ADR Report: Shares Mixed As Energy Stocks And Crude Prices Fall

January 11 2012 - 5:30PM

Dow Jones News

International companies trading in New York closed mixed

Wednesday, in line with the broader markets, as energy stocks fell

along with crude prices.

The Bank of New York index of ADRs ended lower at 0.4% to

121.96.

The selloff in crude-oil futures gained steam after U.S. weekly

oil data showed a sharp drop in demand and a larger-than-expected

rise in oil stockpiles.

Royal Dutch Shell PLC's (RDSA, RDSB, RDSA.LN, RDSB.LN) class A

American depository shares fell 3.3% to $71.91, Statoil ASA (STO,

STL.OS) closed 2.1% lower at $25.28, and Total SA (TOT, FP.FR)

declined 1.3% to $50.84.

Shares of Spanish oil firm Repsol YPF SA (REPYY, REP.MC) dropped

1.8% to $28.38 after it sold 5% of its own shares to institutional

investors instead of another company in its sector.

The European index fell 0.8% to 112.25.

ARM Holding PLCs' (ARMH, ARM.LN) meeting at the Consumer

Electronics Show conference in Las Vegas was positive, says UBS.

The firm said ARM Holding is seeing good penetration of its

graphics, which UBS reckons will translate into market share of at

least 70% globally in Digital TVs. The firm is a little

disappointed there wasn't more positive news flow from the

conference for the company, but still feels comfortable with the

recently introduced short-term buy rating. Shares of ARM Holding

were down 3.3% to $26.99.

Bank of America Merrill Lynch downgraded Unilever (UL, ULVR.LN)

to underperform from neutral and cuts its price target, saying the

company is one of the most expensive stocks in its consumer-staples

universe, trading at a 10% premium versus a historical 10% discount

to parity. It expects the management to issue a cautious 2012

outlook at its full year results in early February. Shares closed

3.8% lower at $32.07.

The Asian index added 0.2% to 118.50

Alcohol producer China New Borun Corp. (BORN) said it has signed

presales contracts worth about 90% of its total output capacity

this year. Shares finished 29% higher at $4.32.

Sify Technologies Ltd. (SIFY, IWY1.FF) said it plans to invest

INR4 billion to INR5 billion in India over the next two to three

years to expand its network capacity and set up data centers.

Shares were up 3.2% to $4.78

The Latin American index advanced 0.6% to 349.41 and emerging

markets index climbed 0.4% to 289.31.

Selling by insiders at Brazil's Gerdau SA (GGB GGBR4.BR) is a

concern as there's no indication the sales will stop in near term,

Barclays Capital says. "In our coverage universe, Gerdau is the

only company where 'insiders' are materially selling their own

shares," the firm said. Nonetheless, Barclays still considers

Gerdau the best risk/return bet among steel players in Brazil.

Shares were up 2.5% to $9.21.

Oil producers and mining companies were battening down ahead of

a tropical cyclone headed for the coast of Western Australia's

iron-ore-rich Pilbara region, with ports shutting down and ordering

ships to anchor at sea. Santos Ltd. (SSLTY, STO.AU) suspended

output while Rio Tinto PLC (RIO, RIO.AU, RIO.LN), the world's

second-largest iron-ore producer after Brazil's Vale SA (VALE,

VALE5.BR), stopped loading iron-ore on ships from terminals. Santos

closed 2.6% lower to $12.98, while Vale shares climbed 1.4% to

$23.18 and Rio shares closed 1.1% higher to $53.56.

-By Maya Pope-Chappell, Dow Jones Newswires; 212-416-3670;

Maya.pope-chappell@dowjones.com

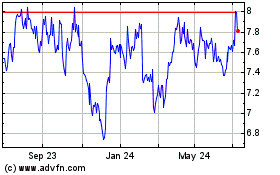

Santos (ASX:STO)

Historical Stock Chart

From Mar 2024 to Apr 2024

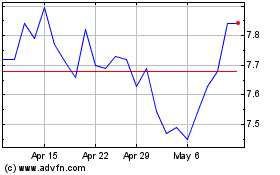

Santos (ASX:STO)

Historical Stock Chart

From Apr 2023 to Apr 2024