Trading Statement

January 11 2011 - 2:00AM

UK Regulatory

TIDMCCC

Pre Close Trading Update - 11th January 2011

Computacenter is today holding an investor and analyst conference call to

provide an update on trading for the year ended 31st December 2010.

The Group's unaudited adjusted* profit before tax for 2010 is expected to be

towards the top end of the range of market expectations.

At the end of the period, net cash excluding customer-specific financing ("CSF")

was GBP138.6 million [net cash of GBP86.4 million at 31st December 2009]. Including

CSF, net cash was GBP112.7 million [net cash of GBP37.3 million at 31st December

2009]. The year-end cash position continues to benefit, by approximately GBP38

million [ GBP30 million at 31st December 2009], due to the extended credit facility

from one of our major suppliers.

2010 has proved to be a year of good progress for Computacenter, as we have

continued with the strong services growth of recent years, coupled with a return

to growth in our product supply business, as customers have invested in new

infrastructures. Additionally, cost reductions made predominantly in 2009, have

increased the operational leverage of the business. Group revenue for services

grew by 6% on an as reported basis and 8% in constant currency. Product revenue

grew by 13% and 15% in constant currency, when you exclude the effect of the

disposal of CCD at the end of 2009, but including acquisitions.

As we expected at the half year, services growth increased materially in the

second half, whereas product revenue growth remained constant throughout the

year, with the decline of UK Government expenditure compensated by accelerated

growth rates in France and Germany.

In the UK, total revenue increased by 10%, excluding the effect of the disposal

of CCD. Services growth for the year as a whole, stood at 11%, boosted by a

particularly pleasing growth in the second half, compared with the same period a

year ago. UK product revenue, excluding the effects of the disposal, showed a

9% growth for the full year, with a 4% growth in the second half. This slower

growth in the second half is attributable to a slowdown in Government spend and

an exceptional one off deal in late 2009, which creates a difficult comparative.

While undoubtedly there has been some incremental revenue in quarter 4, due to

the VAT increase in early 2011, we do not believe this is material.

We have previously highlighted the challenging first quarter experienced in

Germany. Market conditions subsequently, continued to strengthen quarter on

quarter and over the remainder of the year, we have seen a strongly improving

trend in performance of the German business. This improving trend has resulted

in overall revenue for the year, growing by 12% in local currency and 8%, when

excluding the effects of acquisitions. Services growth for the year was 4%, but

a more pleasing 9%, in the second half, alone. Product revenue grew by 18% in

the year, with a growth of 19% in the second half.

Computacenter France has had its most successful year for some time and is

likely to report a small operating profit, for the year as a whole. Overall

revenue in local currency grew by 17%, with services growing 5% and product

revenue growing by 20%. Whilst services revenue growth has been more modest

than it has been for a while, it has been affected by the successful completion

of some contracts and the underlying performance remains steady. The French

business has achieved a significant turnaround over the last few years and its

progress owes a lot to the broadening of its customer base and growth in the

services business.

The Group has made clear progress in 2010. Our customers' appetite to reduce

operating costs is a key driver of sustainable growth for our Services business.

We reported 12 months ago that there had been an improvement in corporate

capital expenditure although it was unclear whether this was a temporary

improvement, or something more fundamental. It is now clear to us that the

improvement has proved to be more fundamental.

Mike Norris, CEO of Computacenter commented: "Customers are refreshing,

upgrading, improving and investing in their IT infrastructures and we are well

placed to meet these needs. The growth of long-term services contract revenue

remains fundamental to the long-term success for Computacenter and it is

pleasing to note that we have seen approximately an 8% increase in the annual

services contract base. There was significant product revenue decline in 2009,

mainly due to the economic environment. However, in 2010 we have seen strong

product revenue recovery and we anticipate that product revenue will grow

steadily in 2011, subject to the overall economic environment."

Computacenter will announce full year results for the year ending 31st December

2010 on Thursday, 10th March 2011.

*adjusted profit before tax is stated prior to amortisation of acquired

intangibles.

Enquiries:

Computacenter plc

Mike Norris, Chief Executive01707 631601

Tony Conophy, Finance Director 01707 631515

Tessa Freeman, PR Manager01707 631514

Tulchan Communications 020 7353 4200

Christian Cowley

Lucy Legh

This announcement is distributed by Thomson Reuters on behalf of

Thomson Reuters clients. The owner of this announcement warrants that:

(i) the releases contained herein are protected by copyright and

other applicable laws; and

(ii) they are solely responsible for the content, accuracy and

originality of the information contained therein.

Source: Computacenter PLC via Thomson Reuters ONE

[HUG#1478554]

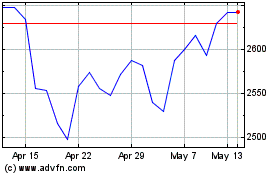

Computacenter (LSE:CCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Computacenter (LSE:CCC)

Historical Stock Chart

From Apr 2023 to Apr 2024