Trading Update (1870K)

July 12 2011 - 2:00AM

UK Regulatory

TIDMCCC

RNS Number : 1870K

Computacenter PLC

12 July 2011

Computacenter plc

Trading Update

12 July 2011

Computacenter plc ("Computacenter" or the "Group"), the

independent provider of IT infrastructure services and solutions is

today providing an update on trading for the six months ended 30

June 2011, in advance of the announcement of its interim results on

Tuesday, 30 August 2011.

Group

Overall, Group profitability in the first half will be

comfortably ahead of the same period last year and trading at this

stage remains in line with management expectations for the year as

a whole.

The first half of the financial year ending 31 December 2011 saw

revenue growth of approximately 6%. Excluding acquisitions, revenue

grew by approximately 4% and in constant currency terms, without

acquisitions, revenue growth was similarly in the region of 4%.

The second quarter was consistent with the first quarter with

growth in Services across all of our geographies, but with weak

Product revenues from our more financial services oriented client

base in the UK, contrasting with much stronger growth from our

predominantly industrially oriented customer base in both France

and, more specifically, Germany.

Cash Position

Cash flow generation in the period has been positive, offset by

the ongoing investments in the business. Net cash at the period

end, before Customer Specific Financing (CSF) was GBP103.2 million,

a reduction of GBP36.3 million since 31 December 2010 and a year on

year increase of GBP7.6 million since 30 June 2010. In addition to

working capital growth, as a consequence of the strong performance

of our German business in particular, we have had cash outflows of

GBP24 million to finance two acquisitions during this period; an

enlarged dividend payment; as well as the GBP11 million purchase of

a freehold property in Braintree, Essex, to consolidate existing

facilities and aid the growth of our IT recycling subsidiary RDC.

The net cash position continues to be flattered (currently to the

extent of GBP30.8 million), by the ongoing extended credit

facilities from one of our major suppliers which at this stage, we

expect will remain in place for most of the second half of the

year. At the end of the period, CSF stood at GBP21.5 million

(GBP38.5 million at 30 June, 2010).

UK

Whilst the UK saw Services growth in the first half of 1%,

during the period we have had several new contract signings and we

exit the first half with a strong pipeline. As a result, we expect

the growth rate to return to more normal levels, when the new

contracts commence service and billing in the months ahead. Product

sales have declined in the first half by 23% as our customers have

been cautious on capital expenditure, compared to a very buoyant

period in the previous year. This decline in Product revenue has

not had a corresponding impact on the profitability, due to

increased margins in both Product and Services. While some of this

improvement in margin has come from a change in mix to Services

from Product, underlying improvements within both businesses

themselves are clearly evident.

Germany

In constant currency, excluding the acquisition, Germany has

achieved strong revenue growth in the first half of 10% in Services

and 38% in Product, in both cases greater in the second quarter

than in the first. Much of our growth in Germany in the first

quarter was due to a softer comparator, but the same was not as

true for the second quarter, making the growth rate even more

impressive. For the first time we will report larger revenues in

Germany for the period than the UK. It would be unrealistic to

expect to continue this level of Product growth in the second half

of the year, particularly as the comparisons get increasingly more

difficult due to the improving environment we experienced in the

latter half of 2010. The HSD acquisition in Germany completed in

the second quarter and did not have a material impact on the first

half. We remain confident that we will see growth in Germany in

both Product and Services in the second half and we are

particularly encouraged by the strength of our Services

pipeline.

France

In France, excluding the effects of the Top Info acquisition, we

grew our Services business by 7% and our Product business by 16%,

in constant currency. Following the acquisition, which is included

in our results from the beginning of the second quarter, growth

rates are 39% and 15% for Product and Services, respectively. We

are likely to report a small profit in France for the first half,

something we have not done for many years. This bodes well for the

year as a whole, as the second half has traditionally been the more

profitable period. Whilst much remains to be done to integrate Top

Info, the early signs are encouraging.

Outlook

The Group remains on track to deliver results in line with the

Board's expectations for the year as a whole. As we have previously

indicated, the second half of the year will be held back somewhat

by an increase in the depreciation charge, as we roll out our new

ERP system. Additionally, due to the improving performance in 2010

as we went through the year, the second half of 2011 presents us

with a less easy set of comparators than the first half. As we look

out beyond 2011, we are encouraged by our progress, particularly in

our Managed Services business, which we believe can present a

cornerstone for Computacenter's growth in the years ahead.

Enquiries:

Computacenter plc

Mike Norris, Chief Executive: 01707 631601

Tony Conophy, Finance Director: 01707 631515

Tessa Freeman, PR Manager: 01707 631514

Tulchan Communications 020 7353 4200

Christian Cowley

Lucy Legh

Conference call

There will be a conference call for analysts and investors this

morning at 8.30am

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTZMGMNVMZGMZM

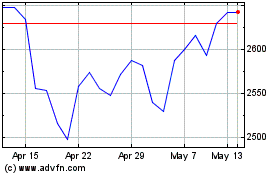

Computacenter (LSE:CCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Computacenter (LSE:CCC)

Historical Stock Chart

From Apr 2023 to Apr 2024