Malaysia Group Cooks Up an IPO -- WSJ

August 31 2016 - 3:02AM

Dow Jones News

Operator of KFC and Pizza Hut could raise more than $400 million

in 2017 listing

By Yantoultra Ngui in Kuala Lumpur, P.R. Venkat in Singapore and Alec Macfarlane in Hong Kong

A consortium that includes private-equity firm CVC Capital

Partners is planning an initial public offering for an operator of

KFC and Pizza Hut restaurants in Southeast Asia that could raise

more than $400 million, according to people familiar with the

matter.

The owners of Malaysia's QSR Brands, including CVC and Malaysian

pension fund Employees Provident Fund, are considering listing the

franchise operator on the local stock exchange next year, the

people said. QSR Brands is expected to invite bankers to pitch for

roles on the IPO next month, one of the people said.

QSR Brands is currently renegotiating royalty fees with Yum

Brands Inc., the Louisville, Ky.-based owner of the KFC and Pizza

Hut brands, ahead of the planned IPO, the people said, while

declining to give further details.

But one of the people said that CVC wants a new fee agreement

with Yum Brands in place before the IPO so that potential investors

can have a clearer view of QSR's business prospects.

Yum Brands didn't respond to a request for comment.

CVC, the Malaysian pension fund and Johor Corp., an investment

arm of the Johor state government, took QSR private in a $1.3

billion deal in 2012. Johor Corp., which owns a 51% stake in QSR

Brands, might continue to hold its shares in the company for longer

than the other investors, the people said.

"There is nothing yet to share at this juncture as it is still

early days," a QSR Brands spokesman said. CVC declined to comment,

while EPF and Johor Corp. weren't immediately available to

comment.

QSR's offering could appeal to investors given the growing

appetite for consumer stocks in Southeast Asia, as a decline in

commodity prices has weighed on shares of the region's oil and gas

companies.

The IPO, if successful, would be the first sizable

consumer-related offering in Malaysia in three years. The biggest

to date was convenience-store operator 7-Eleven Malaysia Holdings

Bhd.'s IPO, which raised $225 million in 2014.

Based in Selangor, Malaysia, QSR operates more than 450 Pizza

Hut restaurants in Malaysia and Singapore and over 750 KFC

restaurants in Malaysia, Singapore, Brunei and Cambodia, according

to its website. The company is also engaged in poultry production

and processing, baking and sauce production. One of the people said

that the IPO could exclude QSR's poultry production business.

London-based CVC, which owns a stake in motor-racing franchise

Formula One Group, has a longstanding presence in Southeast Asia.

Since 2013, CVC has raised more than $2 billion through share sales

of Indonesia's PT Matahari Department Store Tbk.

Write to P.R. Venkat at venkat.pr@wsj.com and Alec Macfarlane at

Alec.Macfarlane@wsj.com

(END) Dow Jones Newswires

August 31, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

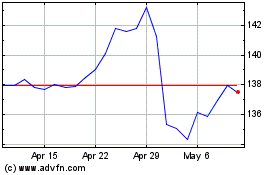

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

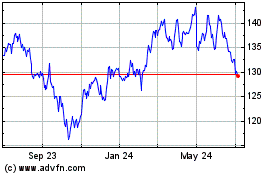

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Apr 2023 to Apr 2024