Yum Looks to Be Leaner After China Spinoff

October 11 2016 - 8:00AM

Dow Jones News

By Julie Jargon

Yum Brands Inc. plans to become a leaner company that operates

fewer of its own restaurants after it spins off its volatile China

business next month.

The parent of KFC, Pizza Hut and Taco Bell said on Tuesday that

it plans to increase the percentage of restaurants owned by

franchisees to at least 98% by the end of fiscal 2018, up from 77%

currently. The China spinoff alone will boost that figure to 93%

because the China business, which accounts for more than half of

Yum's revenue, will license the brands, paying Yum an annual

royalty fee.

Many restaurant brands have been moving to an "asset light"

structure in which they own the brands but not the actual

restaurants. The model allows restaurant companies to shoulder less

risk and volatility because they can collect a stable revenue

stream in the form of a percentage of franchisees' sales.

McDonald's Corp., Restaurant Brands International Inc.'s Burger

King, Wendy's Co. and other major chains have been selling more of

their company-owned restaurants to franchisees.

"As a 'pure play' franchisor, the transformed Yum Brands will

become more efficient and capital-light with an optimized capital

structure, improved cash flow and laser-like focus on our key

strategies to drive same-store sales and new unit growth

world-wide," Chief Executive Greg Creed said in a statement.

The company also announced plans to reduce its annual capital

expenditures to approximately $100 million by the end of fiscal

2019 from $500 million, and to reduce its general and

administrative expenses by approximately $300 million by the end of

fiscal 2019.

Yum last month struck a deal to sell part of its China

operations to a prominent Chinese deal maker and the financial

affiliate of Chinese internet giant Alibaba Group Holding Ltd.

Primavera Capital, run by former Goldman Sachs Group Inc. Greater

China Chairman Fred Hu, and Ant Financial Services Group will buy a

combined $460 million stake in the Yum China Holdings Inc. spinoff.

The China business will begin trading separately on the New York

Stock Exchange on Nov 1.

Louisville, Ky.-based Yum built KFC into China's most popular

fast-food chain since it entered the country in 1987. The company

in recent years has faced increasing competition from foreign and

local fast-food rivals in China as well as numerous food-safety

scares, which resulted in volatile sales. With the China business

separated, Yum can now concentrate on improving the sales of its

brands in the U.S. and other markets.

In its third quarter, systemwide sales at KFC rose 7%. Taco Bell

reported a 5% increase and system sales at Pizza Hut were flat. Yum

executives at an investor conference on Tuesday plan to outline

their plans for boosting sales at all of their brands following the

China spinoff.

Write to Julie Jargon at julie.jargon@wsj.com

(END) Dow Jones Newswires

October 11, 2016 07:45 ET (11:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

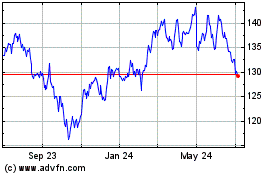

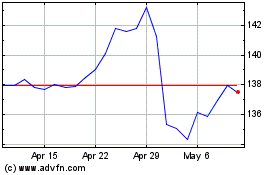

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Apr 2023 to Apr 2024