Yum Board Approves Spinoff Plan, Raises Dividend 11%

September 26 2016 - 11:40AM

Dow Jones News

Yum Brands Inc. said its board approved the planned spinoff of

its China unit, which remains on track to close at the end of next

month, as the company also raised its dividend by 11%.

The Louisville, Ky., company increased the quarterly dividend to

51 cents a share, an increase of a nickel a share.

Yum Brands said its board approved a distribution of one share

of Yum China common stock for each share of Yum Brands held as of

Oct. 19. The spinoff, set to close Oct. 31, is planned as a

tax-free distribution to shareholders.

Yum Brands said it has repurchased roughly $5.1 billion of its

shares and plans to buy back and additional $1.1 billion of its

stock before year's end. The moves are part of a previously

disclosed plan linked to the Yum China spinoff to return $6.2

billion of capital, excluding dividends, to shareholders.

Earlier this month, the owner of KFC and Pizza Hut, struck a

deal to sell a combined $460 million stake in the

soon-to-be-spunoff China operations to Primavera Capital and Ant

Financial Services Group, the financial affiliate of Chinese

internet giant Alibaba Group Holding Ltd.

The decision to separate the operations came after Yum Brands

fell under pressure from activist investors, including Corvex

Management LP and Dan Loeb's Third Point LLC.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

September 26, 2016 11:25 ET (15:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

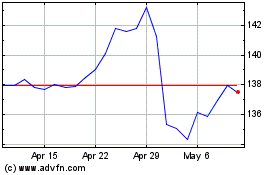

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

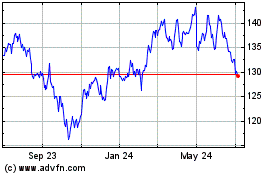

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Apr 2023 to Apr 2024