2nd UPDATE:Fresnillo Sticks To Dividend Policy As It Boosts Capex

March 06 2012 - 8:44AM

Dow Jones News

Mexican precious metals miner Fresnillo PLC (FRES.LN) Tuesday

said it will stick to its current dividend policy after accruing a

large cashpile that will likely be used to finance a hefty capital

expenditure program this year.

"This year we are not expecting an additional dividend to be

paid," Fresnillo's Chief Financial Officer Mario Arreguín told

reporters on a call about the company's full-year results. "We are

planning to have quite a bit of capex this year," he noted.

Fresnillo, the world's largest primary silver producer and

Mexico's second largest gold producer, said it plans to bring

online every year a new mine or expansion project over the next

five years, placing it on track to produce 65 million troy ounces

of silver and a revised 500,000 attributable ounces of gold

annually by 2018. The previous gold target was 400,000 oz but it

already produced more than that in 2011.

To fund that growth, Fresnillo plans to invest $200 million in

sustainable capital expenditure annually over the next five years

and plans to invest about $600 million in annual growth capital

expenditure over the same period, Fresnillo's Chief Executive Jaime

Lomelin said in a call with reporters.

It also plans to spend $360 million on exploration in 2012,

bringing the grand total capital expenditure budget in 2012 to

about $930 million, up from $602 million in 2011. "That's a lot of

money," Lomelin noted.

As a result Fresnillo is sticking to its dividend policy of

returning 50% of its net profit to shareholders, casting aside some

analysts' hopes that it might unveil another special dividend in

the year ahead following last year's $300 million special

dividend.

It also unveiled a full-year dividend of $1.03 a share in 2011,

up from $0.45 a share in 2010 and said it had $685 million in cash

and no debt on its balance sheet at the end of 2011.

The FTSE-100 listed miner Tuesday posted a 36% rise in its

full-year net profit to $902 million, largely due to higher gold

and silver prices and higher gold output, while revenues rose 56%

to $2.19 billion.

The company expects to produce 41 million ounces of silver in

2012, broadly flat on year once the 3 million troy ounces from the

Silverstream contract is taken into account, and 448,866 oz of gold

in 2012 as it starts up its Noche Buena mine in the second

quarter.

Costs remain a concern but analysts say the company has shown

ability in controlling cost inflation, a plight faced by the wider

mining community as miners race to build new mines to meet growing

demand for commodities, primarily in emerging economies.

Fresnillo expects operating unit costs for items such as tires

and explosives to rise 10% to 12% in 2012 and energy costs to rise

15%, both on par with a similar percentage rise in 2011,

Fresnillo's senior executives said.

At 1248 GMT, Fresnillo's shares were up 1.4% or 25 pence at

1,857 pence a share in contrast to a 1.1% drop in the FTSE 350

mining index.

Fresnillo has five producing mines, all of them in

Mexico--Fresnillo, Cienega, Herradura, Soledad-Dipolos and Saucito;

two development projects--Noche Buena and San Ramon; and five

advanced exploration prospects.

-By Alex MacDonald, Dow Jones Newswires; 44 20 7842 9328;

alex.macdonald@dowjones.com

Order free Annual Report for Fresnillo Plc

Visit http://djnweurope.ar.wilink.com/?ticker=GB00B2QPKJ12 or

call +44 (0)208 391 6028

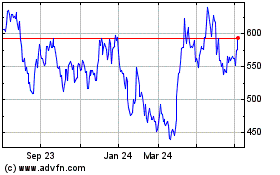

Fresnillo (LSE:FRES)

Historical Stock Chart

From Mar 2024 to Apr 2024

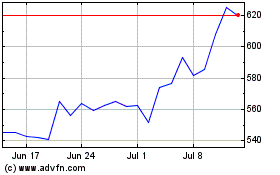

Fresnillo (LSE:FRES)

Historical Stock Chart

From Apr 2023 to Apr 2024