&T's interest cover ratio (EBITDA to interest) was 16.1x

(2010: 15.1x).

Earnings per share

A low taxation charge, principally due to a prior year

adjustment on deferred tax as disclosed in note 4, resulted in an

effective tax rate of 22.7% for 2011. As a result, while PBT fell

year on year, basic earnings per share increased to 51.12 pence

(2010: 48.77 pence). Diluted earnings per share for 2011 was 48.39

pence compared with 47.52 pence in 2010.

Capital Expenditure

Capital expenditure during the year on property, plant and

equipment was GBP4.9 million (2010: GBP3.7 million) of which the

majority related to the 25 new stores opened during the year.

Return on Capital Employed (ROCE)

ROCE, defined as profit before tax, interest receivable, finance

costs and movement in fair value of interest rate swap as a

proportion of net current assets and tangible and intangible fixed

assets (excluding goodwill), decreased from 37.7% in 2010 to 26.2%

in 2011. This decrease partly reflects the one-off working capital

contribution of GBP4.9m delivered in 2010, the early year dilutive

effect of new store openings and the GBP15.6m increase in net

current assets.

Alex Maby

Finance Director

Consolidated statement of comprehensive income

Year ended 31 December 2011

2011 2010

Note GBP'000 GBP'000

Revenue 2 125,516 126,397

Cost of sales (60,082) (59,637)

Gross profit 2 65,434 66,760

Other direct expenses (30,944) (29,790)

Administrative expenses (9,870) (8,329)

Operating profit 24,620 28,641

Investment revenues 1 1

Finance costs 3 (1,708) (2,606)

Movement in fair value of interest

rate swaps 553 (533)

Profit before taxation 23,466 25,503

Tax charge on profit 4 (5,332) (8,316)

Profit for the financial year and total

comprehensive income 18,134 17,187

2011 2010

Pence Pence

Earnings per share

From continuing operations

Basic 5 51.12 48.77

Diluted 5 48.39 47.52

All results derive from continuing operations.

Consolidated statement of changes in equity

Year ended 31 December 2011

Employee

Benefit

Trust

Share premium shares Retained

Share capital account reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2010 1,770 24,082 (13) 21,216 47,055

Profit for the financial

year - - - 17,187 17,187

Total income for the financial

year - - - 17,187 17,187

Issue of share capital 12 474 - - 486

Share option credit taken

directly to equity - - - 149 149

Deferred tax on share options

taken

directly to equity - - - 31 31

Dividends paid - - - (3,227) (3,227)

At 1 January 2011 1,782 24,556 (13) 35,356 61,681

Profit for the financial

year - - - 18,134 18,134

Total income for the financial

year - - - 18,134 18,134

Issue of share capital 23 405 - - 428

Share option credit taken

directly to equity - - - 316 316

Deferred tax on share options

taken

directly to equity - - - 204 204

Dividends paid - - - (3,468) (3,468)

Employee benefit trust

shares - - (12) - (12)

At 31 December 2011 1,805 24,961 (25) 50,542 77,283

Consolidated balance sheet

At 31 December 2011

31 December 31 December

2011 2010

GBP'000 GBP'000

Non-current assets

Goodwill 16,873 16,825

Other intangible assets 847 978

Property, plant and equipment 13,070 10,751

Deferred tax assets 1,137 281

31,927 28,835

Current assets

Inventories 29,439 24,100

Trade and other receivables 58,539 50,159

Cash and cash equivalents 4,695 4,029

92,673 78,288

Total assets 124,600 107,123

Current liabilities

Trade and other payables (8,714) (8,623)

Current tax liabilities (3,631) (4,361)

Derivative financial instruments (418) (972)

(12,763) (13,956)

Net current assets 79,910 64,332

--------------------------------- ----------- ------------

Non-current liabilities

Borrowings (34,000) (31,000)

Provisions (554) (486)

(34,554) (31,486)

Total liabilities (47,317) (45,442)

Net assets 77,283 61,681

Equity

Share capital 1,805 1,782

Share premium account 24,961 24,556

Employee Benefit Trust shares

reserve (25) (13)

Retained earnings 50,542 35,356

Total equity 77,283 61,681

Consolidated cash flow statement

Year ended 31 December 2011

2011 2010

Note GBP'000 GBP'000

Net cash generated from operating activities 6 5,574 22,416

Investing activities

Interest received 1 1

Purchases of property, plant and equipment (4,502) (3,970)

Purchases of intangible assets (2) (115)

Acquisition of trade and assets of

businesses (353) (283)

Net cash used in investing activities (4,856) (4,367)

Financing activities

Dividends paid (3,468) (3,227)

Net increase / (decrease) of borrowings 3,000 (13,500)

Proceeds on issue of shares 428 486

Loan to the Employee Benefit Trust

for acquisition of own shares (12) -

Net cash absorbed by financing activities (52) (16,241)

Net increase in cash and cash equivalents 666 1,808

Cash and cash equivalents at beginning

of the year 4,029 2,221

Cash and cash equivalents at end of

the year 4,695 4,029

Notes to the preliminary announcement

Year ended 31 December 2011

1. Finance information and basis of preparation

The financial information has been abridged from the audited

financial statements for the year ended 31 December 2011.

The financial information set out above does not constitute the

company's statutory accounts for the years ended 31 December 2011

or 2010, but is derived from those accounts. Statutory accounts for

2010 have been delivered to the Registrar of Companies and those

for 2011 will be delivered following the company's annual general

meeting. The auditors have reported on those accounts: their

reports were unqualified, did not draw attention to any matters by

way of emphasis and did not contain statements under s498 (2) or

(3) Companies Act 2006 or equivalent preceding legislation.

Whilst the financial information included in this preliminary

announcement has been prepared in accordance with International

Financial Reporting Standards ('IFRS'), this announcement does not

itself contain sufficient information to comply with IFRS. The

Group will be publishing full financial statements that comply with

IFRS in April.

2. Business and geographical statements

Business segments

For reporting purposes, the Group is currently organised into

six segments - Pawnbroking, Gold purchasing, Retail, Pawnbroking

scrap, Cheque cashing and Other financial services. The principal

activities by segment are as follows:

Pawnbroking:

Pawnbroking is a loan secured against a collateral (the pledge).

In the case of the Group over 99% of the collateral against which

amounts are lent comprises precious metals (predominantly gold),

diamonds and watches. The pawnbroking contract is a six month

credit agreement bearing a monthly average interest rate of between

4% and 8%. The contract is governed by the terms of the Consumer

Credit Act 2008 (previously the Consumer Credit Act 2002). If the

customer does not redeem the goods by repaying the secured loan

before the end of the contract, the Group is required to dispose of

the goods either through public auctions if the value of the pledge

is over GBP75 (disposal proceeds being reported in this segment)

or, if the value of the pledge is GBP75 or under, through public

auctions or the Retail or Scrap activities of the Group.

Gold Purchasing:

Gold is bought direct from customers through all of the Group's

stores and more recently through 54 Gold Bar units located in

shopping centres throughout England and Wales. The transaction is

straight forward with the store or unit agreeing a price with the

customer and purchasing the goods for cash on the spot. Gold

Purchasing revenues comprise proceeds from scrap sales on goods

sourced from the Group's purchasing operations.

Retail Jewellery Sales:

The Group's retail proposition is primarily gold and jewellery

and the majority of the retail sales are forfeited items from the

pawnbroking pledge book or purchased second-hand jewellery. The

retail offering is complemented with a small amount of new

jewellery purchased from third parties by the Group.

Notes to the preliminary announcement

Year ended 31 December 2011

2. Business and geographical statements (continued)

Pawnbroking scrap:

Pawnbroking Scrap comprises all other proceeds from gold scrap

sales other than those reported within Gold Purchasing. Items that

are damaged beyond repair, are slow moving or surplus may be

smelted and sold at the current gold spot price.

Cheque cashing:

This segment comprises two products:

-- Third Party Cheque Encashment which is the provision of cash

in exchange for a cheque payable to our customer for a commission

fee based on the face value of the cheque.

-- Pay Day Advance is a short term cash loan repayable within 30

days, offered both in stores and on-line. Customers can secure a

loan of up to GBP650 either by writing a cheque to the value of the

loan plus a 13% charge, or by giving their debit card details and

agreeing a date for repayment of loan and associated interest.

Both products are subject to bad debt risk which is reflected in

the commissions and fees applied.

Other financial services:

This segment comprises:

-- KwikLoan product which is an unsecured loan repayable over 12

months of up to GBP750. The Group earns approximately GBP300 gross

interest on a GBP500 loan over 12 months.

-- The Prepaid debit card product where the Group earns a

commission when selling the card or when the customer is topping up

their card.

-- The foreign exchange currency (Euro and US Dollar) service

where the Group earns a commission

when selling or buying foreign currencies. This service is

currently offered in a limited number of

stores only.

Only the KwikLoan product is subject to bad debt risk which is

reflected in the interest rate offered.

Further details on each activity are included in the Chief

Executive's Review.

Notes to the preliminary announcement

Year ended 31 December 2011

2. Business and geographical segments (continued)

Segment information about these businesses is presented

below:

Other Consolidated

Pawn- Gold Pawn-broking Cheque Financial Year

broking Purchasing Retail Scrap cashing services ended

2011 2011 2011 2011 2011 2011 2011

2011 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue

External sales 26,727 54,563 19,953 18,835 4,907 531 125,516

Total revenue 26,727 54,563 19,953 18,835 4,907 531 125,516

Segment result - gross

profit 26,727 17,151 9,815 6,303 4,907 531 65,434

Other Consolidated

Pawn- Gold Pawn-broking Cheque Financial Year

broking Purchasing Retail Scrap cashing services ended

2010 2010 2010 2010 2010 2010 2010

2010 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue

External sales 23,181 55,712 19,558 22,301 5,120 525 126,397

Total revenue 23,181 55,712 19,558 22,301 5,120 525 126,397

Segment result - gross

profit 23,181 20,107 8,785 9,042 5,120 525 66,760

Gross profit is stated after charging bad debt expenses and the

direct costs of stock items sold or scrapped in the period. Other

operating expenses of the stores are included in other direct

expenses. The Group is unable to meaningfully allocate the other

direct expenses of operating the stores between segments as the

activities are conducted from the same stores, utilising the same

assets and staff. The Group is also unable to meaningfully allocate

Group administrative expenses, or financing costs or income between

the segments. Accordingly, the Group is unable to meaningfully

disclose an allocation of items included in the income statement

below Gross profit, which represents the reported segment

results.

The Group does not apply any inter-segment charges when items

are transferred between the pawnbroking activity and the retail or

scrap activities.

Notes to the preliminary announcement

Year ended 31 December 2011

2. Business and geographical segments (continued)

Other Unallocated

Pawn-broking Gold Pawn-broking Cheque Financial assets/

2011 Purchasing Retail Scrap cashing services (liabilities) Consolidated

GBP'000 2011 2011 2011 2011 2011 2011 2011

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Other information

Capital

additions (*) - - - - - - 5,124 5,124

Depreciation

and

amortisation

(*) - - - - - - 2,770 2,770

Balance sheet

Assets

Segment assets 52,865 2,506 26,306 627 2,280 1,026 85,610

Unallocated

corporate

assets 38,990 38,990

Consolidated

total

assets 124,600

Liabilities

Segment

liabilities - - (595) - (23) (22) (640)

Unallocated

corporate

liabilities (46,677) (46,677)

Consolidated

total

liabilities (47,317)

Other Unallocated

Pawn-broking Gold Pawn-broking Cheque Financial assets/

2010 Purchasing Retail Scrap cashing services (liabilities) Consolidated

GBP'000 2010 2010 2010 2010 2010 2010 2010

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Other information

Capital

additions (*) - - - - - - 3,889 3,889

Depreciation

and

amortisation

(*) - - - - - - 2,594 2,594

Balance sheet

Assets

Segment assets 45,025 2,769 21,024 308 2,465 979 72,570

Unallocated

corporate

assets 34,553 34,553

Consolidated

total

assets 107,123

Liabilities

Segment

liabilities - - (522) - (41) (24) (587)

Unallocated

corporate

liabilities (44,855) (44,855)

Consolidated

total

liabilities (45,442)

(*) The Group cannot meaningfully allocate this information by

segment due to the fact that all the segments operate from the same

stores and the assets in use are common to all segments.

Notes to the preliminary announcement

Year ended 31 December 2011

2. Business and geographical segments (continued)

Geographical segments

The Group's operations are located entirely in the United

Kingdom and all sales are within the United Kingdom. Accordingly,

no further geographical segments analysis is presented.

3. Finance costs

2011 2010

GBP'000 GBP'000

Interest on bank loans 1,705 2,069

Other interest 3 -

Total interest expense 1,708 2,069

Write off of loan issue

costs - 537

1,708 2,606

Notes to the preliminary announcement

Year ended 31 December 2011

4. Tax charge on profit

a) Tax on profit on ordinary activities

2011 2010

Current tax GBP'000 GBP'000

United Kingdom corporation tax charge at 26.5%

(2010 - 28%) based on the profit for the year 6,258 7,804

Adjustments in respect of prior years (274) 262

Total current tax 5,984 8,066

Deferred tax

Timing differences, origination and reversal (87) 354

Effects of change in tax rate 62 -

Adjustments in respect of prior years (627) (104)

Total deferred tax (652) 250

Tax charge on profit 5,332 8,316

(b) Factors affecting the tax charge for the year

The tax assessed for the year is higher than that resulting from

applying a blended standard rate of corporation tax in the UK of

26.5% (2010 - 28%). The differences are explained below:

2011 2010

GBP'000 GBP'000

Profit before taxation 23,466 25,503

Tax charge on profit at standard rate 6,218 7,141

Effects of:

Disallowed expenses and non-taxable income (151) 861

Non-qualifying depreciation 104 156

Effect of change in tax rate 62 -

Adjustments to tax charge in respect of previous

periods (901) 158

Total actual amount of tax charge 5,332 8,316

In addition to the amount charged to the income statement,

GBP204,000 (2010: GBP31,000) relating to tax has been recognised in

other comprehensive income. This is relating to the deferred tax on

share options taken directly to equity.

Notes to the preliminary announcement

Year ended 31 December 2011

5. Earnings per share

Basic earnings per share is calculated by dividing the profit

for the year attributable to equity shareholders by the weighted

average number of ordinary shares in issue during the year.

For diluted earnings per share, the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all

dilutive potential ordinary shares. With respect to the Group these

represent share options and conditional shares granted to employees

where the exercise price is less than the average market price of

the Company's ordinary shares during the year.

Reconciliations of the earnings per ordinary share and weighted

average number of shares used in the calculations are set out

below:

Year ended 31 December Year ended 31 December

2011 2010

Weighted Weighted

average Per-share average Per-share

Earnings number amount Earnings number amount

GBP'000 of shares pence GBP'000 of shares pence

Earnings per share basic 18,134 35,475,781 51.12 17,187 35,240,321 48.77

Effect of dilutive securities

Options and conditional

shares - 2,001,577 (2.73) - 928,658 (1.25)

Earnings per share diluted 18,134 37,477,358 48.39 17,187 36,168,979 47.52

Notes to the preliminary announcement

Year ended 31 December 2011

6. Notes to the cash flow statement

2011 2010

GBP'000 GBP'000

Profit for the financial year 18,134 17,187

Adjustments for:

Investment revenues (1) (1)

Finance costs 1,708 2,606

Movement in fair value of interest rate swap (553) 533

Movement in provisions 68 318

Tax expense - Consolidated Statement of Comprehensive

Income 5,332 8,316

Depreciation of property, plant and equipment 2,557 2,350

Amortisation of intangible assets 213 244

Share-based payment expense 316 149

Loss on disposal of fixed assets 117 207

Operating cash flows before movements in working

capital 27,891 31,909

Increase in inventories (5,298) (1,035)

Increase in receivables (8,226) (1,411)

(Decrease) / increase in payables (349) 1,838

Cash generated from operations 14,018 31,301

Income taxes paid (6,714) (6,852)

Interest paid` (1,730) (2,033)

Net cash generated from operating activities 5,574 22,416

Cash and cash equivalents (which are presented as a single class

of assets on the face of the balance sheet) comprise cash at bank

and other short-term highly liquid investments with a maturity of

three months or less.

Notes to the preliminary announcement

Year ended 31 December 2011

7. Earnings before Interest, Tax, Depreciation and Amortisation ("EBITDA")

EBITDA is defined as Earnings Before Interest, Taxation,

Depreciation and Amortisation. It is calculated by adding back

depreciation and amortisation to the operating profit as

follows:

2011 2010

GBP'000 GBP'000

Operating profit 24,620 28,641

Depreciation and amortisation 2,770 2,594

EBITDA 27,390 31,235

The Board considers EBITDA as a key measure of the Group's

financial performance.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR BLGDXBGGBGDR

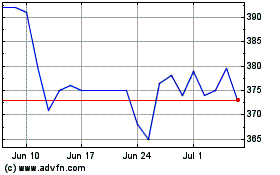

H&t (LSE:HAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

H&t (LSE:HAT)

Historical Stock Chart

From Apr 2023 to Apr 2024