Current Report Filing (8-k)

May 06 2016 - 6:10AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

May 4, 2016

Commission file number 1-13163

YUM! BRANDS, INC.

(Exact name of registrant as specified in its charter)

|

North Carolina

|

|

13-3951308

|

|

(State or other jurisdiction of

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

Identification No.)

|

|

|

|

|

|

1441 Gardiner Lane, Louisville, Kentucky

|

|

40213

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(502) 874-8300

Former name or former address, if changed since last report:

N/A

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01

Entry into a Material Definitive Agreement.

On May 4, 2016, Yum! Brands, Inc., a North Carolina corporation (the “Company”) and certain affiliates entered into a Purchase Agreement (the “Purchase Agreement”) with Barclays Capital Inc., Goldman, Sachs & Co. and Guggenheim Securities, LLC, in each case on behalf of itself and the initial purchasers named therein, under which a special purpose subsidiary of the Company has agreed to jointly issue and sell $800 million of the Issuer’s Series 2016-1 3.832% Fixed Rate Senior Secured Notes, Class A-2-I (the “Class A-2-I Notes”), $500 million of its Series 2016-1 4.377% Fixed Rate Senior Secured Notes, Class A-2-II (the “Class A-2-II Notes”), and $1 billion of its Series 2016-1 4.970% Fixed Rate Senior Secured Notes, Class A-2-III (the “Class A-2-III Notes” and, together with the Class A-2-I Notes and the Class A-2-II Notes, the “Notes”). The closing of the sale of the Notes is subject to various closing conditions specified in the Purchase Agreement. A copy of the Purchase Agreement is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 8.01

Other Events.

On May 5, 2016, the Company issued a press release announcing its entry into the Purchase Agreement and the pricing of the Notes. A copy of the press release is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

Item 9.01

Financial Statements and Exhibits

(d) Exhibits.

|

Exhibit

Number

|

|

Description

|

|

99.1

|

|

Purchase Agreement, dated May 4, 2016, among the Company, certain subsidiaries of the Company, Barclays Capital Inc., Goldman, Sachs & Co. and Guggenheim Securities, LLC.

|

|

|

|

|

|

99.2

|

|

Press Release regarding the Company’s entry into the Purchase Agreement and pricing of the Notes issued by the Company on May 5, 2016.

|

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

YUM! BRANDS, INC.

|

|

|

|

(Registrant)

|

|

Date: May 5, 2016

|

|

/s/ William L. Gathof

|

|

|

|

William L. Gathof

|

|

|

|

Vice President and Treasurer

|

3

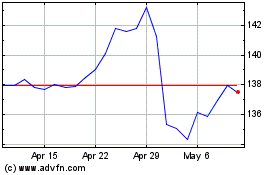

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

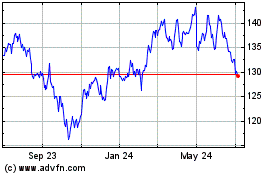

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Apr 2023 to Apr 2024