Additional Proxy Soliciting Materials (definitive) (defa14a)

May 05 2016 - 12:34PM

Edgar (US Regulatory)

|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

Washington, D.C. 20549

|

|

|

|

SCHEDULE 14A

|

|

|

|

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

|

|

|

x

Filed by the Registrant

|

o

Filed by a Party other than the Registrant

|

|

Check the appropriate box:

|

|

o

|

Preliminary Proxy Statement

|

|

o

|

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2))

|

|

o

|

Definitive Proxy Statement

|

|

x

|

Definitive Additional Materials

|

|

o

|

Soliciting Material under §240.14a-12

|

|

|

|

YUM! BRANDS, INC.

|

|

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

Yum! Brands, Inc.

2016 Annual Meeting of Shareholders to be held on May 20, 2016

Supplemental Information Regarding Shareholder Outreach, Engagement and 2015 Vote on NEO Compensation

Dear Fellow Shareholders:

On behalf of your Management Planning and Development Committee, I am writing to you regarding our 2016 Annual Meeting of Shareholders for Yum! Brands, Inc. to be held on May 20, 2016, at which you are being asked, among other things, to cast an advisory vote on our executive compensation package (the “say-on-pay” proposal). The say-on-pay proposal is Item 3 and is described beginning on page 25, with more detail provided in our Compensation Discussion and Analysis, which begins on page 39. This Supplemental Information is being provided to give you additional information about Item 3 as you consider your vote.

Our Board of Directors has recommended that you vote

FOR

Item 3.

The purpose of this supplemental information is to provide more details regarding the shareholder outreach effort that we conducted in 2015. This is intended to supplement the discussion on page 56 entitled “Shareholder Outreach, Engagement and 2015 Vote on NEO Compensation.” We ask for your consideration of these factors and your support FOR Item 3.

Shareholder Feedback During 2015

At our 2015 annual meeting of shareholders, holders of approximately 65% of the shares represented at the meeting voted to approve, on an advisory basis, our executive compensation program. We appreciate the majority support and our Committee strives to ensure that all of our shareholders feedback is considered and taken into account as we design future years’ compensation.

As discussed at page 56, we engaged in a broad investor outreach program during 2015 to hear directly from our largest shareholders their views on our approach to executive compensation. We contacted our largest 100 shareholders, representing 66% of our total shares outstanding, offering our largest shareholders the opportunity to speak with management and members of our Committee and our Lead Director. Two of our directors engaged in conversations with shareholders. We were assisted in our vigorous outreach efforts by a third party solicitation firm. We observed the following key insights from our outreach:

·

Overall

. Notwithstanding the vote total, the responding shareholders provided very favorable feedback regarding our executive compensation program. Some expressed concerns about the

2014 compensation program

, however, they consistently reported that they were pleased with the overall structure of our program as disclosed going forward, and that our program was correctly focused on the right operating performance metrics — those that drive long-term value. A very small percentage of our shareholder base did express some concerns about program design, however, the few concerns that were raised were not uniform. The outreach discussions did not reveal a consensus to change any specific element of our program. Given the shareholders’ focus on the successful execution of the China Division separation as discussed below and the lack of shareholder consensus to make changes to our executive compensation program, the Committee believed that it would be most responsive to the overall concerns of shareholders to consider any significant additional changes to the program beginning in 2017.

·

The Overwhelming Majority of Shareholders Declined to Criticize our Program.

The Committee noted that 93 of our largest 100 shareholders were presented with an opportunity to offer constructive advice, yet elected not to engage in a conversation with management and members of the Committee. Given the willingness of many of these shareholders to offer their opinions when solicited, the Committee interpreted the lack of engagement by the overwhelming number of our largest shareholders to indicate that they are generally supportive of — or at least neutral towards — our compensation programs and practices. Only seven shareholders (representing 17% of outstanding shares) elected to engage in a conversation with the Committee’s representatives, and we have summarized their feedback and our actions in response below. In addition to this outreach, our management and Investor Relations Department engages with shareholders throughout the course of the year through multiple investor conferences and conference calls where comments and recommendations for management and the Board are regularly solicited. This offers shareholders more opportunity to provide

input and during 2015 shareholders did not provide feedback regarding our executive compensation program except as discussed below.

·

Support for CEO Pay Changes.

The most common theme we heard in 2015 revolved around absolute and relative CEO pay. In nearly all of our outreach calls, responding shareholders expressed support for the CEO pay changes. Specifically, shareholders agreed with our decision to pay our new CEO in 2015 below the median of our peer group. In light of the new CEO pay formula, they expected more aligned pay results in 2015. In fact, such results did occur —see pages 43 and 44 for more detail. Some shareholders reported that, while supportive of the 2015 changes to CEO pay, they did not support our 2015 say on pay proposal because of the perceived disconnect between pay for performance in

our CEO’s 2014 compensation

.

·

Market Benchmarking.

Shareholders agreed that our move away from top-quartile benchmarking of CEO pay to benchmarking the market median of our peers was more appropriate. Based on this feedback, in the Fall of 2015 we extended this benchmarking philosophy to all executive officer positions and no longer benchmark compensation above market median. We now align pay around the market median, and adjust as appropriate based on the executive’s role, level of responsibility, experience, individual performance and future potential.

·

Mix of Long-Term Incentives.

Several shareholders expressed a preference for an even greater shift to performance share units (PSUs), however, there was no firm consensus among these shareholders to shift our long term incentive mix from its current allocation of 75% stock appreciation rights (SARs)/25%PSUs .

·

Performance Share Plan Design

. Feedback on plan design was wide ranging with no dominant theme. Shareholders discussed their various preferences, including type of metrics, number of metrics, and comparator group used in plan design. Our shareholders did not provide any consistent objections to our performance share formula which pays out at 100% when total shareholder return (“TSR”) is at the 50th percentile of the S&P 500. This view is consistent with the overwhelming market practice among performance share plans based on relative TSR - where the target award is earned based on median performance when compared with a company’s peer group or broader market index.

·

Impact of decision to separate the China Division in 2016

. In parallel with this shareholder outreach effort, we were planning for and proceeding with the separation of our China Division. We believe this new corporate structure will create substantial long-term value for our shareholders. However, the process of working through the spin and positioning both companies to succeed as stand-alone public companies is a complex undertaking. The Committee believed that altering the structure or mechanics of the pay program during such a pivotal time without a strong desire from shareholders would create distractions, confusion and unnecessary complications. As part of the separation process a thorough review of the performance criteria, goals, underlying leverage and long-term incentive mix are being undertaken. That analysis is precisely designed to optimize the alignment of pay and performance for the new Yum Brands. We are committed to continuing to solicit and be receptive to shareholder feedback as we work through this process.

Accordingly, in considering the favorable feedback received from responding shareholders, and considering that there was not a unifying consensus around any specific adjustments to be made to the overall structure of our compensation program, the Committee believed “no additional changes” was in-line with shareholder feedback. With a deep appreciation for the complexities of the transactions, the Committee believes that any changes that might be considered would be optimally undertaken after the separation is complete and not before.

We urge you to review the information offered in our 2016 proxy statement and consider the additional points in our analysis above, and vote

FOR

Item 3.

Sincerely,

Robert D. Walter

Chair, Management Planning and Development Committee

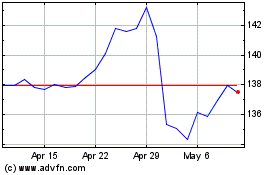

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

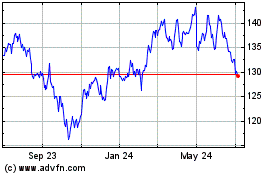

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Apr 2023 to Apr 2024