By Julie Jargon

Yum Brands Inc. is at a pivotal moment as it faces what Chief

Executive Greg Creed calls a "once in a lifetime opportunity" to

rethink the company's business model.

The owner of fast-food chains Taco Bell, KFC and Pizza Hut is

preparing to spin off its massive China business into a separate

company that will begin trading on the New York Stock Exchange on

Nov. 1 -- a historic event for a company that introduced fast food

to China in 1987 with its KFC chain.

Now, Mr. Creed is focused on making Yum a leaner organization

that acts as a steward of brands, rather than an operator of

restaurants.

Mr. Creed, 59 years old, is a career-brand builder who has sold

everything from soap in his early days at Unilever PLC to tacos

made out of Doritos, Taco Bell's most successful product launch

ever. The Australian-born Mr. Creed is a gregarious company

promoter who leads Wall Street analysts in an Yum cheer at the

annual analyst meeting. (Except this year, when he says he forgot.)

He spends a lot of time traveling the globe to coach employees and

franchisees on leadership and reward them for jobs well done.

In an interview, Mr. Creed reflected on the decision to separate

the China business, explained how Taco Bell comes up with its weird

menu creations and discussed how Amazon.com has changed the way

customers expect to order pizza.

Edited excerpts:

WSJ: How did you tell your staff about the decision to separate

the China business?

Mr. Creed: We've tried to take them along on this journey. We've

been very transparent, very top down. I first spoke to the top 60

leaders in the company. Then I did a webcast with about 200 senior

leaders. Then I finally did a webcast with the entire company. I

thought it was really important for me to personally tell the

organization.

WSJ: What is your biggest concern for the business now?

Mr. Creed: We're going to have to change from a mind-set of

owning restaurants to putting the running of restaurants in the

hands of our franchisees and we're going to focus on brand

building.

WSJ: You have an activist, Keith Meister, on your board. How has

that changed the way you do your job?

Mr. Creed: I met with Keith in May 2015 when it was announced

that [Corvex] had an ownership on the share register. I spent two

hours with Keith. What I really appreciated was that he said,

"Look, I don't know how to run a restaurant company; that is what

you do and I'm never going to tell you how to run this restaurant

company. I think I can help unlock shareholder value." He has never

offered one operating suggestion, so he has been true to his

word.

WSJ: Did his presence accelerate the China separation?

Mr. Creed: No. We hadn't made the final decision but we had

completed our analysis and we had determined that the separation of

China was the right thing to do. Keith independently reinforced

that.

WSJ: Pizza Hut has been struggling. What's the problem?

Mr. Creed: We've just made it too hard to get a better pizza. We

need to invest more in our technology than we have, so we're

playing catch up.

WSJ: How much technology do consumers expect when it comes to

ordering a pizza?

Mr. Creed: They actually expect it to be really simple.

Sometimes you need a lot of technology to make it simple. Let's be

honest, Amazon is the standard for ordering. If I can go on Amazon

and order a shirt in one or two clicks, then why can't I order a

pizza in one or two clicks?

WSJ: Taco Bell is known for its unique menu items like the

Doritos tacos and Quesalupas. Take us into your product-development

process.

Mr. Creed: It's a very disciplined process. It always starts

with consumer insights. We often look at what's happening outside

of the category. The cheesy core burritos came from an idea from

Ben & Jerry's. Ben & Jerry's have this hard sort of

chocolate up the middle of their ice cream. We were like, "What if

we actually ran a cheesy thing up the middle of a burrito?"

WSJ: An outsider claims to have come up with the idea for

Doritos Locos Tacos (taco shells fashioned out of Doritos chips).

Is that true?

Mr. Creed: It wasn't true. I was in the very first meeting

[about it] with Al Carey [then CEO of PepsiCo's Frito-Lay unit].

[Mr. Carey] went to Home Depot, bought a paint spray gun and

basically fried a Taco Bell taco, and while it was still warm,

sprayed it with their seasoning. I was there when the very first

one was made. We always have people coming out of the woodwork,

unfortunately.

WSJ: Do people ever pitch food ideas to you that you actually

consider?

Mr. Creed: We have a policy of not accepting unsolicited ideas.

It is the only way you can go. If someone writes to any of us, we

don't open it. I send it off to the legal department.

WSJ: People have more choices for where to get food than ever.

What do people want now that they didn't before?

Mr. Creed: If I go back 20 years, food was fuel and then food

became an experience and now it is an experience worth sharing.

We're not in the food business anymore, we're in the

food-experience business.

WSJ: What keeps you competitive in that kind of landscape?

Mr. Creed: We're in 135 countries. We have critical scale and

we've got the ability to understand consumers in all of these

countries. I remember the first time we put guacamole in a burrito

at Taco Bell. There was this big discussion: OK, everybody on the

West Coast loves guacamole. People were like, "I'm not really sure

about this." We put guacamole [in] and someone on the East Coast

sent us a note saying, "What is this green stuff in my burrito?"

Now, guacamole is just growing. If you think about the consumption

of guacamole, it has just changed dramatically. Peoples' tastes are

definitely changing, they are definitely evolving and you've got to

adapt to those changes.

Write to Julie Jargon at julie.jargon@wsj.com

(END) Dow Jones Newswires

October 25, 2016 11:14 ET (15:14 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

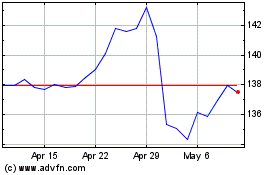

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

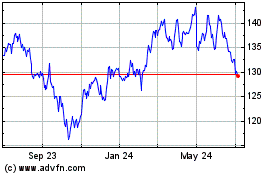

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Apr 2023 to Apr 2024